Author: Anthony Pompliano, compiled by: Shaw bitchain vision

To investors.

The financial market is about to go crazy.I know a lot of people predict the next recession is coming, but they are totally wrong.

I’m not sure whether they draw conclusions based on the wrong data, or whether they draw in the right data, or both.How they draw false conclusions is not really important.

They were totally wrong.

Take the US stock market as an example.Adam Kobeissi wrote:

“The stock market is extremely hot. Since 1975, the S&P 500 has only 6 times risen by 30% or more in five months. 2025 is one of them. In these cases, the S&P 500 has achieved gains over the next six months and 12 months, according to Carson Research. In fact, in these cases, the S&P 500 has gained an average of 18.1% in the next 12 months.”

These numbers are simply crazy.Do you want to bet against history?Then it’s up to you.But I still tend to compare financial markets to science.Things that are in motion tend to remain in motion.Inertia is a powerful force.

But things start to get interesting from here.If the stock market rose 30% in 5 months, there will definitely be someone who will become richer, right?Who is holding these stocks?

Adam Kobeissi continued to explain:

“The latest data released shows that in the second quarter of 2025 alone, U.S. household net assets increased by $7.1 trillion. In other words, for three consecutive months, the average daily net assets increased by $79 billion…

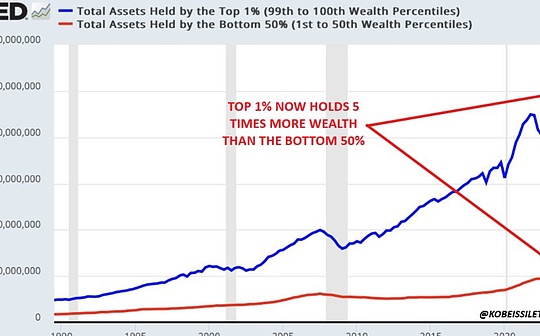

As a result, the rich are getting richer.Currently, 50% of the households in the U.S. have only 2.5% of the total wealth of the U.S.In fact, the wealthiest 1% of families now have $40 trillion more wealth than the total wealth of the lower 50% of families.”

In short, stocks have achieved historic returns over the past five months.It makes the rich richer, while the bottom 50% of Americans can only stand by and watch.

This is not the fault of the rich, it is a problem of financial education.In fact, I think that if we can’t find a way to get every student to be educated in personal finance and investment, our country will face a national crisis.

In the future, asset owners will be winners, while savers will be losers.You may not like this statement, but that doesn’t mean it doesn’t hold.

This bull market is far from over.Mike Zaccardi wrote: “On average, a bull market will last for 70 months. And we are about to usher in the 35th month of this bull market.”

It’s a bit against the narrative, right?I know your pessimistic neighbor won’t tell you this data.But data is data, and almost all data shows that we are in a bull market with strong potential.

Let’s turn our attention to this week’s Fed meeting, which should end with a rate cut.

Yes, they will still cut interest rates when the stock market hits record highs and government inflation data exceeds 2.5%.We have never seen this happen.

Creative Planning’s Charlie Bilello noted that the last time the Fed dropped interest rates with inflation exceeding 2.9% was in October 2008, “at the time when it was in the midst of the worst recession/bear market since the Great Depression.”

From this unprecedented move by the Federal Reserve, I came to two important conclusions.First, the Fed does this because of the labor market.Artificial intelligence has always been a huge deflationary force in the U.S. economy.Businesses are finding ways to achieve higher productivity and profitability with fewer employees.

Secondly, the Fed has been slow for several months.I think the Fed should cut interest rates by 50-75 basis points to return to its due level, but historical experience shows that the Fed often avoids making bold decisions.

Let’s first make a “fair” comparison.The probability of a 50 basis point cut given by Polymarket is only 8%, which is very low compared to the 90% probability of a 25 basis point cut this week.

But it doesn’t matter if the final rate cut is 25, 50 or 75 basis points.

“The last Fed cut was in December 2024, so there was a nine-month gap between the two rate cuts. A 5-12-month gap between rate cuts is usually good for the S&P 500. A year later, if 10 of 11 returns were seen above average, it should be comforting for bulls.”

The Fed will push asset prices from stocks to gold to Bitcoin to higher levels.They have no choice.They must solve the labor market problems or they will face greater trouble.

Regardless of the misleading government data, the Fed is believed to be far higher than the actual level.Don’t worry about the fact that the Fed has become a politicized institution, which seems to be singing a counter-tweet for the current government’s economic plan.Don’t be angry that the Fed says it wants to “rely on data” and then change its words.

The central bank is now in trouble.They had to cut interest rates.Given that asset prices are close to historical highs, we can only expect new influx of cheap funds to push prices higher and higher in the coming weeks and months.

Get your rain boots ready.Liquidity is coming.Investors will be very happy.