Author:Arthur Hayes, founder of BitMEX; compiled by: Bitchain Vision

It’s time for me to become the “keyboard meteorologist” again.Concepts like La Niña and El Niño flooded into my vocabulary.Predicting the wind direction of a snowstorm is just as important as predicting the amount of snowfall, which has a direct bearing on where I should ski.I use my rudimentary weather knowledge to express my opinion on when autumn ends and winter begins in Hokkaido, Japan.I was also talking to other local skiers about my dream of an early start to the powder season.However, the most frequently updated app on my phone is not my favorite cryptocurrency charting app, but a snow forecast app.

As data points came in, I had to decide when to hit the trails with incomplete information.Sometimes you have no idea what the weather will be like until the day before you put on your skis.A few snow seasons ago, I arrived in mid-December to find the entire mountain covered in dust.A cable car line is open, but it has to serve thousands of ski enthusiasts.People queued for hours to ski a flat, lightly snowed trail suitable for beginners to intermediates.The next day, the snow was falling and I enjoyed an epic run of powder at my favorite ski resort surrounded by glades.

Bitcoin is the free market benchmark for global fiat currency liquidity.Its transactions are based on expectations of future fiat currency supply.Sometimes reality matches expectations, sometimes not.Money is politics.The ever-changing political rhetoric will affect the market’s expectations for future legal currency supply.Our imperfect leaders sometimes call for more and cheaper money to support the voters they support; sometimes they call for more and cheaper money to fight inflation and prevent people from being devastated, jeopardizing their chances of re-election or the continuation of their rule.Just like science, in trading, it is wise to keep an open mind rather than being stubborn.

After the fiasco on America’s Liberation Day on April 2, 2025, I called for “Up, not Down!”.I believe that US President Trump and his Treasury Secretary Bessent have learned their lesson and will no longer try to change the world’s financial and trading system too quickly.To regain support, they will print money to distribute benefits to their supporters, who own large amounts of financial assets such as real estate, stocks, and cryptocurrencies.On April 9, Trump announced the suspension of tariffs, which seemed like the beginning of another Great Depression, but turned into the best buying opportunity of the year.Bitcoin gained 21%, a number of altcoins (mainly Ethereum) also gained, and Bitcoin’s market share fell from 63% to 59%.

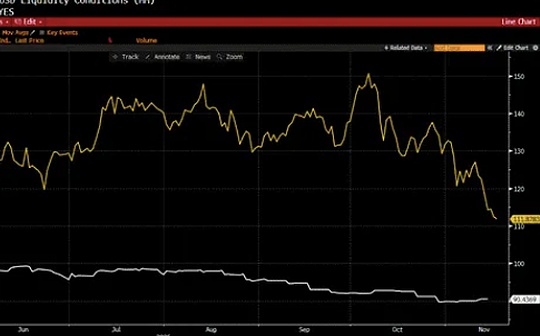

However, Bitcoin’s USD-implied liquidity expectations have worsened recently.Bitcoin prices have fallen 25% since their all-time highs in early October, with many altcoins falling even more than investors in the New York mayoral election.What changed all this?The Trump administration’s rhetoric has not changed.Trump still blasts the Fed for keeping interest rates too high.He and his staff continue to talk about stimulating the housing market through various means.And most importantly, Trump has compromised with China at every critical moment. He has been reluctant to reverse the trade and financial imbalances between the two largest economies, China and the United States, because the economic and political pain caused by this is too much for politicians who must face voters every two to four years.What also hasn’t changed is the shrinking dollar liquidity, which markets now take even more seriously than politicians’ rhetoric.

My USD Liquidity Index (white) is down 10% since April 9, 2025, while Bitcoin (gold) is up 12%.Part of the difference stems from the Trump administration’s aggressive liquidity rhetoric.This is partly because retail investors see inflows into Bitcoin ETFs and DAT’s mNAV premium as evidence that institutional investors want to hold Bitcoin.

Institutional investors are piling into Bitcoin ETFs, or so the officials say.As you can see, net inflows between April and October provided continued demand for Bitcoin, even as USD liquidity declined.I must add a little caveat to this chart.The largest holders of the largest ETF by AUM (BlackRock’s IBIT US) use that ETF for basis trading;They are not long Bitcoin.They shorted Bitcoin futures contracts listed on the Chicago Mercantile Exchange (CME) instead of buying ETFs to earn the price difference between the two.This practice is capital efficient because typically their brokers allow them to use ETFs as collateral for their short futures positions.

The above are the five largest holders of IBIT US.They are all large hedge funds or investment banks focused on proprietary trading, such as Goldman Sachs.

The chart above shows the annualized basis these funds would earn by buying IBIT US and selling CME futures contracts.While the chart above shows the Binance exchange, CME’s annualized basis is essentially the same.When basis spreads were significantly higher than the federal funds rate, hedge funds swarmed in, resulting in continued large net inflows into ETFs.This creates the illusion for those who don’t understand the market microstructure that institutional investors have a strong interest in Bitcoin exposure, when in fact they don’t care about Bitcoin at all and are only in it to get some extra yield above the federal funds rate.When the basis falls, they sell their positions quickly.Recently, the ETF market has seen large net outflows as basis declines.Now, retail investors believe that these institutional investors don’t like Bitcoin, creating a negative feedback loop that prompts them to sell, further reducing the basis, and ultimately causing more institutional investors to sell ETFs.

Digital Asset Treasury (DAT) companies offer institutional investors another way to gain exposure to Bitcoin.Strategy (ticker: MSTR US) is the DAT holding the largest number of Bitcoins.When its stock trades at a much higher price than its Bitcoin holdings, known as mNAV, the company can acquire Bitcoin at a lower cost through stock issuances and other financing methods.As the premium turns into a discount, the rate at which Strategy acquires Bitcoin decreases.

This is a graph of cumulative positions rather than the rate of change of this variable, but you can visually see that the growth in positions slows down as the mNAV premium of the strategy disappears.

Although USD liquidity has continued to shrink since April 9, Bitcoin ETF inflows and DAT purchases have still pushed Bitcoin prices higher.However, this situation has ended.The current basis is not strong enough to sustain continued ETF buying by institutional investors, and with most DATs trading below their minimum net value, investors are now shying away from these Bitcoin derivative securities..Without these inflows to mask the lack of liquidity, Bitcoin is bound to fall., to reflect current short-term concerns that dollar liquidity is shrinking or not growing as fast as politicians have promised.

Let’s see what Besant is really capable of.

Now it’s time for Trump and Bessant to show their real skills.Either they have the ability to put the Treasury over the Fed, create another housing bubble, send out more stimulus checks, etc., or they are just a bunch of weak and incompetent liars.To further complicate matters, Democrats have found (not surprisingly) that building their campaign strategy around narratives of “affordability” is a winning formula.Whether the opposition can deliver on these promises, such as free bus passes, a slew of rent-controlled apartments and government-run grocery stores, doesn’t matter.What matters is that people want their voices to be heard, or at least someone to delude themselves into thinking that those in power have their best interests at heart.People don’t want to be fooled by Trump and his Make America Great Again (MAGA) social media army into thinking that the inflation they see and hear every day is fake news.They want their voices to be heard the way they were heard by Trump in 2016 and 2020, when he told them he would crack down on China and deport brown people so that their good-paying jobs would magically reappear.

For those looking multi-year into the future, a short-term slowdown in the pace of fiat currency issuance is irrelevant.If Republicans don’t print enough money, stock and bond markets will collapse, which will bring monetary policy skeptics in both parties back to the money-printing cult.Trump is a savvy politician who, like former U.S. President Joe Biden, who faced a backlash over inflation spurred by his coronavirus stimulus package, would publicly reverse course and attack the Federal Reserve for causing the inflation that affects middle-class voters.But don’t worry, Trump won’t forget the wealthy asset holders who funded his campaign.Bessant will be ordered to print money in “creative” ways that the populace won’t understand.

