“Trump Account”: A national bet to reshape America’s wealth and future

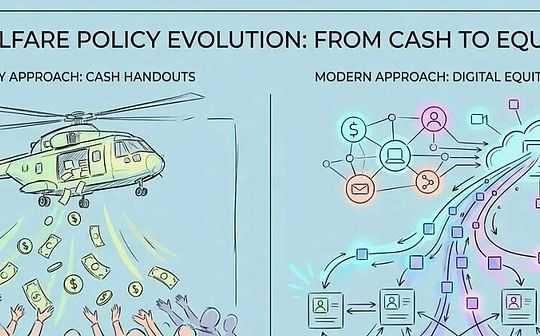

In the rapidly changing global economic landscape, a plan called “Trump Account” is quietly emerging. It is not only a welfare policy, but also a grand social experiment that profoundly changes our understanding of wealth, inequality, and even the future of the country.It represents a shift from traditional “helicopter money” to disruptive “helicopter equity”, closely linking the economic destiny of the next generation to capital market performance.

If this policy is implemented in place, it will continue to provide liquidity to the U.S. stock market from now until 18 years later, and it will be a good thing for the broader market if there is no liquidity in the near future.

From “helicopter money” to “helicopter equity”

Over the past half century, government intervention in the economy has been commonplace.From Keynes’s demand-side management to quantitative easing during the financial crisis, the federal government seems accustomed to stimulating consumption and boosting aggregate demand by distributing cash directly to the people.The tax rebate checks in 2008 and the epidemic relief funds in 2020 all followed this logic.However, the emergence of “Trump Accounts” broke this traditional thinking and introduced the new concept of “helicopter equity”.

The “Trump Account” is no longer satisfied with solving immediate urgent needs, it has greater ambitions.it tries to passMandatory asset lockandLong-term compound interest effect, directly anchoring the economic destiny of our next generation on the performance of the capital market.

Imagine that every new American citizen born would receive $1,000 in “seed money” from the federal government.The money is not used for immediate consumption, but is forcibly invested in the stock market and cannot be used by anyone until the beneficiary reaches adulthood.In addition, the Dell family also generously donated US$6.25 billion to provide “seed capital” in the form of equity for children born before this time.This marks the transition of the concept of “ownership society” from a political slogan to a grand project of concrete financial infrastructure.

The policy structure and operating mechanism of the “Trump Account”

The legal basis for the “Trump Account” stems from a tax and spending bill that takes effect in July 2025.The bill creates aHas tax advantagesAn investment vehicle that is similar to a Roth IRA but has stricter restrictions on beneficiary age and fund withdrawals.

Its core terms include:

-

Beneficiary scope: Every U.S. newborn with a Social Security number born between January 1, 2025, and December 31, 2028.

-

Federal Seed Funding: The U.S. Treasury makes a one-time deposit of $1,000.

-

Administration and expenses: Funds are under the overall management of the Ministry of Finance and are operated by private financial institutions. The annual management fee ceiling shall not exceed

0.10%. -

Fund lock period: Mandatory lock-in until the beneficiary reaches the age of 18, unless the beneficiary dies or suffers severe disability.This 18-year lock-in period aims to make full use of the compound interest effect and ensure that the “capital” attribute of the funds is not alienated.

However, there is a clear generational gap in the bill, which only covers newborns after 2025 and lacks federal funding for children born before then.This may result in children of different ages in the same family facing differentiated state treatment.It was at this time that the huge donation from Michael and Susan Dell filled this gap, setting a precedent for private capital to directly intervene in the distribution of national welfare.

Dell Plan Algorithm Assignment and Challenges

Dell’s donation is not inclusive;Sophisticated geographical and economic algorithmsCarry out targeted delivery.Children must meet the following criteria to receive $250 in Dell Seed Funding:

-

Aged 10 years and under (i.e. born before January 1, 2025).

-

Live in a zip code where the median household income is less than $150,000.

-

Did not receive $1,000 from the federal government.

This forms aThree levels of stratificationThe “helicopter equity” system:

-

first level: For newborns from 2025 to 2028, the federal Ministry of Finance provides US$1,000, which is universal.

-

Level 2: For existing children under 10 years old, the Dell Foundation provides $250, subject to the median income limit of the place of residence.

-

Level 3: Children over 10 years old or in high-income areas are not subsidized.

Dell’s intervention marks a major shift in the logic of welfare policy—from tax regulation to reliance on the “philanthropic capital” of the super-rich.Although this algorithmic allocation based on postal codes aims to improve funding accuracy, it also brings new equity issues, such as “gentrification misjudgment” and “high-cost traps”, which may lead to the exclusion of some low-income families.

