Source: Coingecko; Compilation: Wuzhu, bitchain vision

Do people think AI agents can better trade and invest?

About half of the people think that most of the time, AI agents will do better than humans in crypto trading and investment.That being said, the remaining half of the survey participants believe that AI has no better advantage than humans in the crypto market, suggesting that opinions on such comparisons remain divergent.

For short-term crypto trading, 26.7% of survey participants expected AI agents to generally outperform humans, and 22.0% of survey participants expected AI to win forever.Meanwhile, for long-term cryptocurrency investments, 23.6% say AI agents will usually do better than humans, while 23.0% think that will always be the case.

Overall, 48.7% believe AI is more profitable than humans in cryptocurrency trading, which is slightly superior to 46.6% who favor using AI to invest in cryptocurrency.

However, the most common personal view is that AI agents sometimes outperform humans in the cryptocurrency market: 29.3% expect AI agents are just sometimes better at cryptocurrency trading than humans, and 28.3% say the same is true in terms of investment.

Despite the growing popularity of crypto AI, at least one in five survey participants held the opposite view, believing that AI will lose largely to humans in terms of crypto trading and investment.When it comes to cryptocurrency trading, 13.0% believe that AI agents rarely outperform humans, while 9.0% think that this will never happen.And when it comes to crypto investments, 15.3% expect AI agents to rarely do better than humans, and 9.8% expect AI will never defeat humans.

How trust does AI agents do transactions and investments?

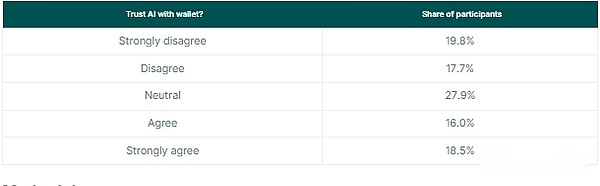

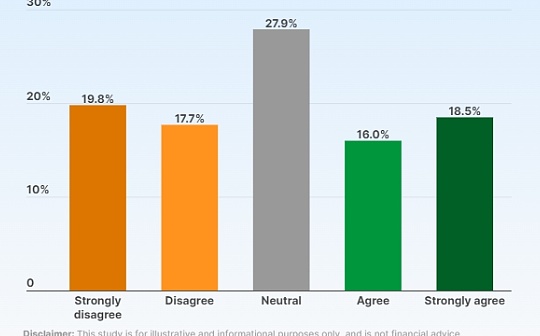

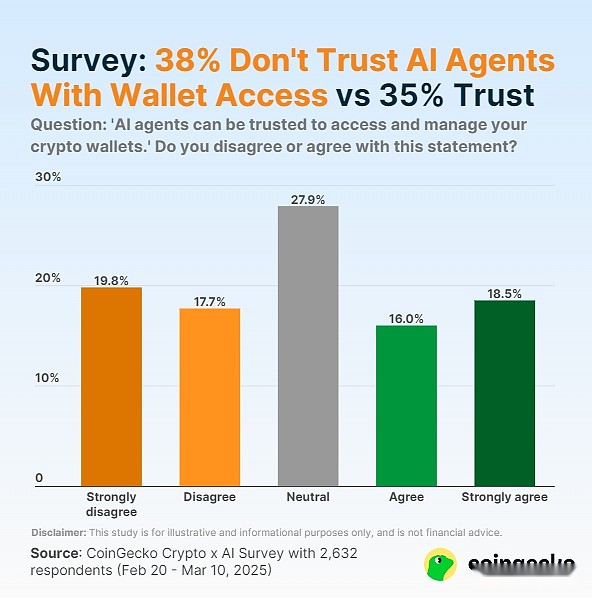

The same survey found that participants had very complex views on whether AI agents could be trusted to access and manage people’s crypto wallets.Specifically, 37.5% said they did not trust AI agents to manage their crypto wallets, while a slightly lower 34.5% said they could trust and 27.9% were neutral on the matter.

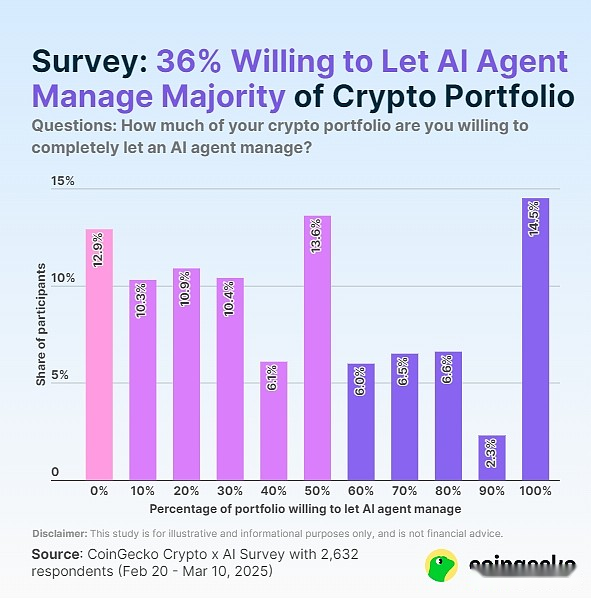

Meanwhile, 87.1% of respondents expressed their willingness to have an AI agent manage at least one-tenth of the cryptocurrency portfolio.This suggests that despite doubts about the security of AI agents, crypto users are still primarily curious about the technology and want to try to use them to trade or invest.

Of these, 35.9% expressed willingness to have an AI agent manage most of its cryptocurrency portfolio (i.e. 60% or more).Of these, 14.5% of the few are willing to hand over their entire cryptocurrency portfolio to artificial intelligence agents for management.In other words, one in seven participants either think they can fully trust AI agents, hand over all cryptocurrencies to them, or believe that the potential profits will outweigh the risk, or just have a high risk tolerance for their cryptocurrency holdings.

Another 51.3% are willing to have an AI agent manage half or less of a cryptocurrency portfolio.Interestingly, overall, the second most popular amount was to let AI agents manage half of the portfolio, and 13.6% of participants chose this approach.

On the other hand, 12.9% said they would not hand over their cryptocurrency portfolio to an AI agent for management.This means that 1 out of 8 participants completely distrusts the AI agent to manage their cryptocurrency or thinks they can manage their cryptocurrency portfolio better than the AI agent.

Opinions on trading and investing in AI agents

According to a survey of cryptocurrency participants, the frequency of AI agents predicting that they outperform humans in short-term cryptocurrency trading and long-term cryptocurrency investment is as follows:

In the same survey, participants were asked to what extent they agreed or disagree that they could trust AI agents to access and manage people’s crypto wallets, and their views were distributed as follows: