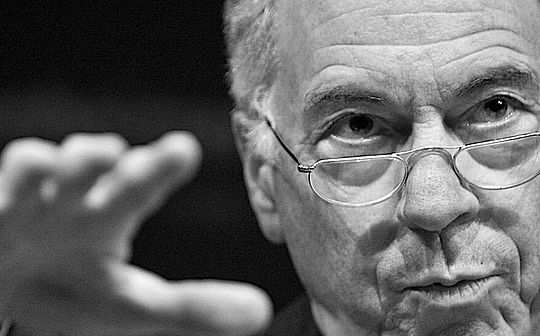

The September PCE data released by the U.S. Department of Commerce on December 5, 2025 became a key node: the U.S. core PCE annual rate was 2.8%, slightly lower than the previous value, but still significantly higher than the Federal Reserve’s 2% target.At the same time, the yield on Japan’s 10-year Treasury bonds rose to the highest level since 2007 (it exceeded 1.5% in December and continues to approach 2%), and the yield on 10-year U.S. Treasury bonds soared 60 basis points in a single day, causing a rare synchronized sell-off in the global bond market.The market generally attributes this to the “Yen Carry Trade reversal”, but Steve Hanke, professor of applied economics at Johns Hopkins University and monetarist standard bearer,The disillusionment of Japan’s “fiscal illusion” marks the end of an era: from low interest rate shelter to high debt and high pressure.) gave a completely different explanation: the real risk is not in Japan, but in the coming “reflation” and “excessive easing” of the United States itself.

1. The U.S. money supply has quietly exceeded the “gold growth rate”, and the reflation signal has been seriously underestimated.

Hank has long used the “Golden Growth Rate” rule: If the annual M2 rate continues to be stable at 6%, then stable inflation of 2% can be achieved under the conditions of 2% potential real growth + 2% money demand growth in the United States.Below 6% there is a risk of deflation, and above 6% there is a risk of inflation.

The latest data (end of November 2025) shows:

-

The year-on-year growth rate of US M2 has rebounded to 4.5% (Federal Reserve official website), which seems to be still in the safe zone;

-

However, 80% of M2 created by commercial banks (broad money driven by bank credit) has reached 6.8%~7.1% (as calculated by Hanke’s team), which has significantly exceeded the 6% warning line;

-

In April 2024, the Federal Reserve completely canceled the additional capital constraints on banks under the “Supplementary Leverage Ratio” (SLR). It is expected that commercial banks will release an additional credit capacity of approximately US$2.3 to 2.8 trillion from the second quarter of 2026;

-

Starting from December 2025, the Federal Reserve has officially stopped QT (quantitative tightening) and will no longer shrink its balance sheet every month, but will instead turn to neutral or even slightly expand its balance sheet;

-

The federal deficit/GDP in fiscal year 2025 will still remain at 6.2~6.5%, of which about 45% of the deficit is financed through the issuance of treasury bills with a maturity of less than 1 year. These short-term treasury bonds are heavily absorbed by money market funds (Money Market Funds), directly pushing up M2.

Hank admitted publicly for the first time: “I have been saying for the past two years, ‘Inflation will not return unless M2 breaks through 6% again.’ Now I have changed my tune – money creation by banks has broken through, and overall M2 is accelerating. We are at a turning point.”

He roughly calculated: If M2 reaches 10% year-on-year in 2026 (Hank thinks it is a high probability event), after deducting 2% actual growth + 2% money demand growth, the remaining 6% will be conservatively estimated to correspond to 5% CPI inflation; if not conservative, it may return to 6~7%.This is completely consistent with the experience that the M2 peak of 26.7% in 2021~2022 corresponds to 9.1% inflation (26.7% ÷ 2.7 ≈ 9.9%).

More importantly, since 2025, the leading-lag relationship between M2 and CPI has been significantly shortened from the typical 12 to 24 months to 6 to 9 months, and has even appeared “synchronous” characteristics, which means that once money accelerates, inflation may appear at an extremely fast rate.

2. The Fed still “turns a blind eye” and is more inclined to be easing under political pressure.

Hank sharply criticized: The Federal Reserve claims to be “data dependent”, but it only ignores the most critical variable for inflation-money supply M.They stare at PCE, CPI, unemployment rate, and manufacturing PMI, but turn a blind eye to the core monetarist formula of MV=PY.

At the FOMC meeting on December 10-11, 2025, it is a foregone conclusion that the market pricing will drop by 25bp with a 94% probability.The median expected rate cut in 2026 is 75~100bp.If Kevin Hassett, nominated by Trump, really succeeds Powell as Chairman of the Federal Reserve in the second quarter of 2026 (the forecast market probability has rapidly increased from 30% in November to 60%), the market will regard him as “Trump’s man” and favor a sharp interest rate cut and a weak dollar policy.

