Author: Erik Lowe, Pantera Capital content director; Translation: 0xjs@作 作 作 作

So far, cryptocurrencies, especially DEFI, are mainly operating in their own world.The constructed primitives are essentially focusing on the needs of the usual currency holders in the DEFI ecosystem.For example, DEX mainly supports exchanging governance, utility or GAS token to other similar tokens.The borrowing agreement allows users to use other tokens as a mortgage to borrow to tokens.There are many activities, but most of them are still within the scope of the “encrypted world”.This raises a question: “How will this technology break into the world outside the blockchain?”

The answer may be earlier than we think.In fact, the “encrypted world” and “real world” are in integration.

The world’s largest asset management company integrates DEFI

Since its announcement of spot Bitcoin ETF last year, BlackRock has been in the field of digital assets.They recently launched the first chain fund, the first one named Buidl (The Blackrock USD Instificational Digital Liquidity Fund, Perrye’s US dollar agency digital liquidity fund).

BUIDL strives to provide a stable value of $ 1 each token, and pays daily dividends per day as a direct payment of New Type to investors’ wallets.The fund invests 100%of total assets in cash, US Treasury and repurchase agreements, allowing investors to earn benefits while holding blockchain tokens.Investors can transfer their tokens to other pre -approved investors 24/7/365.Fund participants will also have flexible hosting options to allow them to choose how to hold tokens.

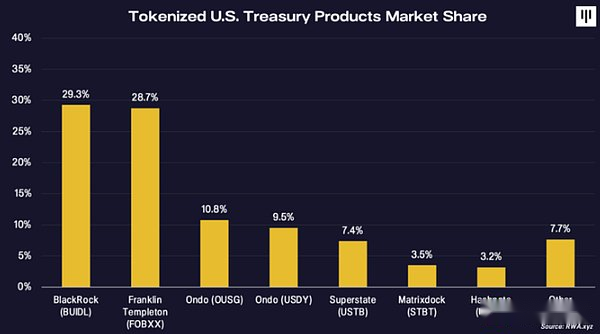

Since its launch on March 21, BUIDL has accumulated $ 375 million in assets, accounting for nearly 30%of the U.S. Treasury token market.This growth is largely promoted by the Pantera Investment Group ONDO. The company contributes $ 140 million to the fund through its short -term U.S. Treasury Fund.

BlackRock and Franklin Templeton are in a leading position in the tokens, bringing RWA (“real world assets”) to cutting -edge and centers.The world of centralized finance is integrating with decentralized finance.

“We believe that the next step will be the tokenization of financial assets. This means that each stock and each bond basically have their own cusip. They will be recorded on one general account. Each investor will have their own identity numberEssence

“We can eliminate all issues related to illegal activities related to bonds and stocks through the tokenization. But the most important thing is that we can customize the currency customization strategy suitable for everyone …

“We believe this is a technical change in financial assets.”

——Bellaide CEO Larry Fink, Bloomberg TV interview, January 12, 2024

The actual benefits of tokens cannot be ignored. This is why we believe that more traditional companies will follow suit.Benefits include 24/7/365 liquidity, instant transaction settlement, and reduced operating friction. These characteristics are rarely achieved in traditional systems.This is not only the technical upgrade of financial operations, but also a strategic expansion, which may eventually enhance financial inclusiveness and deepen the market.

Berleide’s BUIDL Fund may promote a wider integrated integration between Tradfi and DEFI.In the end, the difference between traditional finance and decentralized finance may become more and more blurred.