Author: Marcel Pechman, Cointelegraph Translation: Shan Ouba, Bitchain Vision Realm

Bitcoin spot ETF has become headlines due to media reports of US $ 2.8 billion, but what is the importance of this number?

The Spot Bitcoin Soaring Exchange Trading Fund (ETF) has become the focus of the financial market, causing people to speculate on the potential of traditional assets such as gold.ETFs can be easily bought and sold on the conventional stock exchange, simplifying the process of daily investors trading Bitcoin using standard brokerage accounts.

Another advantage is that these tools are supervised and supervised, breaking the obstacles that the common funds and professional financial managers have not been directly held and manage digital assets before.

The impact of spot ETF Bitcoin on the basic spot market

ETF has a unique way to maintain the value of its price as the value of its assets, which involves a process called creation and redemption.This process plays a vital role in managing the number of ETF shares in the management market and ensuring that ETF prices are closely related to the asset value it represents.

Similar to the price of other buying and selling items, the price of ETF is affected by the number (demand) that people want to buy it and the number of people want to sell it.Sometimes, the demand for ETFs may be very high or very low, causing the price to deviate from the actual value of its assets.

In order to prevent major differences between ETF prices and its asset value, there are some special participants in the financial industry, called authorized participants.These participants can create or redeem ETF shares according to market demand.Creating new shares will increase the supply, and redeeming stocks will reduce the supply.By doing this, they can help control ETF prices and avoid significant deviations from the real value of their assets they represent.

Spot Bitcoin ETF transaction volume exceeds expectations

Bitcoin ETF spot transactions began on January 11th. These products accumulated a record of $ 14 billion in transactions in the first five days, which is an unparalleled feat of other products ETFs.

>

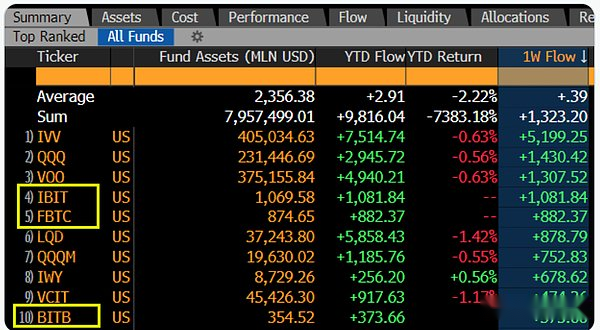

As the Bloomberg Senior ETF analyst Eric Balchunas emphasized, the only asset category that surpassed Bitcoin in terms of transaction volume is the asset class that tracks the Standard 500 Index or the Nasdaq 100 index.Objectively speaking, the US stock market value is US $ 5.2 trillion, which is more than 60 times more than $ 810 billion in Bitcoin.

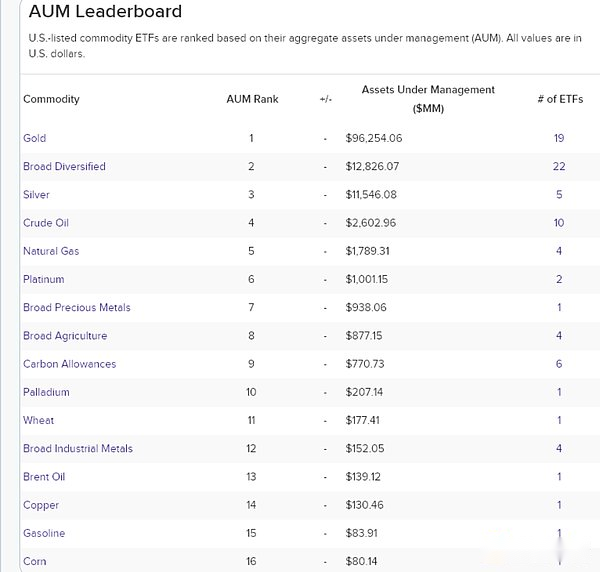

More importantly, the total management assets (AUM) of Bitcoin spot ETF issuers reached 2.8 billion US dollars, exceeding the sum of silver, crude oil and extensive diversified goods, making gold the only remaining competitor.

A article published by James Van Straten, chief analyst of Cryptoslate James Van Strate, described precious metal gold as an absolute leader in the field of commodities in the field of commodity. Its ETF tool holds gold worth $ 96 billion.

>

However, the scale of Bitcoin ETF’s asset management currently accounts for only 3.5%of Bitcoin’s current market value.In contrast, even if it excludes 63%of the scale of gold asset management for jewelry, coins, electronic products and other applications, its ETF industry only accounts for 2%of the market value of $ 5 trillion in gold.

Gold is not the only direct competitor in the ETF industry

Although the growth rate of Bitcoin ETF exceeds the growth rate of the commodity ETF, the bond market tells different stories, and the global asset management scale has reached an impressive $ 2 trillion.Similarly, the scale of the asset management of the Standard 500 ETF industry exceeds $ 1 trillion, highlighting the persistence of traditional stocks.

Although the market value of Bitcoin ETF has not exceeded gold, the recent growth shows a convincing story.Compared with oil, silver, and gold commodities, the influence of Bitcoin as a legal asset category is increasing.

With the maturity of Bitcoin, the potential of its market value of more than $ 1 trillion has become more and more possible, which confirms its status as a transformation power as a financial field.