Source: Web3port Foundation

Foreword:

Web3port Foundation is a cryptocurrency fund that focuses on blockchain and Web3 ecology. It is committed to promoting the widespread adoption of Web3 technology through strategic investment and incubation with innovative potential.

We have recently investigated the web3 payment track and PayFi track. Through the study of the concept, payment type and typical case of Web3 payment/Payfi track, understand the overall situation of the track, assist business investment decisions. The content is only for industry learning and exchanges.Use, does not constitute any investment reference.

Web3 payment

With the expansion of stable currency volume and the expansion of application scenarios, web3 payment has become a popular track in the encryption market.Web3 payment covers many business scenarios and categories, including stablecoin, wallets, asset custody, transactions, payment, payment, credit cards, etc., traditional financial institutions and web3 entrepreneurs combine blockchain technology and cryptocurrencies to build many Web3 web3sPayment items and use cases.

concept:

Traditional payment: Currency transactions conducted through traditional financial systems usually involve centralized institutions such as banking, credit card companies, payment processing companies (such as PayPal, Visa, MasterCard, etc.).The payment process is verified, liquidated and settled by these financial institutions.Traditional payment includes cash payment, bank transfer, credit card payment, debit card payment, electronic checks, and electronic wallets.

Web3 payment: Web3 payment is a payment method based on blockchain and cryptocurrency technology. It completes transactions through smart contracts, decentralized applications (DAPPS) and cryptocurrencies.Web3 payments do not depend on traditional financial institutions, but the value transfer between users who are decentralized directly between users.

Traditional payment vs web3 payment

Traditional payment is a set of payment methods based on the account system. Value transfer is recorded in the accounts of intermediaries (such as banks and third -party payment companies).Due to the large number of participants, the process of capital transfer is very cumbersome, and the cost of friction is huge, so the cost is higher.

The web3 payment is based on the blockchain network infrastructure, allowing cryptocurrencies to transfer between the sender and the receiver, which can solve problems such as high costs in traditional payment, low cross -border transfer efficiency, and high cost.

Web3 payment type

The specific scenarios of Web3 pay, including consumer use of crypto assets for chain interaction, paying consumption to enterprises/merchants, and cross -border transfer, encrypted asset payment among enterprises.To sum up, there are two main types of web3 payment:

-

On RAMP & AMP; OFF RAMP, that is, exchange and payment between cryptocurrencies and legal currencies.Investment refers to exchanging cryptocurrencies with fiat currencies (FIAT), and gold refers to exchanging cryptocurrencies to exchange fiat currencies.

-

Cryptocurrency payment, including 2 types:

-

Native payment on the chain: ** refers to the use of cryptocurrencies to participate in the trading of Web3 native scenes, such as buying NFT with cryptocurrencies, making new Launchpad, SWAP and chain fees between different cryptocurrencies;

-

Physical payment under the chain: ** refers to buying goods or services in the offline real economy with cryptocurrencies, such as using cryptocurrencies to pay offline consumption orders, cross -border transfer transactions, etc.;

-

Investment fee: Users to conduct the in -expenditure business of cryptocurrencies and fiat currencies through third -party payment institutions, and they need to pay the entry and exit fee. Generally, third -party payment institutions charge 0.6%of the transaction amount as the handling fee./Merchants pay for it, and the participants in the payment payment link (third -party payment institutions, aggregates, card issuers and international card organizations).

-

Access service fee.This scene involves the aggregate payment and settlement network, and the upcoming existing third -party payment products are connected to its own product system as one of the underlying payment channels to broaden the ability to transfer funds and provide Web3 payment settlement services for merchants and institutions.The access service fee charged in this process.

-

Blockchain GAS network fee: When paying with web3, the final result of the payment requires confirmation and processing on the chain, thereby generating blockchain network GAS costs.

-

Forex spread.Only cross -border payment products are involved. The payment channels for the transfer of funds of different countries will generate a fund pool. At this time, when there is a cross -currency transaction, it can avoid banks to directly exchange currency exchanges for users to obtain exchange spreads.

-

Crypto exchanges: Exchange generally uses the form of credit cards with centralized financial systems to conduct payment business.Coinbase, Binance, Crypto.com, etc. all carried out payment business around 2020, cooperating with MasterCard or VISA to issue cryptocurrency credit cards, supporting users with cryptocrete assets to use credit card consumption globally.

-

Independent access to gold payment institutions: such as MoonPay, BitPay, PayPal, Stripe, MasterCard, etc., around its main business, gradually open/access Web3 payment business and scenes, including wallets, hosting, payment, transaction and stablecoins, and finally gradually covered coverage.The entire ecology forms a logical closed loop.

