Author: shisilu, source: okx

Pectra is the first major upgrade after Ethereum Dencun, covering Prague execution layer hard forks and Electra consensus layer updates, integrating the largest number of 11 EIPs in history, significantly improving validator flexibility, network scalability and execution efficiency.With the Ethereum main network Pectra hard fork officially activated on May 7, 2025, EIP-7702, the “ultimate form” of Account Abstraction, has also officially entered the public’s vision!

If there are any EVM-based Web3 wallets that do not support EIP-7702, then there is no doubt that it is equivalent to giving up the entire Ethereum ecosystem and users.This is Vitalik and EF’s determination, and it is also the beginning of Pandora’s box coming soon!Currently, in order to support the Ethereum ecosystem, OKX Wallet has taken the lead in supporting Ethereum’s latest account abstraction standard EIP-7702, and has opened an official entrance for users who are willing to try it out. You can upgrade through [OKX Wallet homepage functional area-More-7702 upgrade] to experience the secure and professional EIP-7702.Warm reminder: You can choose to upgrade and experience it as needed. If you do not upgrade, it will not affect the normal use of the existing ecosystem and applications.To ensure the safety of assets, be sure to operate through official channels, beware of phishing links and malicious websites, and avoid risks from assets.

Please follow this article to fully understand the evolutionary history of account abstraction, the user value and market changes brought by EIP-7702, and the dangers hidden in the darkness.

Overview

-

The code involved in this article is located atokx/js-wallet-sdk, the EIP-7702 SDK implementations used by OKX Wallet are all open source and open to community partners.

-

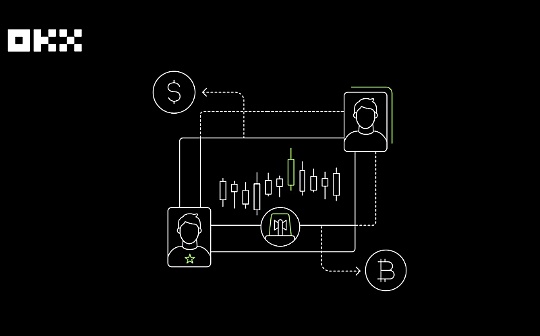

EIP-7702 has added a transaction type, allowing ordinary EOA to set a contract address to its logical proxy contract.

-

EIP-7702 will fully inherit and surpass the ecology built by ERC-4337 for many years due to its “cost advantages” and “flexibility”.

-

EIP-7702 is also an invisible risk to ordinary users. Even if the user does not upgrade, it will cause transaction failure or security damage risks in specific scenarios.

-

EIP-7702 will bring a new user experience. When the user subject undergoes contractual migration, market applications will also evolve. Gas abstraction, family grading accounts and other long-awaited silky experiences will lead one billion people and enter the Web3 world at a low cost.

-

For exchanges and DApps, the features of EIP-7702 on the application will bring more than 50% cost reduction, and thus fully embrace the era of contract account.

Why do accounts need to be abstract?

It is hard to imagine that the vision of account abstraction will even precede Ethereum itself.

During this HK Web3 carnival, Vitalik repeatedly emphasized that Ethereum has achieved 50% of the “iPhone Moment” target through a series of solutions such as Multi-sig, Account Abstraction, and ZK Email.

Is it fast or slow, optimistic or limited?Let’s go deep into the bottom and see why AA has such influence!After all, after 10 years of long-distance running, Vitalik finally ushered in the end of the AA field, adding a rich and colorful mark to the Ethereum roadmap progress bar drawn in 23 years.

What is the purpose of account abstraction?

In fact, the essential solution is the problem of separation of property rights, because the ownership and signature rights of EOA (Externally Owned Account) are actually held by the same unit (both rely on the private key to control any instructions). The root of it comes from the transaction structure of Ethereum. In fact, there is no From party in standard Ethereum transactions. When executing, the From address is reverse parsed through its VRS parameters (i.e., user signature).

Moreover, as a “world-class state machine”, Ethereum relies entirely on transactions to achieve on-chain state changes. In combination with the inability to specify the From party, the execution permissions of the transaction are coupled with the highest ownership.

This is the root of a series of problems that are simple and easy to understand, but inconvenient to use:

-

Private keys are difficult to protect: the loss of the private key (loss, hacking, quantum cracking) means losing all assets.

-

There are few signature algorithms, and different signature algorithms bring different performance losses, and even the cost of on-chain storage.

-

The signature permissions are high, and the EOA native private key has the right to all this.

-

The handling fee for complex transactions is high, and the handling fee can only be paid through ETH. Any transaction and a single operation require a basic fee of at least 21,000.

-

Transactions have no privacy, and even though there was once a confidential ERC-20 protocol proposed by Circle, it has not become mainstream.

In the final analysis, today’s blockchain world is too complicated for users who come and go. Users need to understand the concepts of Gas price, Gas limit, and transaction blocking (Nonce order), and hide complex information from regular users. This is the problem that EIP-7702 will ultimately solve.

What are the core differences between ERC-4337 and EIP-7702?

There are actually more than ten different proposals around AA, which I have explored before.In fact, after sorting out the overall situation, there are two essentials:

Route 1: Let the EOA address drive the CA address

ERC-4337 is a typical example in this aspect. In a word, it is summarized as: propose a new transaction object UserOperation. The user sends this object to the memory pool, packages instructions in batches, and executes transaction transactions one by one by delivery of the contract.In essence, it is to bring the underlying transactions and account operations to the contract level to execute.

The execution principle is as follows:

Through the role of bundler, it can be said that this solution can all solve problems such as batch transactions, gas-free, and few signature algorithms.But what he cannot solve is the complexity and user transaction costs, as well as the single point of failure risk of bundler and EntryPoint.

Because once the user migrates to ERC-4337, even if the user2 needs in the figure above are just doing a Transfer transaction, the user transaction fee will be doubled compared to EOA.

From the latest user data of CA and EOA, it can be seen that even if some users are high-end players, they rely heavily on various operations with CA as the main body on the chain, batch call, etc., but why not just use ordinary CA if so?

The design of the bundler allows it to avoid hard fork level upgrades and be launched directly on the application layer, but ERC-4337 also brings double the risk of cost expenditure single point failure, and users also lose the original flexibility of EOA.Therefore, in the face of diverse user needs, it is obvious that users in the current market do not favor ERC-4337’s solution. The overall trend has declined significantly over the past two years of development. Even if the number of peak users is far apart from the number of independent address addresses of Ethereum 300M.

Of course, we are not criticizing the shortcomings of ERC-4337, but the roles and concepts such as Paymaster and Gas abstraction that have developed along with it have actually been applied again in EIP-7702.

The author believes that the development of any industry will not be achieved overnight. The important thing is to discover laws and summarize experience from the rise and fall of the past.

Route 2: Change the EOA address to the CA address

In fact, as early as November 2015, Vitalik proposed EIP-101, using contracts as a new structure for the account.Change the address to only code and storage space, change the handling fee and support payment by ERC20, and change the native token to ERC20 class to deposit the balance through precompiled contracts (can have functions such as deduction authorization).In January 2018, there was another EIP-859 solution. The core function was to use the transaction with the code parameter to perform the contract wallet deployment if the transaction party contract is not deployed.Finally, EIP-7702, which was further deduced from the EIP-3074 plan, was finally included in the Ethereum main network!

The concept and effect of EIP-7702 are actually very simple. It completes initialization through new transaction types. In the future, users can allow EOA to temporarily and optionally have the functions of smart contracts in a single transaction, and then support batch transactions, Gas-free transactions and custom permission management in the business. The most critical capability is to give users temporary and optional space.