Continuous Funding and Super IRAs

The long-term effectiveness of the “Trump account” lies in itsContinuous capital injection capability.It allows for additional contributions of up to $5,000 per year, adjusted for inflation after 2027.Diversified funding sources:

-

Families can use their after-tax income to make contributions and enjoy increased value.tax deferral treatment.

-

Employers can contribute up to $2,500 per year to employees’ children’s accounts, which will not be included in employees’ taxable income, forming a newtax-free salary benefits.

-

Local governments and other charities can also contribute capital without counting against the annual cap.

This structure is essentially a “super IRA” for minors.When the beneficiary turns 18, the account converts to a traditional IRA, and the funds can be used for higher education, a first home purchase, or starting a business.Withdrawals for non-specific purposes are subject to income tax and even penalties.This dual mechanism of “lock-in” and “tax preference” enforces long-term capital accumulation.

Forced Investment and Market Impact: A Bet on Asset Inflation

The most striking feature of the “Trump Account” is itscompulsory investment directive: The bill requires funds to be invested in index funds that track the U.S. stock market, such as the S&P 500 Index.This tied the future wealth of millions of American children to Wall Street performance and introduced massive, price-insensitive passive buying into the market.

“Inelastic Market Hypothesis”It is shown that the elasticity of demand in the stock market is much lower than traditional assumptions.For every dollar of inflow, the total market capitalization may increase by five dollars or more.

We can estimate that if approximately 3.5 million newborns are born in the United States each year, federal seed funding will inject $3.5 billion into the market annually.Combined with Dell’s donation and additional contributions from millions of families, this will create a sustained and significant flow of funds.The inflows of these funds are not affected by valuations, but are determined by laws and birth rates, and funds will continue to buy S&P 500 stocks regardless of market booms or recessions.

This mechanism mayExacerbating the “head effect” of the market, causing new funds to flow disproportionately to giants such as Apple, Microsoft, and Nvidia.Academic research has confirmed that passive investing significantly drives up large-cap stock prices, often disconnected from fundamentals.Therefore, “Trump accounts” may inadvertently become a booster for the stock prices of giant companies and strengthen market concentration.

“Trump Account” is also a contest aboutasset inflationof gambling.”Helicopter money” triggers inflation in consumer goods, while “helicopter equity” directly affects asset prices.Critics believe that the policy essentially subsidizes asset holders, artificially increasing the demand for stocks and pushing up asset prices while the supply remains unchanged or even decreases.

This forms aself-reinforcing feedback loop: Federal funds and household savings force the purchase of stocks, pushing up stock prices; when corporate managers see rising stock prices, they are more inclined to reward shareholders through stock buybacks rather than dividends; buybacks reduce the supply of circulating shares, matching the continued buying needs of accounts, further pushing up stock prices.

This is effectively a state bet: it is betting that this kind of financial engineering can continue to create paper wealth without a catastrophic return to valuations at some point in the future.

Beneficiary sequence risks and new challenges in charity governance

For the beneficiaries, the biggest risk in this bet is that“Sequence risk”.Unlike the Singapore Provident Fund, which offers guaranteed interest rates, the Trump Account transfers all market risks to the individual.Consider the “2043 problem”: when children born in 2025 come of age in 2043, if the market crashes, their “national dowry” will shrink instantly.The current bill does not specify whether it includes an automatic deleveraging mechanism similar to that of “target date funds,” which exposes beneficiaries to extreme tail risk.

The involvement of the Dell family is not only a donation, but also represents a“Charity Governance”new model.By setting a zip code threshold of “$150,000 median income,” the Dell Foundation is effectively performing a quasi-governmental function in deciding who qualifies for benefits.Although this kind of big data governance is accurate, it also has flaws such as “gentrification misjudgment” and “high-cost traps”.

When state welfare policy relies on private philanthropists to fill the gaps, the nature of the social contract changes.Welfare ceased to be a legal right based on citizenship and became a handout based on the goodwill of the wealthy.This model may solve funding problems in the short term, but in the long term it may undermine the stability and predictability of the public welfare system.

Lessons from international experience: Britain, Singapore and “baby bonds”

In order to understand the pros and cons of the “Trump Account” more clearly, we can place it in the coordinate system of global asset-based welfare policies for comparison.