-

Web3 aggregate payment platform and Web3 bank: access multiple independent entry -exit gold payment institutions interfaces to form a polymerization platform, as well as bank services providing multiple accounts for Web3 users.For example, Alchemy Pay is a hybrid cryptocurrency payment gateway solution, which supports two -way exchange and payment of fiat currency and cryptocrete assets; FIAT24 creates a chain bank account for users, providing access to in -expending funds, encrypted consumption payment, savings, transfer, exchange exchange, etc.Series of web3 banking services.

-

Cryptocurrency retail terminal: including crypto ATM machines (head project Bitcoin DEPOT) and offline convenience store retail terminal POS (typical project Pallapay)

-

Alchemy Pay: It is a company that provides cryptocurrencies and fiat currency payment solutions to connect traditional financial systems and decentralized finance (DEFI) world.Alchemy Pay provides a hybrid payment gateway for merchants and consumers, allowing them to use cryptocurrencies and fiat currencies for transactions, thereby simplifying the use and popularization of cryptocurrencies.Its plans to expand the coverage of global encryption payment and obtain more than 20 regulatory licenses globally. At present, the number of users exceeds 2 million and supports 180+ countries and regions encrypted payment.

-

FIAT24: It is a fintech company issued by the Swiss Financial Market Supervision Bureau (Finma). The web3 banking agreement driven by smart contracts is launched to create a chain bank account (Iban+Card) for users to provide access to money and encryption.Consumer payment, savings, transfer, exchange exchange, exchange, exchange and other series of Web3 banking services and Crypto services.

-

Helio: A platform focusing on cryptocurrency payment and Web3 provides a tool for receiving, processing and managing cryptocurrency payment.It is the leading Web3 payment platform on Solana, with more than 450,000 unique active wallets and 6,000 merchants.With its Solana Pay plug -in, millions of Shopify merchants can now use cryptocurrency settlement to pay, and in real time, USDY can be converted into other USDC, EURC and Pyusd stablecoins.

-

MoonPay: It is a global cryptocurrency payment infrastructure provider that allows users to use credit cards, debit cards, bank transfer and other methods to purchase cryptocurrencies.MoonPay is currently the leading project of cryptocurrencies. The number of registered users exceeds 20 million, supports more than 160+ cryptocaries in countries and regions, supports more than 80 types of cryptocurrencies and more than 30 types of legal currencies.The payment business license in the area has been processed more than 6 billion+pen transactions.

-

BitPay: It is a cryptocurrency payment processing company established in 2011. It is committed to helping merchants and individuals use Bitcoin and other cryptocurrencies for payment and transactions.BitPay provides a series of services that allows merchants to accept cryptocurrency payment and convert these payments into fiat currency to help users use cryptocurrencies for daily consumption.At present, BitPay enables merchants to accept payment of 16 different cryptocurrencies from 229 countries and regions. It has dealt with more than 10 million transactions and has a total value of over $ 5 billion.

-

Coinify: It is a cryptocurrency transaction and payment processing service provider.Coinify’s payment solution allows merchants to allow their customers to use 10 supported cryptocurrencies for payment, and at the same time, they use their legal currencies to get payment.The company is conducting business in more than 180 countries and is providing services for more than 45,000 merchants.

-

CoinPayments: Founded in 2013, it is one of the world’s leading encrypted payment service providers.The company is providing more than 100,000 merchants from more than 190 countries/regions.CoinPayments’s payment solution allows merchants to accept more than 175 types of cryptocurrencies.The company also provides many tools for merchants, including shopping carts, payment buttons, APIs, invoice generators and sales tools.As of October 2022, the company has dealt with an encrypted payment worth more than $ 10 billion.

-

PayPal: In August 2023, a stable coin “PayPal USD” (Pyusd) linked to the US dollar was launched. Pyusd stabilized currency was used as a bridge between the legal currency and cryptocurrency for transfer, payment and other services.

-

Metamask: Metamask itself does not provide a direct fiat currency exchange function, but through integration with third -party services (such as MoonPay, WYRE, Transak, etc.), users can easily convert the transformation between fiat currencies and cryptocurrencies (the operation of gold and gold)EssenceAt present, Metamask Portfolio DAPP has gathered functions such as Sell, Buy, Stake, Dashboard, Bridge, and SWAP to help users manage assets conveniently and achieve unified asset operations on the unified chain.

-

On the chain of trillions of offline traditional payment, better optimize the time value of currency.

-

Provide sustainable risk adjustment yields: the rate of return to double digits.

-

With extremely low systemic risks, it expands the scale rapidly and improves the liquidity of assets.

-

Relying on the convenience of smart contracts to provide more efficient and rich new financial paradigms.

-

Sablier is a token distribution protocol that can use the Sablier protocol to create tokens to deal with the issuance of tokens, paid bills, airdrops, gifts, etc., and the receiver can track and extract flow funds at any time.This payment method enables users to carry out continuous real -time payment per second to achieve seamless and frictional transactions, and improve the financial flexibility of users, enterprises and other entities.SABLIER uses the passage of time as a trust restraint mechanism and releases business opportunities that could not be obtained before.

-

Zebec is a decentralized infrastructure network, which aims to create a future of free and seamless flow of real world value, allowing individuals, enterprises, investors and teams to immediately obtain funds and tokens; provide instant financial control and promote more promotionTolerant and accessible financial environment.Zebec’s integrated products include RWA payment (real -time salary bills and cross -border remittances), chain payment infrastructure (Zebec Cards) and network DEPIN (POS retail equipment, which provides convenience for merchants and consumers, even with integrated encrypted payment processing,Solution).

Web3 payment connects the legal currency with cryptocurrencies through the payment of funds, and the cryptocurrency payment (on the chain/under -chain payment) enables crypto assets to circulate in payment and consumer scenarios, thereby building a complete payment ecological closed loop.

Web3 payment business model

According to the requirements and types of web3 payment scenarios, the profit methods of common web3 payment projects/companies include the following: the following:

Among them, the entry and exit fee and access service fee are one of the most profitable methods of the web3 payment project/company. These two profit methods rely on the network effect (referring to the value of a certain product or service.Increased phenomenon).The larger the number of users and merchants using web3 payment, the larger the transaction amount generated, the more benefits can be generated. At the same time, with the increase of the number of users and the expansion of the transaction value, the web3 payment project/company constructed Web3 payment networkThe greater the market share and influence, further promoting its brand and market influence.

WEB3 Payment Circuit Participants:

Participating role

According to the research of Galaxy Ventures, the participants of the web3 payment track can be divided into 4 categories from the perspective of the technology stack:

Typical projects and cases:

Web3 payment supervision compliance

For the regulatory compliance of the web3 payment track, it is mainly to meet the compliance requirements of licenses, qualifications, licenses and other compliance requirements before the project party can carry out Web3 payment business without standards.

Different countries and regions have different supervision requirements for the Web3 payment business. Therefore, the web3 payment track project wants to conduct related businesses in some countries and regions, and it is necessary to apply for the corresponding license.

Payfi track concept and its business scenario and case research

Payfi concept

Lily Li, chairman of the Solana Foundation, put forward the concept of Payfi on the web3 carnival in Hong Kong:

Payfi’s motivation is the initial vision of Bitcoin payment.Payfi is not a new financial market built by the Time Value of Money. This type of financial market on the chain can realize the new financial paradigm and product experience that traditional finance cannot achieve.

Payfi can be understood as the fusion of DEFI + Web3 payment, focusing on helping users maximize the time value of the currency.PayFi is suitable for the application of web3 transactions, consumer scenarios, retail environments, creators monetization, account receivables, payment processing, private credit pools and other scenarios.Sex, create a new paradigm on chain finance.

Payfi market prospect:

Since 2015, the stable coin has grown in index level, providing effective payment and settlement for the encryption market with a market value of 2 trillion.At present, the overall market value of stable coins exceeds $ 171B, and the market value of Tether USDT has further increased to $ 117.9B on the basis of 2022, which has increased by 42%, showing a drastic increase in the demand for stable currency in the crypto market.

In addition to serving as a price unit in cryptocurrency transactions, stable coins have gradually exerted its strength in traditional payment tracks and multinational financial trade, and is changing the global payment pattern.The PayFi market combined with stablecoin and web3 payment will further expand the demand scenario of stablecoin to provide financial support for the payment application on the chain and under the chain.

Payfi can::

Payfi business scenario and case:

1. WEB3 payment innovation business that integrates DEFI:

Combining the ability of DEFI finance and instant settlement on the chain, allowing users to pay the chain in real time on the chain to pay the cost of instant consumption under the chain.

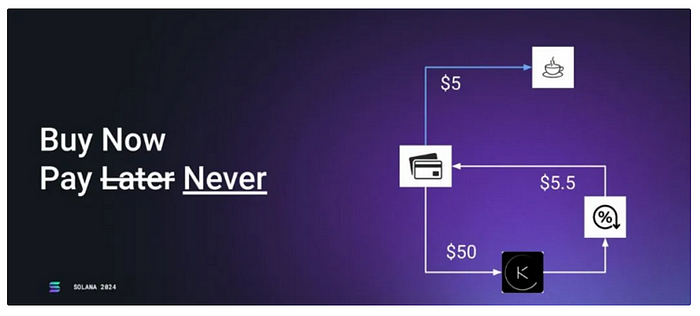

Case: Buy Now Pay Later: Users will store $ 50 on the DEFI protocol on the chain to get interest $ 5.5. The interest can be used for instant settlement and payment to buy a cup (no money) coffee.

2.Web3 Bank:

Combined with the Web3 and Web2 banking business to provide users with digital banking services.

Case: FIAT24 is a financial service platform based on blockchain technology, and is committed to providing users with decentralized digital banking services.FIAT24 establishes the Cash Account of Swiss Bank (Cash Account) for users of KYC. On the one hand, it can integrate Web3 payment services, which can achieve currency acceptance and web3 payment. On the other hand, FIAT24’s Swiss Bank account and Swiss Bank, European Central BankDirect connection with the Visa/MasterCard payment network can realize traditional banking services such as savings, exchange exchange, and merchant settlement of fiat currency.

3.RWA Finance:

The time value of offline RWA assets to capture assets is captured, and more asset investment categories and returns are provided for encrypted users.

Case: ONDO Finance is an RWA token US debt agreement, committed to providing institutional -level financial products and services for everyone.ONDO Finance will tokens the low -risk, stable, and large -scale fund products (such as US Treasury bonds, currency market funds, etc.), which provides a way to earn a stable currency to earn benefits for investors on the chain.For non -U.S. users, USDY (US dollar income tokens), which is the first tokenized bills that do not require licenses and income to generate income by U.S. Treasury bonds.USDY can be used for multiple use cases, including borrowing, cash management, payment, etc., and can also earn benefits.USDY has also made breakthroughs in Web3 payment. With the help of USDY, users and merchants can now use assets that can generate income for payment or settlement, which means that merchants can now obtain balance interest by accepting USDY as a settlement method.More and more projects have begun to use USDY to promote more extensive adoption of encrypted payment.

4. Payment financing:

The funds of DEFI borrowing are used to solve the financing demand in the real -time payment trading scenario, and the chain settlement of paying financing income is achieved.

Case: Huma Finance is a PayFi network that allows companies and individuals to borrow it with global investors on the chain as a mortgage to provide financing and liquidity support for global payment.Its specific use cases include cross -border payment financing, digital asset credit cards, RWA instant settlement, trade financing, DEPIN financing, etc.

5. Payfi encryption payment network:

Use web3 payment and blockchain DID identity, etc., to build a encrypted payment network to match the scenario of paying offline payment.

Case: Polyflow is a modular decentralized encrypted asset operation protocol, the goal is to build a Payfi encryption payment network.Through the modular design, the Payment ID (PID) and Payment Liquidity POOL (PLP) can be launched. It can abstract the information flow of payment transactions from the flow of funds and digs the value.PID is a digital identity system that is used to perform KYC recognition, identity authentication, compliance access, and data confirmation. PLP use smart contracts to handle the capital flow of service providers to achieve funding management and payment settlement.Polyflow inspires merchants and liquidity providers by providing liquidity to payment transactions to provide liquidity.This model not only opened up new sources of income, but also encouraged more extensive stakeholders to participate in the DEFI ecosystem and promote the development and popularization of encrypted payment.

6. Crypto payment application:

Use the credit and web3 payment to transform the traditional consumption scenarios.

Case: Blackbird is based on the Web3 catering loyalty platform. Focusing on the catering industry, relying on Blackbird Pay (credit card on the chain) and $ FLY (consumer points on the chain) to build a chain payment and loyalty plan, and use the payment business as a leverage of growthLet’s promote the development of the entire ecosystem.At present, 40,056 wallets have 125,571 Blackbird restaurant membership cards (NFT), and 142 restaurants have signed in.

7. Stream payment:

Streaming payment is an emerging payment method that allows the value (usually currency or cryptocurrency) from the payment party to the receiver for a period of time, instead of completing the entire payment from the payment party.Streaming payment is mainly suitable for billing or salary issuance of continuous services, such as working at hours, network services charged by traffic, content subscriptions or consumption, continuous contracts and lease payment.In the future, flow payment will have a profound impact on value flow, operating capital management, Internet of Things payment, and even the valuation model of large companies.

Case:

Reference article:

1.Web3 Payment Wanxing Report: The entire army of the industry giants is expected to change the existing crypto market pattern

https://mp.weixin.qq.com/s/owec4gdu8hqk86ALS3K9QW

2.Web3 Pay Wanxin Report: From electronic cash, tokens, to Payfi Future

3.Web3 Payment of Fan -based interpretation and trend analysis | Zonff Research

4. Blackbird’s Trojama: turn Crypto consumer company into a payment company, use payment to leverage the growth flywheel

https://www.web3brand.io/p/web3brand-blackbird- Crypto- Payment

5.IOSG Weekly Brief | Stream Payment —— Payment New Formula for Blockchain Payment #154

6. Development of encryption payment | Thuba Research

7.2022 The status quo of the encryption payment track: Although the market turns, the demand for encrypted payment is still rising

https://mp.weixin.qq.com/s/xgs1xphkfawp_32pzy0wda

8. [English long push] encrypted payment market view: What trends and innovation are worthy of attention?