Moreover, multiple people can share the same logical contract, which greatly reduces the cost of user migration. To complete the EIP-7702 setting, users only need 8W of gas, which is about US$0.06. To set up a new contract again or cancel the logical contract, they only need 4W of gas.

After completing the settings, you can significantly bring users’ gas optimization during batch transactions. See the table below:

Of course you may feel that it is necessary to do it twice, or even six times, Token Transfer?

When regular users are used to doing one thing at a time, there may not be many scenarios, but in diversified application scenarios such as Web3 Game and Web3 Pay, it will actually happen very often, such as the consumption of copper coins (currency generated in the game) and silver coins (user recharge currency) at the same time.Or participate in some kind of event, and consume NFT tickets and admission fees.

Even if we don’t imagine complex scenarios and return to the most mainstream Swap requirements on the chain today, there are also batch requirements for approve and Transfer.Even now, you can make a gadget that can help users quickly delete their useless approve authorization.The effects are easy to compare, and obviously, the cost can be directly reduced by about 40%.

The core principle of EIP-7702

To explore why this effect is achieved, we must return to its principle. In fact, its core is two logics, divided into user settings and daily usage links

Setting up logical contract links

The core process is as follows:

-

Step 1: Signature authorization, sign a special hash string through the private key of the original EOA, and the content is composed of chain_id, address, nonce. Here Address is the address of the logical contract that will be set in the end, while Nonce is a strategy to ensure that the transaction is not replayed.

-

Step 2: Signature transaction. With the first step of authorization information, anyone can build a transaction of type 4, which can contain multiple authorization information and set authorization for multiple addresses at one time.

-

Step 3: Broadcast on the link, and then the logical contract will take effect when the transaction is processed.

There are more technical details here, please refer to:okx open source js sdk implementation, to see the process of encoding the underlying data.Of course, this solution actually hides some hidden dangers and complexities, which we will explain in detail below.

Execution of logical contracts

When you complete the setup, when any transaction To address points to you, it will be the same as calling a smart contract. The system will “load” the code of the logical contract you originally set into your current EOA state to execute its logic.

Similarly, we use 2 scenarios to view:

The first one is to call yourself

If you set up a high level of security and custom control capabilities like the OKX 7702 Smart Contract contract, then you can write calldata specifications in advance to allow your current operation to complete multiple instructions at one time.For example, you can complete Approve+Transfer at the same time, or Approve+Swap at the same time.

Don’t underestimate it. Among the 2.7 billion Ethereum transactions at present, Approve is about 75M. Calculated at 8W Gas per transaction, there are 46W ETH consumption, and calculated at the ETH market price of 1,700 US dollars, it is close to 800 million US dollars.

The second type is called by someone else

In the past, Ethereum did not call EOA addresses, but now you are a universal contract that can be customized. You can open up sub-accounts and separate permissions, or you can set a whitelist with a few Paymasters and license designated accounts to initiate some transactions on your behalf, thus completely eliminating the dilemma of repeatedly popping up signatures in traditional blockchain applications.

What a powerful ability!So this is also the reason why almost all the mainstream wallets: OKX Wallet, Metamask, WalletConnect, Biconomy, BaseWallet, Rhinestone, ZeroDev, TrustWallet, Safe and other related teams are responding quickly to support them.

Is EIP-7702 an account abstract end?

Yes, because this time the user will choose him!

It’s not that EOA is not good enough. Objectively speaking, EOA is concise and clear, simple and safe.But in this Prague upgrade, EOA after the introduction of EIP-7702 will be better.Because of the cost, because of the experience.When Jobs took out his iPhone from his jeans pocket, those experiences were something users did not expect at first, and they could still play like this.

Account abstraction is actually an area where many chains are exploring and actively trying.for example:

-

Starknet, as ZK-Rollup (Layer 2), has its default accounts all contract accounts and does not have EOA.

-

zkSync Era, using an AA account is the default method, and there is no need for the complicated links of Bundler.

-

Nervos CKB, similar to the UTXO model, but it also allows all accounts to customize the validator used, stripping away the hold and control rights.

-

Aptos / Sui, as a pivotal role in Layer1 of the Move system, is not an AA in EVM mode, but also has the ability to customize accounts, licensing modular signatures, multi-factor verification, etc.

-

EVM’s Linea / Base / Mantle / Polygon / Arbitrum / Optimism, these related ecosystems have not only completed AA support through ERC4337, but also will follow up on the upgrade of EIP-7702 in the same way as the ethereum main network.

The infrastructure in the wallet and AA related fields is more comprehensively laying the foundation for EIP-7702.

It optimizes the core experience of EIP-7702: batch trading, Gas abstraction (i.e., gasless and other gas-free solutions), and account hosting. These service providers such as Coinbase, Metamask, Biconomy, Zerodev, Rhinestone, Ithaca, etc. all support them.

These are also adaptations further completed from the era of ERC-4337, which is also a major advantage of EIP-7702. The ultimate account entity is a form that belongs to EOA and CA, so a large number of infrastructure that once revolves around AA can be migrated and adapted.

Now let’s use a table to reflect the final effect layer differences between EOA, ERC-4337, and EIP-7702.

Objectively speaking, the Ethereum system has a much heavier historical burden than other chains. This is the reason why the community voices recently opposed Vitalik’s changes to the EVM virtual machine, and it is also the reason why ERC-4337 was forced to choose ERC-4337 in the early days. However, once a better choice (EIP-7702) can achieve compatibility with historical burden and excellent cost optimization, users will usher in the “iPhone moment”.

With the transformation of the underlying form, the derived form can be further imagined, such as

-

Users can use Passkey or Google Account to control their wallets.Implement experience functions such as limited conditions and visa-free.

-

Users can realize the Recovery capability by setting up ZKEmail and other methods to realize the function of retrieving the private key.

-

For large on-chain operators, with multiple transactions integrated into one transaction, the block waiting time can be greatly reduced, allowing on-chain Swap to take a step faster, and reducing the risk of transaction failure through continuous transactions.

Time has a huge impact on user experience. As ETH, which ranks second in the consensus system in the entire blockchain world (second only to BTC), it cannot randomly reduce block time from 3s to 1.5s like BSC to improve user experience. Then, the wallet tool based on EIP-7702 is the most important bridge for user experience.

So, in combination with our previous discussion of its underlying level, it can be said that EIP-7702 is the ultimate form of account abstraction!

However, it is not very likely that users will use it in the future, because their own applications need to be cautious. After integrating complex intelligence, there are actually many security risks brought by them, and some attack methods are even very obscure.Therefore, after the upgrade and activation of Ethereum Prague on May 7, 2025, what users need most is a truly safe wallet, which is protected by technical expertise.

Is the final battle over?

No.

Indeed, Pectra is Ethereum’s most ambitious upgrade to date, covering 11 EIPs, the highest number in history!And we can see the many benefits of EIP-7702 and make judgments based on the above principles and data.

But it is also after users participate in the choice that the market will usher in a chaotic battle.

In the process of continuous development of the AA ecosystem, the trend of fragmentation has gradually emerged. Among them, EIPs that define account abstraction from the framework already have interface standards such as ERC-4337, ERC-6900, ERC-7579, etc., but there are obvious differences in user experience, interface specifications and behavior expectations between different implementation solutions.Different wallet implementation solutions focus on similar application scenarios and limited core functions, but each adopts incompatible design assumptions and implementation logic.

One of the most typical hidden problems is storage disorder.

After the launch of EIP-7702, the storage space under the EOA account becomes available to contracts, and the storage space is not exclusive to a single contract, but may be switched to use by multiple smart account providers.

When the user initiates a “re-delegation” operation, the original account contract will be replaced by the new contract.However, the status data written by the old contract will not be cleared and remains in the storage of the EOA.This means that the new proxy contract can access or even modify the stored data written by the old contract, which introduces theStorage pollution”The risk may interfere with or even destroy the execution logic of the current contract.

