Author: Prathik Desai, Source: Token Dispatch

This article will explore Galaxy Digital’s second quarter 2025 financial report, which is preparing for a major transformation.From its core business (Contributes 95% of revenue, but profit margin is less than 1%) Turn to a new business model that promises super high revenue and expense ratio.

summary

summary

-

Galaxy’s crypto trading business generated $8.7 billion in revenue, but only $13 million in profits (Profit margin is only 0.15%), while quarterly compensation expenses are$18.8 million——The cash flow of core business is negative.

-

AI Transformation: A 15-year agreement with CoreWeave has signed a 526MW capacity agreement, promising to achieve an average annual revenue of more than US$1 billion in three phases starting from the first half of 2026, with a profit margin of up to 90%.

-

In a market with limited supply, Galaxy controls 3.5GW of Texas power capacity, and data center demand is expected to quadruple by 2030.

-

$1.4 billion in project financing has been obtained, validating commercial viability and eliminating execution risks.

-

The current model relies on crypto treasury earnings ($198 million in the second quarter) to fund operations, as capital-intensive transactions pay little.

-

Shares rose 17% first before falling back as investors would have to wait until the first half of 2026 to see incremental revenue.

When you look at Galaxy Digital’s second-quarter earnings, one thing that is easy to overlook: that’s what happens next.On closer inspection, you will see that the company, led by Michael Novogratz, is at a turning point in the transition from cyclical crypto transactions to more stable AI infrastructure revenue.

Gold Mine of AI Infrastructure

Gold Mine of AI Infrastructure

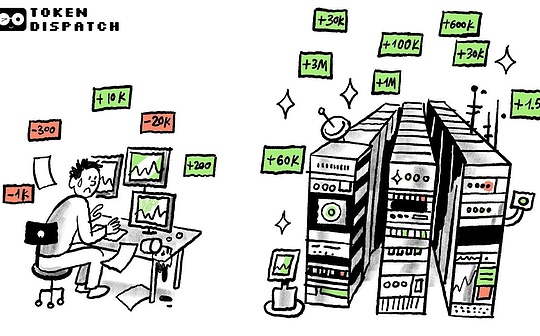

Galaxy Digital is undergoing one of the biggest business transformations in the crypto space—from low-margin trading businesses to high-margin AI data centers.

Galaxy recorded $31 million in net income for the quarter, with EBITDA (earnings before interest, taxes, depreciation and amortization) of $211 million after adjusting for non-cash and unrealized expenses.

Of total revenue, its trading business earned only $13 million from $8.7 billion in sales, with a margin of slim at just 0.15%.This means that 95% of its revenues brings little profit.

Of total revenue, its trading business earned only $13 million from $8.7 billion in sales, with a margin of slim at just 0.15%.This means that 95% of its revenues brings little profit.

By comparison, their new AI data center contract promises an average of over $1 billion in revenue per year that will result in a 90% profit margin.

Although I am very optimistic about building AI and high-performance computing capabilities, I think the promised profit margins are too exaggerated.This is not my assumption.You can combine it with the top AI data center operators of the quarterEquinixandDigital RealtyComparison of reported profit margins of 46-47%.

However, I still think this direction is correct.It’s purely from the perspective of generating income.Currently, most of Galaxy’s revenue comes from its trading business, which is expensive and has low profit margins.Most of its earnings (revenue minus expenditure) come from its treasury and corporate sectors.

The Treasury sector includes investment in digital assets and mining activities, equity investments, and realized and unrealized profit and loss of these digital assets and equity investments.

Its $2 billion treasury is both an investment vehicle and a strategic source of financing under favorable market conditions.

The division generated $198 million in revenue (excluding non-cash unrealized revenue).Unlike purely crypto companies, Galaxy’s treasury business allows it to acquire funds by selling treasury assets at strategic timing.

The division generated $198 million in revenue (excluding non-cash unrealized revenue).Unlike purely crypto companies, Galaxy’s treasury business allows it to acquire funds by selling treasury assets at strategic timing.

This is how I discovered Galaxy’s encryption treasuryMichael SaylorThe Bitcoin treasury is completely different.Strategy’s “buy, hold but never sell” approach achieved unrealized gains of $14 billion in the quarter.But all of this is just book profit.Strategy shareholders can’t get a share of the $14 billion unrealized earnings.

The situation with Galaxy is different.It not only buys and holds crypto assets in the treasury, but also sells them strategically, resulting in realized profits.This is real money that shareholders can share.

Still, I think Galaxy’s treasury sector is an unreliable source of income.As long as the crypto market is at its best, the sector will continue to generate revenue.But neither traditional nor crypto markets operate in this way.The market is cyclical at best, which makes these returns heavily dependent on the state of the crypto market.

That’s why Galaxy needs its AI transformation to be successful because its current model is unsustainable.

Market Opportunities

Galaxy positioned itself at the intersection of two huge trends: explosive demand for AI computing and long-standing shortages of power infrastructure in the United States.Global data center demand is expected to quadruple from 55GW in 2023 to 219GW in 2030, a McKinsey report shows.

Large cloud service providers (Hyperscalers) expect to invest $800 billion in capital expenditure (CapEx) in data centers by 2028, a 70% increase from 2025, but are constrained by electricity supply.

The advantage of Galaxy is that its potential capacity of 3.5GW in the Helios campus in Texas is enough to power more than 700,000 households in the state.Helios has received 800MW of approval, and another 2.7GW is being studied by the Texas Electricity Reliability Commission (ERCOT), which allows Galaxy to control some of the largest available power capacity in the market for supply-constrained AI infrastructure.

