source:Coinbase Research;Compiled: bitchain vision

Key points:

-

Despite changes in perceptions of the altcoin season, Coinbase’s outlook for the third quarter of 2025 remains optimistic.Coinbase believes thatAs September approaches, current market conditions may herald the full arrival of the altcoin season.(A common definition of altcoin season is that at least 75% of the top 50 altcoins in market cap have outperformed BTC in the past 90 days..)

-

Many argue whether the Fed’s rate cut in September means that the cryptocurrency market has reached a local peak.Coinbase believes that is not the case.Given that a large amount of retail capital is on the wait-and-see position in money market funds (more than $7 trillion) and other areas, Coinbase believesFed’s easing policy may unleash the potential for more retail investors to participate in the medium term.

-

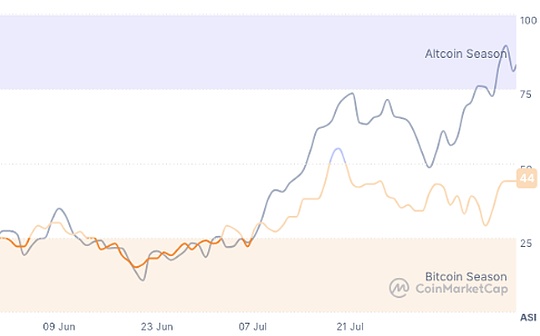

Follow ETH.(1) CoinMarketCap’s Altcoin Season Index has been significantly down, while (2) The total altcoin market value has increased by 50% since early July, and the difference between the two largely reflects the growing interest of institutional investors in ETH.This is due to the demand for a digital asset library (DAT), and the growing discussion around stablecoins and real-world assets.

-

Tokens such as ARB, ENA, LDO and OP all have beta values higher than ETH, but it seems that only LDO benefits from the recent rise in ETH, with a cumulative monthly increase of up to 58%.In the past, Lido has provided relatively direct ETH exposure given the nature of liquidity staking.In addition, we believe that the rise in LDO is also supported by the US SEC statement, which states that liquid staking tokens do not constitute securities under certain conditions.

Entering the altcoin season

Bitcoin’s market dominanceIt has dropped from 65% in May 2025 to about 59% in August 2025, marking an early stage of capital rotation towards altcoins.

CoinMarketCap’s Altcoin Season IndexCurrently 44, well below its historical threshold for defining altcoin season 75 points.

Although the altcoin market value has climbed more than 50% since early July, it has reached $1.4 trillion as of August 12.We believe that the current market conditions have begun to herald the possibility of a full-scale altcoin season as September approaches.

Figure 1.Dominant rate of open contracts for altcoinsSoaring

Coinbase’s constructive outlook is based on our macro perspective and expectations of major regulatory progress.We have pointed out before,Global M2 Money Supply IndexLeading Bitcoin by 110 days and heralding a new wave of upward liquidity at the end of the third quarter/early the fourth quarter of 2025.This is crucial because for institutional capital, the market seems to be constantly focusing on blue chip tokens, which we believe makes the support of altcoins mainly come from retail investors.

Coinbase’s constructive outlook is based on our macro perspective and expectations of major regulatory progress.We have pointed out before,Global M2 Money Supply IndexLeading Bitcoin by 110 days and heralding a new wave of upward liquidity at the end of the third quarter/early the fourth quarter of 2025.This is crucial because for institutional capital, the market seems to be constantly focusing on blue chip tokens, which we believe makes the support of altcoins mainly come from retail investors.

It is worth noting thatCurrently, about $7.2 trillion is stored inUS Money Market Fund, hitting a record high.(See Figure 2.) U.S. money market funds cash balances fell by $150 billion in April, which we believe prompted cryptocurrencies and risky assets to perform strongly in the following months.Strangely, however, the cash balance of U.S. money market funds has increased by more than $200 billion since June, which is a radical contrast to the cryptocurrency appreciation trend we have seen during the same period.Normally, there is often an inverse relationship between the rising cryptocurrency price and the cash balance.

Figure 2. Money market fund assets have expanded to over $7 trillion

We believe that this unprecedented cash reserve means missing opportunity costs, which include: (1) increased uncertainty in traditional markets (caused by trade conflicts, etc.); (2) excessive market valuations; and (3) lingering concerns about economic growth.However,along withFed cuts interest rates in September and OctoberAs we approach, we believe that the attractiveness of money market funds will begin to weaken, and more funds will be allocated to cryptocurrencies and other risky asset classes.

In fact, based on factors such as stable currency net issuance, spot and perpetual contract transaction volume, order book depth, and free circulation, weCryptocurrency liquidityWeighted z-value measurements indicateLiquidity has begun to rebound after a six-month decline in recent weeks.(See Figure 3.) The growth of stablecoins is partly due to a clearer regulatory environment for these assets.

Figure 3. New signs of a recovery in cryptocurrency liquidity

ETH Test

Meanwhile, the difference between the altcoin quarterly index and the total altcoin market value largely reflects the growing interest in ETH from institutional investors, thanks to the demand for digital asset treasury (DAT), and the growing discussion around stablecoins and real-world assets.BitMine alone has purchased 1.15 million ETH, with the new round of financing reaching US$20 billion, bringing its total purchase capacity to US$24.5 billion.(Sharplink Gaming, the former leader of ETH DAT, currently holds about 598,800 ETH.)

Figure 4. ETH held by some digital asset treasury companies

The latest data as of August 13 show that the top ETH treasury companies control about 2.95 million ETH, accounting for more than 2% of the total ETH supply (120.7 million ETH).(See Figure 4.)

In terms of beta of ETH, tokens such as ARB, ENA, LDO and OP ranked first, but it seems that only LDO has benefited from the recent rise in ETH, with a cumulative monthly increase of 58%.In the past, given the nature of liquidity staking, Lido provided relatively direct ETH exposure, and the current beta of LDO relative to ETH is 1.5.(Beta above 1.0 means that the asset is theoretically more volatile than the benchmark — which may amplify both gains and losses.)

Figure 5. Beta values of some altcoins relative to ETH (3-month window)

Furthermore, we believeThe rise of LDO is worthy of benefiting from the US SEC statement on liquidity pledge on August 5.Staff from the Finance Department of the SEC Company said that when the services provided by the liquid pledge entity are mainly “service” and the rewards of the agreement pledge are transferred in a one-to-one manner, the liquid pledge activities do not involve the issuance or sale of securities.However, earnings guarantees, discretionary replenishment or additional returns programs may still trigger securities issuance status.Please note that the current guidance only represents the staff’s point of view – future SEC adjustments or litigation may change this interpretation.

in conclusion

Coinbase’s outlook for the third quarter of 2025 remains optimistic, despite changes in perceptions of the altcoin season.closeThe decline in Bitcoin’s dominance in the future shows that funds are currently undergoing early rotations to altcoins instead of entering the altcoin season in full.

However, with the rise in altcoin market value and the positive signals shown early on by the altcoin quarter index, we believe thatWith September on the way, the market may enter a more comprehensive altcoin season.Both macro factors and expected regulatory progress support our optimistic view.