Although, there have been multiple solutions in the community, such as isolating storage through namespace (ERC-7201) to reduce the impact of storage chaos.However, no matter what solution is adopted, there is still a lack of mandatory unified norms in the ecosystem to ensure the uniqueness and security of nonce.

Another typical problem is the disorder of implementing standards.

As revealed in this article:From fragmentation to unification: the necessity of smart account standardization》

now:Safe,BiconomyandZeroDevAll of them implement batch calling functions of their respective versions, but the function naming, interface parameters and result processing methods of the three are different.Among them, ZeroDev considers the situation of batch call failures, while Safe and Biconomy do not handle such scenarios.

The industry’s standard “each owns” approach will inevitably lead to a chaotic battle.Users, dApps, and developers are all victims.Therefore, the launch of EIP-7702 is not only a technological innovation, but also an opportunity to establish a general infrastructure for smart accounts.It provides us with a window period for “reconstructing consensus”, promoting the entire Web3 wallet ecosystem from diversified functions to structural unity, and achieving true sustainable development.

Three essential security understandings after activation of EIP-7702

Now, let us switch from different perspectives to different perspectives, from users, DApps, exchanges and other organizations, and look at how this system affects us, it will bring opportunities and risks. Only by understanding the risks can we enjoy the benefits brought by this system more perfectly.

Eip-7702 is very complicated, can I not upgrade it?

Of course, you can choose not to actively upgrade, but there is a risk you need to know that after the upgrade in Prague, your message signature may inadvertently put yourself in danger.

Indeed, EIP-7702 has a strong phishing risk, because its Authorization parameters are composed of: address, nonce, and chainid. If the chanid is 0, the signature authorization can also take effect when any chain meets nonce.

Through the specific implementation method of the 7702 process in the OKX open source signature SDK, we can see that in order to meet this standard, the user finally signed a hash value: 0xabc, which is calculated as follows:

Among them, keccak is the mainstream hashing algorithm on Ethereum, which is characterized by a fixed 32-byte length result that can be calculated by data of any length.rlp is a set of information encoding methods, and finally Magic is a fixed value.

However, since the final result is a hash value that cannot understand the specific content, if the user hastily signed a message and others can also bring your authorization to the chain to take effect, then the code will be set unconsciously, which will trigger a 0day-level attack event.And because set code is mandatory, you cannot think that you have set up a secure contract and will not be replaced.

Therefore, a secure wallet will prohibit the user from signing an arbitrary hash value, which was also before (because the hash value may also represent a normal transaction).

If you accidentally upgrade a risky contract, how can you protect yourself?

This risk is also very common, after all, you cannot ensure that you will not be fished at all.

To protect this problem, we must first know that a technical background is that transactions in the Ethereum system need to be in the nonce order. Only when they are kept continuity can they be recognized on the chain.

Therefore, there are two attack methods.

The first case is that the hacker steals the next nonce value of your current address and signs the Authorization, so the processing is also very simple. If you are attacked, please quickly use a wallet that can customize Gasfee, such as OKX Wallet or other secure wallets, and quickly transfer ETH (to other secure other addresses of yours).On the one hand, this move can transfer funds at the ETH level, and on the other hand, it can replace the valid nonce value, thus invalidating the hacker’s hands.

The second case is that the hacker stole the subsequent nonce value, so it is possible that your current Transfer will make the authorization in the hacker effective.Since you are not sure what nonce is, then any operation cannot lead to absolute security.You can only transfer assets as soon as possible to protect yourself.

It seems that EIP-7702 is more dangerous?Actually, it is not the case!

For blockchain, the real return of user sovereignty to the system that truly brings users’ sovereignty to all users’ private keys. At any time, random signatures will lead to capital losses. However, the key here is that aside from the situation where large users are targeted to poison, most of the reason why users have to use important private keys often, there will be risks.

If you have already achieved the sum of family accounts and personal sub-accounts through AA and set the available limit for each sub-account, then your main account only needs to be called up when modifying the system level settings, and regular daily use only requires a small account to solve it.

Why do some common transactions fail after upgrading?

This often happens in wallet tools that do not support EIP-7702.

First, add a technical background. During the contract call on Ethereum, the code field of the user’s current address will be judged. If there is content, it will go through the function it accepts by default to execute the corresponding logic.

Based on this, the performance for ordinary users is that if I complete the contract settings of EIP-7702, I will basically have the function of accepting functions by default. Any ordinary ETH Transfer transaction will execute some contract logic, thereby increasing the overall Gas use.If your normal transaction sets Gas Limit to 21000, then it will naturally fail.

Similarly, since many NFT projects will detect whether the receiver’s address is a black hole address (that is, the address that cannot be transferred out of the asset) and prohibit transactions, if your acceptance function is improperly processed, it will also lead to the unacceptable loss of assets of ERC20 and ERC721.

In this regard, it is recommended to set up by explicitly supporting EIP-7702 wallets, or use logical contracts that are highly secure audited and user-recognized, such as:https://github.com/okx/wallet-core

What else has changed on Ethereum mainnet Pectra?

There are many voices on the market who believe that Ethereum seems to be lost?Why do many upgrades have nothing to do with users?Is this really the case?Let’s take a look at the other EIP upgrades to find the answers.Chen Ran, EIP-7702 is the biggest upgrade change that users can feel, but there are 10 other EIPs, which bring changes to the Ethereum ecosystem in different dimensions.

First of all, cryptography support.Through EIP-2537, precompilation operations of BLS12-381 elliptic curves are introduced, which can optimize complex encryption operations such as BLS signature verification, providing higher security (120+ bit security) and computing efficiency (Gas optimization).

There are multiple optimization points for pledge scenarios.Objectively speaking, staking does need to be optimized. Ethereum’s validator cluster has been growing rapidly, and nearly one million validator pledge addresses have been available.This is because MAX_EFFECTIVE_BALANCE is limited to 32 ETH, and node operators need to create multiple validator accounts to manage larger staking assets, which leads to the existence of a large number of “redundant validators”.Therefore, the maximum ceiling has been increased through EIP-7251. For those aggregation staking protocols of lido, the number of control accounts can be reduced and the complexity of the system can be reduced, but this may exacerbate the decentralization problem and make the ETH staking market more centralized.

After this upgrade, larger node operators can merge multiple validator accounts, while also bringing more flexibility to small validators, such as increasing revenue through compound interest income accumulation or more flexible staking increments.This is very important. After the 32ETH was reached, if you generate 10 new ETH income, you will not continue to use ETH pledge, because you still need to gather 32 to open a new account.But after this update, you can directly pledge 42 ETH.Then obviously your compound interest income can return to the ETH system, which has the convenience of user experience and some foreshadowing to reduce ETH liquidity.

Finally, it is a significant optimization of the L2 ecosystem.Ethereum has always been firmly on the road to the L2 ecological community.Other SVM and MOVE systems are essentially developing their own L1, and even exploring the L2 on it, there are still some contradictions and conflicts. The root cause is that the high performance of these chains is relatively less dependent on doing L2.

In order to encourage more L2 to interact with the Ethereum main network efficiently, the gas fee of calldata in transactions is increased directly from 4/16 gas per byte to 10/40 gas through EIP-7623. This is forcing L2 not to use calldata, but to use more blobs.

Through EIP-7691, the capacity of blobs in blocks is also increased to support larger L2 storage space. In the previous Cancun upgrade, there were two core parameters target and max representing blobs, which represent the target blobs for each block and the maximum blob number for each block.

Cancun is 3 and 6. Now after Prague, the parameters become 6 and 9, which is an expansion.