-

Lessons from Britain’s “Children’s Trust Fund”: From 2002 to 2011, although the children’s trust fund implemented in the UK was automatically opened, more than 758,000 accounts were still “unclaimed” when the children reached adulthood, involving 1.4 billion pounds.This is a warning to us that the “opt-in” mechanism of the “Trump Account”, combined with an 18-year forgetting period, may result in millions of low-income children who need it most being unable to access this wealth.

-

Mandatory Consolidation of Singapore’s Central Provident Fund: Singapore mandates a contribution rate of up to 37% of salary, closely links funds with living infrastructure such as housing and medical care, and provides a risk-free guaranteed interest rate of 2.5% to 4%.In contrast, the “Trump Account” lacks such full life cycle integration and risk coverage, and is more like an isolated piggy bank than a social security system.

-

‘Baby Bonds’ Contradictions: The “baby bond” plan proposed by Democrats such as Cory Booker advocates differential funding based on family wealth status to narrow the gap between rich and poor.The “Trump Account” provides equal federal seed funding, but allows wealthy families to invest an additional $5,000 per year for tax-free growth.Critics argue that this is effectively using public funds to create tax shelters that benefit the wealthy and could ultimatelyExacerbating the gap between rich and poor rather than narrowing it.

We can deduce through mathematical models: If the annualized rate of return is 7%, even if a child from a low-income family receives US$1,250 in seed capital, if they are unable to contribute, the total account value after 18 years may be only about US$4,200.For children from high-income families, if they receive federal seed funding of US$1,000 and make top contributions of US$5,000 per year, the total account value may be close to US$200,000 after 18 years.There may be a huge gap of 46 times between the two.

Benefit Cuts and Future Scenarios

Critics worry that the establishment of the “Trump Account” is not a simple “addition”, but a prelude to future “subtraction” of benefits.Policymakers may use the excuse that “everyone has a stock account” to cut Social Security or other welfare spending.Existing reports indicate that the legislation includes provisions to cut Medicaid and food stamps.This means exchanging the “bread of the future” for the “bread of the present”, an extremely dangerous exchange for families on the edge of survival.

Based on current data and historical experience, we can conduct three scenario war games for the future of the “Trump Account”:

-

Scenario A: The Golden Age of Ownership Society (Bull Market Scenario):

-

Premise: The U.S. economy will grow strongly in the next 20 years, AI technology will bring about a jump in productivity, and the annualized return rate of the S&P 500 will exceed 8%.

-

result: General asset appreciation, alleviation of class conflicts, and rising support for the capitalist system among young people.

-

political influence: The Republican Party’s “investor class” strategy won a great victory and consolidated the right-wing political landscape.

-

Scenario B: Lost Twenty Years (Stagflation Scenario):

-

Premise: The United States has fallen into long-term stagflation, or the stock market valuation has returned sharply after being pushed up by passive funds.The inflation rate offsets nominal returns.

-

result: The purchasing power of accounts has shrunk, and ordinary families have been hit hard.

-

political influence: The “state scam” argument is prevalent, society’s trust in the financial system has collapsed, and populism is on the rise.

-

Scenario C: Administrative quagmire and dormant assets (UK scenario):

-

Premise: Complex forms prevent low-income families from opening accounts, and private administrators lack incentives to service small accounts.

-

result: Millions of accounts are dormant, and Wall Street financial institutions are eroding “ownerless assets” through management fees.

-

political influence: The policy is seen as regressive fiscal subsidies, sparking criticism of bureaucracy and financial predation.

Conclusion: Locking in the future, betting on equity and opportunities

The “Trump Account” and the “helicopter equity” concept behind it are a profound reconstruction of the logic of American national governance.It attempts to transform every citizen into a stakeholder in the capital market through the power of financial compound interest.

The core of this bet lies in three assumptions:

-

market assumptions: The U.S. stock market will always be an efficient machine for wealth creation, not a casino.

-

behavioral hypothesis: All families, whether rich or poor, can have the knowledge and patience to manage long-term assets.

-

social assumptions: Asset ownership can replace income redistribution and become the ultimate solution to inequality.

Dell’s donation fueled the plan but also exposed the fragility of its reliance on private capital to patch up public institutions.If it succeeds, it may create a generation of asset-owning middle class; if it fails, it will bury the economic security of an entire generation in the fluctuations of the K-line chart.

This is no longer simply “throwing money”;“Spread equity”.Not only does it redefine welfare, it also seeks to redefine citizens’ relationship to capitalism.During this 18-year lock-in period, it was not just funds that were locked up, but also the entire imagination of American society about the word “opportunity.”