Author: Matt Hougan, Chief Investment Officer of Bitwise; Compiled by: BitChain Vision

Summary: Gold prices have risen far more than Bitcoin, and there are hidden benefits behind this.

There are currently two core questions about Bitcoin in the encryption market:

1. Why does the price of gold far outperform Bitcoin?

2. Since ETFs and companies are buying heavily, why is the price of Bitcoin still stagnant?

In fact, if the first question is answered carefully, the answer to the second question will also emerge – and this answer paints a very bullish picture for the future of Bitcoin.

Next I will analyze it in detail.

Question 1: Why does the price of gold far outperform Bitcoin?

Although the price of gold is currently correcting, it has risen rapidly this year, with an increase of 57% in 2025, and is heading towards the second best annual performance in US dollar terms in history.Meanwhile, Bitcoin has stalled near the $110,000 mark, with prices roughly flat since May.

This is frustrating for investors who view Bitcoin as “digital gold,” butThere is actually a simple explanation behind it: the differences stem from the behavior of central banks in various countries..

Since the United States froze Russia’s holdings of U.S. Treasury bonds after Russia invaded Ukraine, central banks have begun to increase their gold holdings.According to data from Metals Focus, the central bank’s gold purchases have nearly doubled since the outbreak of the Russia-Ukraine war, from about 467 tons per year to about 1,000 tons today. This scale is about twice the estimated purchase volume of gold ETPs (exchange-traded products).

Bitcoin cannot enjoy this treatment.Although some central banks are studying Bitcoin, no central bank has yet actually bought it.therefore,If central banks are the main driver of this rise in gold prices, then it would be logical for Bitcoin to fail to follow gold prices higher.

This idea is nothing new.Institutions and individuals such as Morgan Stanley, JPMorgan, and Mohamed El-Erian have all pointed out that central bank gold purchases are the key driver of the surge in gold prices.

Question 2: Why is the price of Bitcoin still stagnant despite the massive buying by ETFs and companies?

How does this relate to the second question?

The answer is: a huge correlation.

The biggest mystery in the Bitcoin market is why its price has remained relatively flat despite heavy buying by ETFs and corporates.Since the launch of the Bitcoin ETF in January 2024, ETFs and companies have bought a cumulative 1.39 million Bitcoins, while the new supply of the Bitcoin network during the same period was less than a quarter of this size.Although the price of Bitcoin has risen by 135% since then, many people are still wondering: shouldn’t it go higher?

I have also had the same question: Who is selling Bitcoin in large quantities?What’s holding it back from breaking the $200,000 mark?

The current rise in gold prices provides the answer.

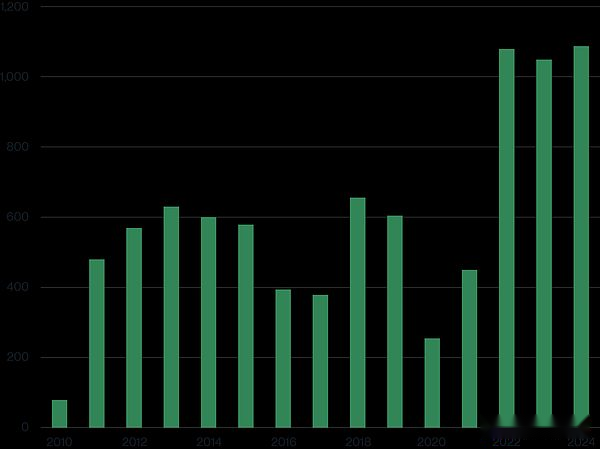

Please see the table below, which shows the annual gold purchases by central banks from 2010 to 2024.The central bank’s gold purchases were 467 tons in 2021, jumping to 1,080 tons in 2022, and have remained at this high level since then (forecasts indicate that demand in 2025 will be slightly lower than in 2024).

Gold purchases by central banks of various countries from 2010 to 2024 (unit: tons)

Source: World Gold Council

in short,Although central bank gold purchases are an important catalyst for the rise in gold prices this year, such purchases did not begin this year, but in 2022.

This also provides an answer to Bitcoin’s current situation.

When central bank gold purchases begin to increase significantly in 2022, the price of gold rises more slowly: the average price is US$1,800 in 2022, rising to US$1,941 in 2023 (an increase of only 8%), and rising to US$2,386 in 2024 (an increase of 23%).It was not until this year that the price of gold experienced an explosive rise, rising nearly 60% to approximately $4,200.

That is to say:The central bank will start buying gold in 2022, and gold prices will only see a parabolic rise in 2025.

I think the logic of the matter is clear: In any market, there is a segment of investors who are price-sensitive – investors who tend to take action when prices rise or fall by 10%-15%.When the central bank starts buying large amounts of gold in 2022, driving up gold prices, these investors will take advantage of the rising demand to sell gold.But eventually, this selling power will be exhausted, and prices will rise sharply.

I doubtBitcoin is currently in a similar phase.

As mentioned earlier, the price of Bitcoin has increased 2.3x since 2024 when ETFs and corporates began buying aggressively.During this period, price-sensitive holders will seize profit opportunities and sell out.

But as the gold price example shows,There comes a time when all this selling power is exhausted.As long as the joint buying trend of ETFs and companies continues (I think there is a high probability that it will continue), Bitcoin will usher in its “golden moment in 2025.”

My advice: be patient.

Don’t be envious of gold’s skyrocketing price, but consider it a sign—it may be showing us where Bitcoin is heading in the future.