Author: Tim Craig Source: DLNews Translation: Shan Oppa, Bitchain Vision

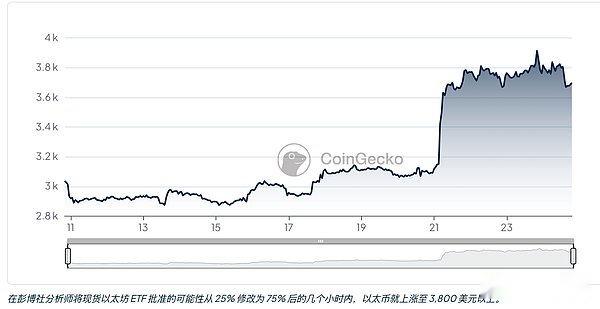

When Ethereum’s Ethereum (ETH)When it hit a record $3,800 in May 2021, the increase in on-chain activity caused transaction fees to soar and users flocked.The cost of trading tokens is as high as $100, but many people don’t care because they can make a profit from it.

Fast forward to 2024, and Ethereum has relived these high prices for the first time in more than two years.But this time the situation is different.Despite the recent surge in prices due to the policy shift of Ethereum spot ETFs, transaction fees for top smart contract networks are still low——It is only slightly higher than when the crypto winter is at its worst in 2022.

This shows thatThe demand for transactions on Ethereum is no longer as strong as before.So, what is the reason?

Increased transaction efficiency, coupled with the transfer of activity to Ethereum’s low-cost layer 2 networks such as Base and Arbitrum, helped curb demand and reduce Ethereum’s usage costs.While this is a good thing for Ethereum users, it also has some negative effects.

As the transaction fees on the Ethereum mainnet decline, the number of tokens for network destruction (destruction in crypto terminology) is not enough to deflate the supply of Ethereum.The key is that if the fees remain low, it may shake the network’s economic model.

Ethereum becomes too efficient?

When the Ethereum network destroys the number of tokens from the transaction fee exceeds the number of tokens rewarded to the validator to process these transactions, the total supply of Ethereum curtails and becomes deflated.This situation is beneficial to the network because it rewards those who help run the network without increasing the supply of Ether.

But if the user spends insufficient Ether on transactions, the supply of Ether will expand infinitely, destroying the economic model of the network.Continuing inflation, while unlikely, will depreciate Ether, making it no longer attractive to users to lock in to validators to ensure network security.After all, an asset in a constantly printing unit is more suitable for spending than storage.

So far, Ethereum supply has generally decreased since the Ethereum merger upgrade in September 2022 reduced the Ethereum issuance.But that is changing.The network has added more than 50,000 Ethereum coins to a value of $190 million in the past month due to the lack of Ethereum activity.

If activity and transaction fees on Ethereum do not rebound, Ethereum supply will expand by 0.5%, or $2.2 billion in the next year.

Where did the handling fee go?

In recent years, many Ethereum users have turned to what is called a layer 2 network.Layer 2 networks like Arbitrum, Optimism, and Base provide Ethereum compatibility, faster transaction speeds and lower costs while still relying on the security of the Ethereum master network.

Explosive growth in activity.Activity and transaction volumes on the second-tier network have soared to record highs since the beginning of 2024.These second-tier networks still pay transaction fees on the Ethereum main network, but only account for a small part of the fees required for all users to send transactions directly on the Ethereum main network.

In addition, Ethereum’s Dencun upgrade in March further reduced the cost of releasing second-tier transaction data and further reduced the demand for the main network.

On the other hand, developers are improving factors that affect Ethereum transaction costs, with the result that gas fees are lower and users pay less for the same type of transaction.

Ethereum has been unprecedentedly efficient and the second layer of ecosystem is booming. How can the network avoid economic turmoil?