Author: Yue Xiaoyu; Source: X, @yuexiaoyu111

Many people are still searching for solutions, but they do not realize that the Bitcoin market has undergone structural changes.

1. Is Bitcoin’s four-year cycle still there?

Gold has surged, silver has surged, and even A-shares have surged, but Bitcoin has not risen this year.

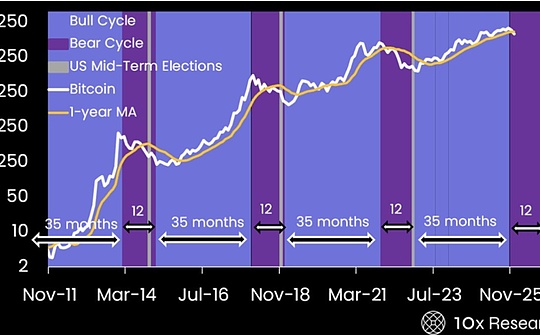

In fact, the four-year cycle has been clearly broken.

Not only did this bull market start early, but the rise and fall patterns did not replicate the previous cycle.

According to past rules, 2025 was supposed to be the Year of the Ox, but this year’s performance was relatively poor.

2. Why was the four-year cycle broken?

One of the core reasons is:Bitcoin has changed from supply determining price to demand determining price.

Previously, the supply of Bitcoin was halved every four years, and the price would naturally rise if the demand remained unchanged; but now that most Bitcoins have been mined, changes in the annual supply of Bitcoin have less impact on the price.

On the other hand, the pricing power of Bitcoin prices has been in the hands of Wall Street, traditional financial institutions continue to enter the market, and traditional funds continue to flow in.

Changes on the demand side of the market have greater influence than changes in supply.

3. Where is the next stage of Bitcoin?

The current narrative of Bitcoin is “digital gold”, but if Bitcoin really wants to replace gold, it needs to have superior attributes that are 10 times more than gold.

Bitcoin already has the scarcity of gold, but there is still one greatest potential that has not yet been released:Digitality.

Or it can be called programmability.

If you just simply hoard coins, it will be no different from gold. What gold cannot do is turn it into an interest-earning asset, but Bitcoin can.

A financial system can be built around Bitcoin.

Imagine that Bitcoin has become digital oil, which can be used in various practical scenarios; Bitcoin can also be transformed into digital bonds, spawning various financial derivatives.

There are already some projects that are continuing to build in this direction, such as the GOAT Network, which is positioned as the income layer of Bitcoin.

Bitcoin’s next narrative should be “interest-bearing digital gold.”

This narrative point has not been fully discovered by the market.It is recommended to plan relevant projects in advance.