This will form a “quadruple easing resonance” with the explosion of bank credit, QT cessation, and deficit monetization, which Hank calls the “perfect reflation recipe.”

3. The truth about yen carry trading: It is not the main cause of this round of bond selling, but it may be the detonator of the US stock bubble in 2026

The general market narrative: Japan’s 10-year government bond yield rose to an 18-year high → the yen appreciated → carry trades were closed → global risk assets sold off.

Hank thinks this logic is grossly exaggerated:

-

The current round of U.S. 10-year bond yields has surged from 3.8% to over 4.6% to 4.8% in December. The main driver is not Japan, but the United States’ own reflation expectations + the “ease fear” of Hassett coming to power.Although Japan’s 10-year JGB yield has reached a new high since 2007, the absolute level is only 1.5~1.8%, which is still far lower than that of the United States, and the interest rate spread is still as high as more than 300bp;

-

The current yen exchange rate is still in the range of 152~155, which is far from the extreme weakness when it approaches 160 in August 2024, and there has not yet been a systematic liquidation of carry transactions;

-

What really worries Hank is the “reverse scenario”: once the Federal Reserve is forced to pause or even restart interest rate hikes due to reflation in 2026, U.S. interest rates rise again, but Japan stops raising interest rates because inflation is under control, and the yen rapidly appreciates by 10~15% (back to 130~135), then the “stampede” liquidation of carry transactions will truly occur.

Long-term research by Hank and Tim Lee (author of “The Rise of Carry”) shows that Japan’s private sector savings rate has been as high as 8-10% of GDP all year round. Although the public sector deficit is large, the overall current account still has a surplus of 4-5%. This is the world’s largest and most persistent capital exporting country.As long as the yen does not appreciate significantly, carry trading will continue to “transfuse blood” into the US asset bubble.

Once the appreciation of the yen triggers the reversal of carry transactions, a large amount of Japanese capital will be withdrawn from high-yield assets such as U.S. stocks, U.S. bonds, and the Mexican peso, and return to Japan.This is a replica of the 8-12% plunge in global stock markets when the yen surged in August 2024, except that the valuation of U.S. stocks in 2026 will be higher (the current forward price-to-earnings ratio of the S&P 500 has reached 24.5 times, and Hank’s bubble model shows that the bubble degree is at the 90% percentile), and it will be more lethal.

4. The most likely macro scenario from 2026 to 2027 – Hanke’s latest judgment

-

First half of 2026: The Fed continues to cut interest rates + SLR cancellation + deficit monetization → M2 accelerates to 8~11% → Inflation rises again to 4~6% → Long-term U.S. bond interest rates rise instead of falling (reflation trade);

-

Second half of 2026 ~ 2027: The Federal Reserve is forced to suspend interest rate cuts or even raise interest rates again → The interest rate gap between the United States and Japan widens again → The yen rapidly appreciates by 10~20% → Large-scale reversal of carry trading → The US stock market bubble bursts, and the S&P 500 may correct by 25~40%;

-

Global impact: Emerging market currencies (Mexican peso, Turkish lira, Indian rupee) plummeted simultaneously, commodities first rose and then collapsed, and gold first declined and then rose.

5. Investment response suggestions – selected original words of Hank

-

Don’t try to predict when the bubble will burst, but do acknowledge that we are in one;

-

Immediately rebalance the portfolio back to the stock-bond ratio before the epidemic (for example, from 85/15 back to 60/40 or 50/50);

-

Shorten the duration of bonds, avoid long-term U.S. bonds, and increase allocations of 1 to 3-year U.S. bonds or floating rate notes;

-

Hold a certain proportion of gold and commodities as a double hedge for currency over-issuance and carry-transaction reversal;

-

Pay attention to the Japanese yen exchange rate: 145 is the mid-term warning line, and below 135 is the starting line for systemic risks.

Conclusion

December 2025 is not the starting point of “the Japanese yen carry transaction detonating the world”, but the starting point of the transition of “US monetary policy from tightening to excessive easing”.The real risk is in 2026~2027: the United States first reflated, and then was forced to brake suddenly; Japan first raised interest rates, and then stopped because inflation was under control; the Japanese yen finally appreciated sharply, carrying the transaction reversal, and the US stock market bubble burst.This is a late textbook case of monetarism – when the central bank no longer pays attention to the total amount of money, but only focuses on employment and short-term prices, inflation and asset bubbles will eventually get out of control.

Professor Hanke’s last original words are worth remembering by all investors: “The Federal Reserve can ignore the money supply, but the money supply will not ignore the Fed. History will repeat itself, but in a different way. This time it may be a combination of ‘first loose and then tight + yen appreciation’.”