Author: Jack Inabinet, Bankless; Compilation: Deng Tong, Bitchain Vision

More than $500 million ENA has just been distributed to eligible investors through Athena’s first round of airdrops, but the debate over the deal has reached a white-hot level on Crypto Twitter.Why are the two blue chip DeFi protocols now in conflict with Athena?

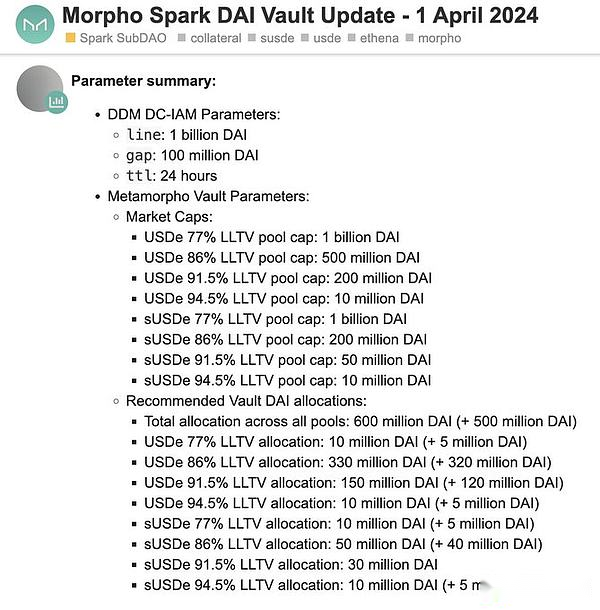

Yesterday afternoon,A governance proposal was published on the Maker forum asking delegates to consider increasing the capacity of recently established USDe and sUSDe lending facilities on Morpho from 100 million DAI to 600 million DAI, and to expand that amount to up to 1 billion DAI, largeSome funds will be loaned at a relatively high loan value (LTV) ratio of 86% or higher.

Maker’s move to increase Athena’s synthetic dollar stablecoin as collateral is to increase DAI adoption, and this move comes as its stablecoin’s market dominance has plummeted by 20% since the beginning of the year.

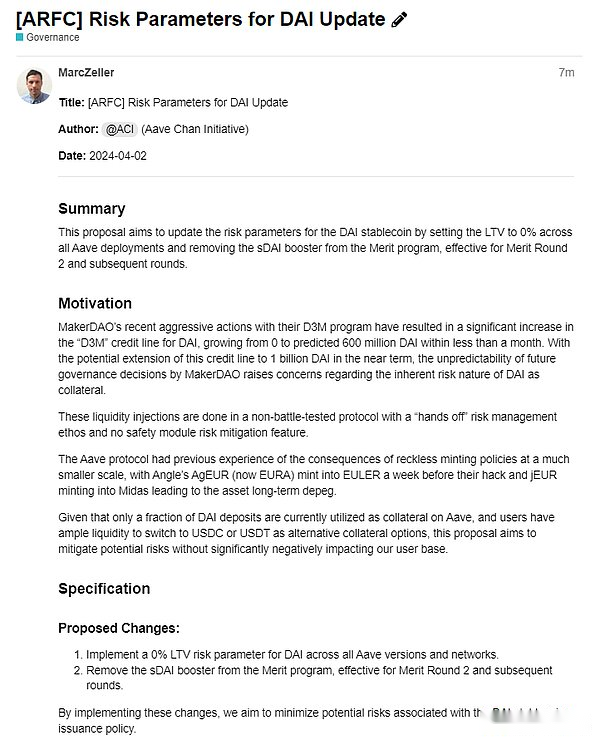

In response to Maker’s governance proposal, Aave contributors launched their own proposal, seeking to set DAI’s LTV to 0% in all Aave deployments, eliminating the ability of users to borrow with DAI as collateral assets.

Confusing many, Aave showed willingness to include Athena’s sUSDe into its V3 Ethereum deployment, with temperature checks on March 19 passed with almost consistent support, which is in line with the protocol’s recent increase in lending activity against Maker for its tokensThe instinctive reaction of effort is in sharp contrast.

While DAI loans through Aave have the potential to be done in a risk isolation manner (similar to how the sUSDe market may operate in the future), thus eliminating the possibility of spread, Aave is no longer willing to take on the increasing risks.Maker has shown that it will be committed to increasing DAI supply and fiscal revenue.

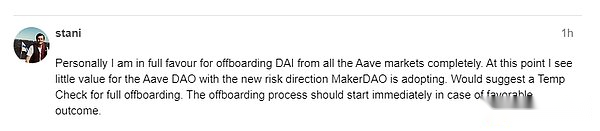

Aave founder Stani Kulechov reiterated this view, proposing to remove DAI from all markets entirely, saying he believes “with the new risk directions that MakerDAO is adopting, Aave DAO is of little value.”

Source: Aave Governance

Given the extremely high yields of Athena stablecoins, sUSDe generates the best-in-class returns of stablecoins through funding/staking payments, while USDe offers huge airdrop rewards, with high leverage demand for these assets and holders are willing to pay for the fees to obtain it..

Although Maker’s current Athena lending business has only 2% of its circulating DAI supply is collateralized, the loans have an annualized return of 36%, contributing 10% to Maker’s expected revenue.

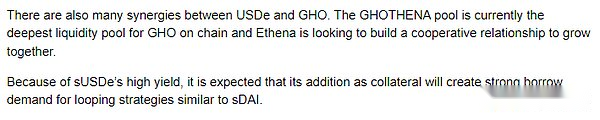

While Maker’s increasingly adoption of Athena assets as collateral undoubtedly increases the risk profile of DAI to some extent, Aave’s retaliation response feels harsh and can be seen as aimed at further supporting GHO-the agreementIts own stablecoin, also a direct competitor to DAI, is considered in the governance proposal to consider the potential benefits that Athena and Aave may bring to GHO to support the sUSDe market…

Source: Aave Governance