Source: Coingecko; Compiled by Deng Tong, Bitchain Vision

How wide is the scope of adoption of encryption AI in 2025?

In a survey conducted this year, 59.3% (nearly three-fifths) of cryptocurrency participants considered themselves the first to adopt crypto AI.Another 34.7% of participants considered themselves the mainstream adoption of crypto AI, while the remaining 6.1% expressed doubts that they were least willing to adopt crypto AI.

Compared to the technology adopts the bell-shaped curve distribution that is usually followed, the first participants with encrypted AI account for an unusually high proportion.This can be attributed to self-select bias in participants who are already interested in crypto AI, but it may also indicate that crypto AI adoption is still dominated by technology enthusiasts and has not yet gained mainstream attention even within the crypto industry.

Among the pioneers of adoption of crypto AI, 26.6% of participants considered themselves “innovators” or tech enthusiasts who were keen to follow any new trend, and 32.7% considered themselves “early adopters” with trend-sensitive.The increase in the proportion of “early adopters” may reflect the latest cognitive shift, with the crypto industry increasingly viewing crypto AI as a promising key area rather than just hype.

Meanwhile, 22.8% of crypto participants considered themselves “early mass” in the field of crypto AI adoption, almost twice the 11.9% of cryptocurrency considered themselves “latest mass.”This shows thatThe current challenge facing crypto AI is how to promote and apply it among mainstream people who focus on practice and are more risk-averse.In order to make the crypto-AI project first adopted by “early public”,They may need to clearly demonstrate how to solve practical problems or create value for users.

Finally, 6.1% of the few people consider themselves to be skeptical and resistant to change, consistent with the tail end of a typical bell-shaped curve distribution.These “laggards” may be a combination of realists (who are only interested in engaging in crypto AI for monetary gains), AI critics, and cautious users waiting for more mature technologies.

More cryptocurrency newbies experience differentiation in crypto AI adoption

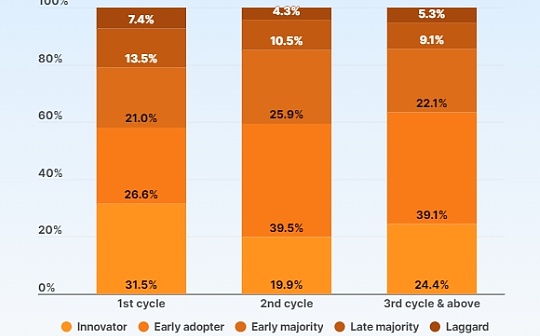

It is worth noting that in the first market cycle, 31.5% of participants considered themselves “innovators” in crypto AI adoption and 7.4% considered themselves “laggards”.Both of these proportions were higher than those of the second-cycle participants (19.9% of participants considered themselves “innovators”, 4.3% of participants considered themselves “laggards”) and senior participants in the third and above (24.4% of participants considered themselves “innovators” and 5.3% of participants considered themselves “laggards”).This shows thatCryptocurrency beginners may have stronger and more divergent views on crypto AI, especially when some people may have entered the cryptocurrency space due to the latest crypto AI boom.

On the other hand, participants and veterans who have experienced the second crypto cycle have similar attitudes toward crypto AI adoption.The only difference is that the “early mass” group of participants in the second round accounted for a slightly higher proportion, while the “innovator” group of veterans accounted for a higher proportion.

Encryption AI adoption curve in 2025

The crypto market’s interest or attitudes in adopting crypto AI are distributed as follows: