Source: Coinbase; Compilation: Bitchain Vision

Coinbase believes thatMacro data this week weakened market expectations for a sharp rate cut, the dollar strengthened and the financial environment tightened.

The U.S. Bureau of Economic Analysis (BEA) third estimate raised U.S. annualized GDP growth rate to 3.8% in the second quarter, indicating that potential demand is stronger than previously suggested.Meanwhile, durable goods orders rebounded by 2.9% in August (excluding the transportation industry’s growth of 0.4%), and core capital goods orders (a key indicator for measuring corporate investment) rose by 0.6% month-on-month.The number of initial unemployment claims fell to 218,000 in the week, indicating that the labor market is weakening, but the deterioration is not as high as previously suggested.

Taken together, we believe these data indicate stronger than expected economic growth and labor conditions, weakening the possibility of rapid monetary policy easing amid continued high inflation.The market seems to be digesting the shift: Interest rates are rising slightly, the U.S. dollar index approaches a three-week high, dollar liquidity tightens slightly, and cryptocurrency prices fall.

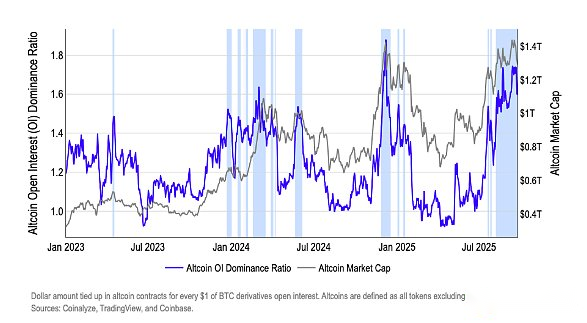

From a more global perspective,Coinbase’s customized M2 liquidity index shows liquidity headwinds will begin in November.Our customized global M2 liquidity index (which optimizes the growth of money supply, which is 110 days ahead of Bitcoin) starts downward inflection point starting in November.Since the index’s correlation with BTC over the 1-month to 3-year time frame is about 0.9, we believe that the inflection point is likely to indicate a liquidity headwind at the end of the year (Figure 1).However, the index also shows that liquidity is in good shape in October, which may support risky assets in the short term.

Figure 1. M2 liquidity index is expected to start declining in early November

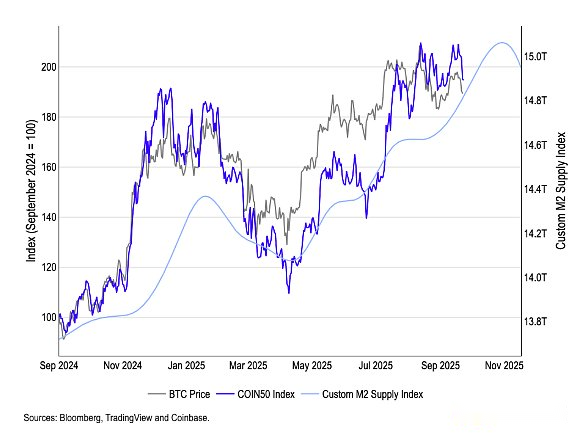

In addition to macro factors, we believeCryptocurrency clearing this week is caused by position pressure, which has been going on for several weeks, and a warning signal was issued.As we discussed in our previous article,The dominance of the altcoin open contract is much higher than the 1.4 threshold, which usually heralds the occurrence of large-scale liquidation.Last weekend, the ratio reached 1.7, and then we saw about $1.8 billion of long positions being forced to close because the long positions in the entire market were liquidated (Figure 2).

Even after closing the position, the ratio remains at a high of 1.6, we believe this highlights the need to be cautious in position before the upcoming data that may affect interest rates and the U.S. dollar is released.

Figure 2. Altcoin holdings dominant ratio