Remember this photo from 2022?Our favorite Fed Chairman, Powell, was lectured by then-President Biden and Treasury Secretary Yellen.Biden explained to his supporters that Powell would keep inflation in check.Then, because he needed to grow the financial assets of the wealthy people who put him in power, he ordered Yellen to undo all of Powell’s rate hikes and balance sheet contractions at all costs.Yellen has issued more short-term Treasuries than long-term Treasuries or bonds, draining $2.5 trillion from the Fed’s reverse repurchase program from the third quarter of 2022 to the first quarter of 2025, which has pushed up the prices of stocks, real estate, gold and cryptocurrencies.To the average voter, and to some of you readers, what I just wrote will sound like heavenly scripture, and that’s exactly the point.The inflation you are feeling is a direct result of a politician who promised to solve the affordability problem.Bessant had to work a similar magic.I am 100% sure that he will promote similar results.He is one of the most proficient experts in currency market operations and Forex trading in history.

Preparation

The market patterns in the second half of 2023 and the second half of 2025 are surprisingly similar.The debt ceiling battle ended in mid-summer (June 3, 2023, and July 4, 2025), forcing the Treasury to rebuild the General Account (TGA), resulting in reduced liquidity in the system.

2023:

2025:

Yellen pleased her boss.Can Bessant find his position and allow the market to correct itself so that Republicans can mobilize voters with financial assets to turn out in the 2026 midterm elections?

Whenever politicians listen carefully to the voices of the inflation-stricken majority, they talk a lot about reining in central bankers and Treasury officials who are obsessed with printing money.In order to discourage them from tightening credit, the market presented a dilemma.Stock and bond market prices fell rapidly after investors realized that printing money was taboo in the short term.Politicians can either print money to save the highly leveraged fiat financial system that is propping up the overall economy but causing inflation to accelerate again, or they can do nothing but allow the credit crunch to devastate wealthy asset holders and cause mass unemployment as overleveraged companies have to cut production and staff.The latter option is generally more politically acceptable, since 1930s-style unemployment and financial distress always result in electoral defeats, but inflation is a hidden killer that can be masked by printing money to subsidize the poor.

As confident as I am about snowmobiling on Hokkaido, I am 100% sure that Trump and Bessant want their Republican team to stay in power, so they will find ways to be tough on inflation while printing money to maintain a Keynesian fractional reserve system, thus continuing the charade of the US and global economy.In the mountains, arriving early can sometimes get you onto slushy snow.In financial markets, before we return to an all-up, no-down situation,In layman’s terms, the market must fall first before it can usher in a real “eagle strike against the long short”.

The music videos they make now are different than before.

Reasons to watch cattle

The counter-argument to my “negative dollar liquidity” theory is that as the U.S. government resumes operations after the shutdown, government financial assistance (TGA) will be reduced by $100 billion to $150 billion to reach the $850 billion target in the short term, which will increase liquidity in the system.In addition, the Federal Reserve will stop shrinking its balance sheet starting on December 1 and will soon resume balance sheet expansion through quantitative easing.

In the early days of the government shutdown, I was optimistic about risk assets.However, digging deeper into the data, I found that roughly $1 trillion in liquidity has evaporated since July, according to my index.An additional $150 billion is welcome, but what happens next?

Although many Fed governors have suggested that restarting quantitative easing is crucial to rebuilding bank reserves and ensuring the normal functioning of money markets, this is just talk.Only when The Wall Street Journal’s Fed “insider” Nick Timilaus announces the green light to restart QE will we know for sure they mean it.But we haven’t reached that point yet.At the same time, the standing repurchase mechanism will be used to print money on a scale of tens of billions of dollars to ensure that money markets can cope with huge government debt issuances.

In theory, Bessent could reduce the size of TGA to zero.However, because the Treasury Department must roll over hundreds of billions of dollars in Treasury debt every week, it must maintain a large cash buffer to deal with emergencies.They cannot bear the risk of defaulting on maturing government bonds. Once they default, they cannot immediately inject the remaining $850 billion into the financial markets.