Therefore, Ethereum improves Ethereum itself through L2 TPS, although there are many problems, such as liquidity dispersion, cross-chain complexity, emergency escape capacity, etc.Therefore, in the current Pectra upgrade, Ethereum is adding “highway” to L2, but how to solve “vehicle flow management” and “toll standards for different highways” in the future is the most fundamental problem.

See the future

This article is nearly ten thousand words. We start from the root of the abstract development of account, to the two routes and comparisons represented by ERC-4337 and EIP-7702, and then go deep into the principles and mechanisms of EIP-7702 to analyze its advantages and disadvantages and adjustment effects on the mainstream user scenarios.

The author believes that “Not your keys, Not your money” is a great concept. EIP-7702 is not to subvert it, but to complete and perfect another dimension, so that it can be both sovereignty and ease of use.As Ethereum Foundation researcher Yoav Weiss said, “The next billion users won’t write 12 words on paper.”

Then through the comparison of the two, it can be said that it has significantly optimized ERC-4337, giving user space and flexibility, so that it is easier to be recognized by users in the subsequent market and used. Once the user starts to adopt CA as the on-chain subject, complex transaction types will surge in large quantities on the EVM tether.

From this, we can see that the shadow of the future is accompanied by the richness of underlying account entities and transaction types. Many of the once boring application experience problems will be solved. No longer forcibly requires users to understand logic such as Nonce, Gas, etc., but also provide simplified processing by entry service tools such as wallets.

Although facing industry-level diversity, bringing a certain degree of disorder in interface standards and storage space, the author is also optimistic that the more valuable the chaos, the more unified the standard can be produced. The decentralized diversified game will ultimately promote the development of the industry.It is precisely because of this that after EIP-7702 is launched, it will not immediately ignite the ecosystem on Ethereum, because it is a spiraling technological underlying upgrade. Often such upgrades will be ahead of the market application for 2-3 years, and will be left to the application layer to gradually ferment.

Moreover, starting from this upgrade, user security will rely more on the service quality of the entrance tool layer. Open source and openness are an important step to bring users a sense of security. Therefore, the implementation of the EIP-7702 underlying SDK integrated by OKX Wallet is also implemented.Open source and open, openly accepts the test of the community and the market, and there are also many wallets that remain open to go further and further on the road of self-hosting, giving users absolute autonomy with open source fairness.

Finally, after returning to the Pectra upgrade itself, we can see Ethereum’s thinking and persistence in the future direction again. Now that the L2 strategy has entered a period of stable execution, Ethereum’s roadmap has changed a lot in details in the past decade, but the core goal has always been unexpectedly consistent: we hope to have a secure and decentralized green (POS) blockchain, which is both highly scalable and easy to verify.The introduction of AA proposals such as EIP-7702 to effectively improve user experience from hard forks represents that Ethereum is always exploring how to improve the competitiveness between multiple chains while ensuring decentralization (even in the face of competition from new generation public chains such as Solana), and how to become an ideal supercomputer!

References:

-

https://github.com/okx/js-wallet-sdk

-

https://github.com/ethereum/EIPs/blob/master/EIPS/eip-7702.md

-

https://www.okx.com/zh-hans/learn/smart-account-standardization

-

https://mp.weixin.qq.com/s/WjpPNKEVlxlCSz1WyHH4tw

-

https://vitalik.eth.limo/general/2024/12/03/wallets.html

-

https://metamask.io/news/account-abstraction-past-present-future

About “OKX Research Institute”

The “OKX Research Institute” column is based on the institutional-level research perspective and focuses on the phenomenon-level hot spots, innovative applications and technological development frontiers of the encryption industry. Through data analysis, on-chain behavior and cross-market linkage analysis, it reveals the core reasons and potential impacts behind market dynamics, aiming to promote knowledge sharing, thought collision and in-depth discussion within the industry, and help the healthy development of ecological encryption.