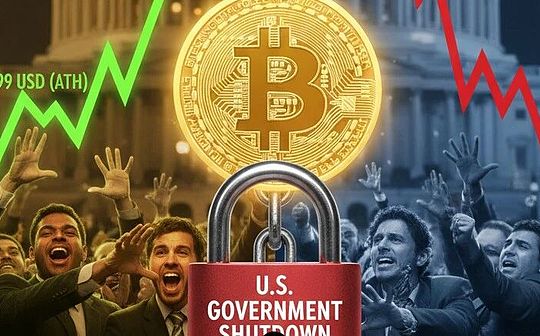

Recently, the US government has been shut down again!As the U.S. Senate failed to pass a temporary appropriation bill on September 30, the U.S. federal government began to shut down at 0:01 on October 1, 2025 local time.

As a senior financial planner, today I will use two waves of historical data to show you: When Uncle Sam “strike”, what will happen to our gold and Bitcoin???

Gold reaches new high: On October 3, London gold (XAU) reached a historical high of US$4,059.07 per ounce with four consecutive positive lines, and the market retail gold spot price was RMB 1,160 per gram.

“Digital gold” is advancing rapidly: On September 26, the cryptocurrency market began to react in advance. The spot price of BTC “killed” from $108,620 to $126,199 (ATH), an increase of 16.18% in 11 days!

What is a government shutdown?

To put it simply, the two political parties in the United States are quarreling and running out of money, and some government departments have closed down.This will not only affect the salary of civil servants, but also shake the confidence of global investors in the U.S. dollar and U.S. debt, triggering market panic!

Historical data doesn’t lie

After reviewing two typical lockout events, the results are very interesting:

Lockout October 2013 (16 days)

⚫ Gold: basically unchanged (-0.68%), when the market was more concerned about the Fed’s exit from QE

⚫ Bitcoin: Soaring 29.6%!It was an early bull market and the digital gold narrative was hot

⚫ US dollar: fell slightly by 0.59%, the panic index first surged and then fell back

2018-2019 lockout (35 days, longest ever)

⚫ Gold: Steady rise of 3.74%, perfectly demonstrating its safe-haven properties

⚫ Bitcoin: down 6.02%, was in a bear market and was sold as a risk asset

⚫ US dollar: dropped significantly by 1.22%, the panic index fell sharply after rising

core argument

gold:The hedging properties are more stable!Reliable performance especially in ongoing crises (as evidenced by data from 2018-2019);

Bitcoin:The dual attributes are obvious;

Early/Bull Market:May demonstrate “digital gold” potential (2013 case);

Bear Market/Market Panic:More like high-risk technology stocks, prone to sell-offs (2018 case);

The dollar and the fear index:Both events showed that shutdowns would weaken the dollar and drive market panic.

For investors

conservative investor: Gold is still the “ballast stone” in uncertainty;

enterprising investor: Bitcoin needs to be wary of short-term fluctuations and see whether the narrative logic can be strengthened in the long term;

most important: The duration of the shutdown and overall market sentiment are key variables!Like the shutdown in 2013, Bitcoin is still in a bull market, so there is an obvious siphon effect.

Do you think that if there is a shutdown this time, Bitcoin will continue to go out of its independent market?