Galaxy’s transformation path is based on a 15-year deal with CoreWeave, one of the industry’s largest AI infrastructure deals.CoreWeave has committed to using 526MW of key IT capacity in three phases.

Galaxy’s transformation path is based on a 15-year deal with CoreWeave, one of the industry’s largest AI infrastructure deals.CoreWeave has committed to using 526MW of key IT capacity in three phases.

90% of expected profit margins are attributed to data center infrastructure once builtLight assetsoperational nature.

I see a huge risk in CoreWeave transactions: execution.Just as I was thinking about how Galaxy would need to raise funds, plan and execute, the company had cleared the first hurdle.

I see a huge risk in CoreWeave transactions: execution.Just as I was thinking about how Galaxy would need to raise funds, plan and execute, the company had cleared the first hurdle.

On August 16, Galaxy successfully served Helios data centerCompleted$1.4 billion in project financing, which received the funds needed to complete the first phase of construction.This gives me more confidence in how it can help eliminate critical financing risks and verify the commercial viability of the Helios project.

Cash flow equation

Galaxy’s current cash flow exposes the unreliability of its trading business, while highlighting why AI infrastructure provides true financial stability.

The company had $1.18 billion in cash and stablecoins at the end of the second quarter, which sounds like a lot, but there are more details behind it.Galaxy’s trading business adopts a capital-intensive model, and margin lending requires a large amount of cash reserves.Most of this $1.18 billion is not at discretion.

The free cash flow actually generated by Galaxy is minimal.After paying $14.2 million in interest expenses and ongoing operational needs, the core business almost broke even on a cash basis.

This makes Galaxy have to rely on the appreciation of the crypto market, i.e. its treasury and mining operations, generating revenue from inherent cyclical and unpredictable nature to fund operations.And CoreWeave’s three-stage contract structure and the high profit nature of its business are likely to create positive cash flow immediately.

Even if the profit margin is not as high as 90%, a more reasonable 40-50% profit margin is still more reliable and stable than the cyclical treasury sector.

Unlike transactions that require continuous capital investment in working capital and technical infrastructure, data center operations generate cash that can be reinvested in expansion or returned to shareholders.

Galaxy’s recent Helios project financing helps solve cash flow problems.By obtaining dedicated construction funds, Galaxy separates infrastructure development from its operating cash flow needs.This is impossible in the expansion of trading business, because it requires balance sheet capital that competes directly with other business needs.

Fee details

The total expenses in the digital asset sector are $8.714 billion, with transaction fees accounting for the vast majority ($8.596 billion).These are purely hand-in-hand costs with few chances of price increase.Since they are inevitable in commoditized trading businesses and spreads continue to compress, Galaxy can hardly optimize these costs.

More worryingly, quarterly compensation expenses include $18.8 million in equity incentives, which must be paid in cash.This means that Galaxy spends more on talent retention than the revenue generated by its core business ($13 million).

More worryingly, quarterly compensation expenses include $18.8 million in equity incentives, which must be paid in cash.This means that Galaxy spends more on talent retention than the revenue generated by its core business ($13 million).

The transformation of AI infrastructure will help change that.Once the facility is put into operation, the cost of change required for data center operations is minimal.

For example, Galaxy’s entire digital asset business had adjusted gross profit of $71.4 million in the second quarter.And with full utilization, the first and second phases of Helios alone (approximately 400MW) could generate $180 million in quarterly revenue, with operational complexity and cost only a fraction of its operational complexity and cost.

Market reaction

Galaxy shares rose modestly 5% in the 24 hours after announcing second-quarter earnings and jumped about 17% in the following week before investors pulled out their funds.

This is likely because investors realize that $180 million of the $211 million earnings comes from non-cash adjustments and treasury gains, rather than operational improvements.

Investors may not have taken Galaxy’s complex AI infrastructure transformation into consideration, as no meaningful data center revenue is expected to be until the first half of 2026.

Given what is coming, I am still optimistic about long-term sentiment.

The additional 2.7GW of capacity in the ERCOT study suggests that Galaxy aims to consolidate its position as a long-term infrastructure provider, not just a single-tenant facility operator.

After full development, Galaxy’s Texas business scale is comparable to some of the largest hyperscale data center campuses operated by Amazon, Microsoft and Google.This scale could provide bargaining chips for negotiations with more AI companies while creating operational efficiency to improve profit margins.

The company’s crypto-native expertise gives it a unique position in the cross-section of emerging AI and blockchain technologies.

The road to the future

Galaxy is making a huge, either-or-or-ta bet.

If the AI infrastructure transformation succeeds, they will transform from a profit-squeezed trading company to a cash-creating machine.If it fails, they will spend billions of dollars building expensive real estate in Texas, and their core businesses will slowly be exhausted.

The $1.4 billion project financing verifies external confidence, but I am focusing on two key metrics: Can they actually deliver 133MW of AI facilities by the first half of 2026, and will that 90% margin be maintained when they start paying for actual operating costs?

Current operations provide sufficient cash flow to maintain operations, but the crypto market needs to continue to strengthen in order to make meaningful growth investments.AI infrastructure opportunities promise to provide stable and reliable revenue creation potential, and their success depends entirely on execution in the next 18-24 months.

Recent project financing eliminates an important execution risk, but Galaxy now has to prove that they can successfully transform crypto mining infrastructure into enterprise-level AI computing facilities in order to get investors to bet on long-term bets.