The privatization of government-backed mortgage lenders Fannie Mae and Freddie Mac is certain to happen, but it won’t be completed in the next few weeks.Banks will also fulfill their “responsibility” and provide loans to companies that make bombs, nuclear reactors, semiconductors, etc., but again, this loan will be completed over a longer period of time, and these credits will not flow into the dollar currency market immediately.

The bulls are right; over time, the money printing presses will eventually roar to life.But first, the market must give back its gains since April to better align with liquidity fundamentals.Finally, before I discuss Maelstrom’s position, I don’t believe in the four-year cycle.Bitcoin and certain altcoins will only reach new all-time highs after the market plummets to a point that prompts the pace of money printing to accelerate.

Maelstrom position

Over the weekend, I added to my holdings of USD stable assets in anticipation of lower cryptocurrency prices.I think,The only cryptocurrency that can escape the USD illiquidity dilemma in the short term is Zcash(Code is ZEC).With artificial intelligence, big tech companies, and governments getting involved, privacy is no longer available in much of the internet.Zcash and other privacy cryptocurrencies with zero-knowledge proof encryption are humanity’s only hope against this new reality.Because of this, Balaji and others believe that the core idea of privacy will continue to drive the cryptocurrency market for years to come.

As followers of Satoshi Nakamoto, we are rightly outraged that the third, fourth, and fifth largest cryptocurrencies by market capitalization are, respectively, dollar derivatives, useless coins on blockchains with no real functionality, and Changpeng Zhao’s (CZ) centralized computer.If 15 years from now, these cryptocurrencies have the largest market capitalization after Bitcoin and Ethereum, then what are we doing?I’m not targeting Paolo, Garlinghouse, and Changpeng Zhao personally; they are all masters at creating value for token holders.Founders, please take note.But Zcash or similar privacy cryptocurrencies should have a market capitalization second only to Ethereum.I believe the grassroots cryptocurrency community is gradually realizing that what we are implicitly supporting by giving these tokens such high market caps is antithetical to a decentralized future.In a decentralized future, we, flesh-and-blood humans, should still be able to maintain our autonomy in the face of oppressive technology, government, and artificial intelligence giants.So while we wait for Bessent to get back into its money-printing rhythm, the price of Zcash or other privacy-focused cryptocurrencies will rise in the long term.

Maelstrom is still very strong, and if I have to buy at the highs like I did earlier this year, then so be it.I accepted defeat because having enough fiat on hand allowed me to go all out to win and ensure success every time.If a similar opportunity arises in April 2025, having sufficient liquidity will determine your profit and loss this cycle more than blindly pursuing sporadic trades (which will inevitably lead to losses).

The collapse in Bitcoin prices from $125,000 to just over $90,000 while the S&P 500 and Nasdaq 100 hovered near all-time highs made me realize a credit crisis was brewing.The continued decline in my USD Liquidity Index from July to the present also supports this view.If I’m correct, then a 10% to 20% correction in the stock market, coupled with a 10-year Treasury yield approaching 5%, would be enough to prompt some kind of emergency money-printing program from the Fed, Treasury, or other U.S. government agencies.During this period of weakness, it is entirely possible that Bitcoin prices could fall to $80,000 to $85,000.If broader risk markets collapse and the Fed and Treasury accelerate money printing, Bitcoin prices could surge to $200,000 or $250,000 by the end of the year.

I still believe the Chinese economy will inflate again.But only when the United States truly accelerates its issuance of U.S. dollars will China press the start button.The dragon is about to awaken and pour Moutai into the flames of the 2026 cryptocurrency bull market.

Before I leave to dance in beautiful Argentina, one last thing to say about China: Isn’t it hilarious that Beijing is furious about the United States “stealing” Bitcoin from a wire fraud kingpin who defrauded Chinese citizens of their money?Clearly, China believes that Bitcoin is a valuable asset that should be held and preserved by the Chinese government or people, not the U.S. government.If the United States and China both believe that Bitcoin has value, why are you not optimistic about Bitcoin’s long-term prospects?