Author: Rick, Messari Research Analyst; Translation: @bitchainvisionxz

2026 is coming,The relationship between Ethereum price and fundamentals at this time is clearer than at any time since the NFT mania period.

As of December 16, 2025, the price of Ethereum fell below $3,000.Judging by the MVRV metric and its dominance among tokenized assets, ETH appears to provide allocators with a constructive long-term investment target.

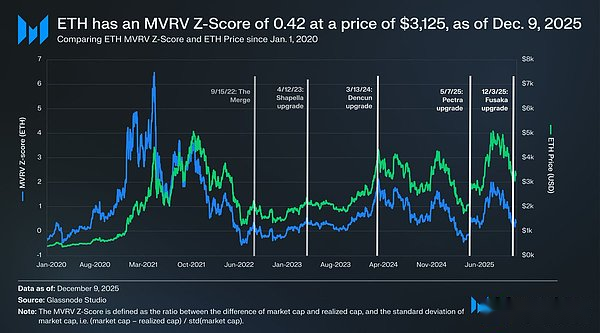

The MVRV Z-score is used to evaluate whether ETH is overvalued or undervalued relative to its fair value.This metric compares market capitalization (i.e. spot price times circulating supply) to realized value (i.e. total cumulative capital inflows into ETH).It is formally defined as: The MVRV Z-score is equal to the difference between market capitalization and realized market capitalization, divided by the standard deviation of market capitalization (calculated cumulatively from the earliest available data point).

During the NFT craze from 2021 to 2022, ETH’s MVRV Z-score once soared to nearly 6, showing the extreme enthusiasm of the market.Since the Ethereum Merge, the metric has reverted to the mean and now primarily fluctuates between 0 and 2 – 0 being undervalued, 1 being close to fair value, and 2 being overvalued.On May 7, 2025, when Pectra, an important technical upgrade of Ethereum, was launched, the price of ETH was approximately US$1,800, and the MVRV Z-score was approximately -0.1.As prices have since reached record highs, MVRV has gradually climbed closer to 2.Following the Fusaka upgrade on December 3, 2025, ETH was trading at approximately $3,189 with an MVRV Z-score of 0.47, indicating that it remains undervalued at a significantly higher price level, suggesting a similar post-upgrade market structure, but with a more robust fundamental positioning.

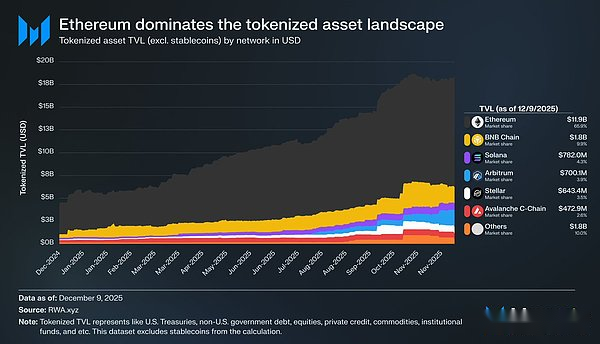

On-chain data further strengthens Ethereum’s bullish logic.In the field of asset tokenization, Ethereum is the core settlement layer.According to data from RWA.xyz (stablecoins are excluded from the statistics), Ethereum carries a total tokenized locked value of $11.9 billion, accounting for 65.9% of the market share.Although other base layers and Rollup have developed, they are far from the scale.As institutions move Treasuries, credit and other real-world assets to crypto channels to improve capital efficiency and reduce operating costs,Ethereum’s liquidity, tool ecosystem, and compliance-oriented infrastructure are continuing to deepen its moat.

The undervaluation signal shown by the MVRV Z-score, the positive price performance after the upgrade, and the increasing dominance among tokenized assets all point in the same direction.However, this still only reveals a small part of the bullish narrative for Ethereum.As spot ETFs introduce regulated funds into ETH, and digital asset treasury companies (DATs) continue to accumulate ETH supply, the market’s free circulation gradually tightens, and prices become increasingly sensitive to marginal demand.For allocators seeking scalable smart contract exposure with real economic throughput,ETH at the current price is more like an opportunity to build a core position in 2026 than a risk at the end of the cycle.