Source:Grayscale Research;Compiled by: Bitchain Vision

Key points of this article:

-

Bitcoin investors have enjoyed high returns but also experienced multiple severe corrections.The roughly 30% pullback since early October is in line with historical averages and is the ninth significant pullback in this bull market.

-

Grayscale Research believesBitcoin is not currently in a deep and prolonged cyclical decline, and its price is expected to reach new highs next year.From a strategic perspective, some indicators point to a short-term bottom, while others remain unclear.Looking ahead to the end of the year, positive catalysts could include another rate cut by the Federal Reserve and bipartisan progress on cryptocurrency legislation.

-

In addition to mainstream cryptocurrencies, privacy-related cryptoassets continue to perform prominently.Meanwhile, the first exchange-traded products (ETPs) for Ripple (XRP) and Dogecoin have also begun trading.

Judging from historical data, investing in Bitcoin can usually bring substantial returns, with annual returns as high as 35%-75% in the past 3-5 years.However, Bitcoin has also experienced many significant declines: its price typically falls at least three times a year, each time by at least 10%.Like every other asset, Bitcoin’s potential investment returns can be viewed as compensation for its risk.Investors who hold Bitcoin over the long term have reaped handsome returns, but they also have to withstand the potential for wild swings along the way.

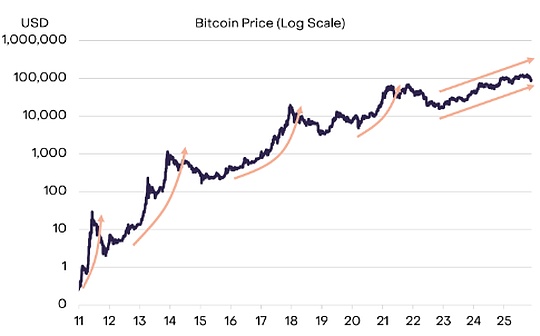

Bitcoin’s downtrend that began in early October lasted through most of November.From peak to trough, its price fell 32% (see chart 1).This puts the magnitude of the recent pullback now close to historical averages.Since 2010, there have been about 50 occasions when the price of Bitcoin fell by at least 10%; the average decline in these declines was 30%.Since the price of Bitcoin hit bottom in November 2022, its price has fallen by at least 10% nine times.Bitcoin prices fluctuated significantly during this period, but this is not unusual for a bull market.

Chart 1: Latest pullback in line with historical averages

Bitcoin price retracements can be measured by their magnitude and duration, and data analysis shows that price retracements fall into two main categories (Chart 2).A “cyclical retracement” refers to a deep and prolonged price decline lasting 2-3 years.Historically, such retracements occur approximately every four years.In contrast,The average price drop in a “bull market retracement” is 25% and lasts 2-3 months.During bull markets, these types of retracements occur 3-5 times per year.

Chart 2: Bitcoin has experienced four large cyclical declines

Gradually fade out the four-year cycle

Bitcoin’s supply follows a four-year halving mechanism, and historically large cyclical price drops have occurred approximately every four years.As a result, many market participants believe that Bitcoin’s price will also follow a “four-year cycle.”According to this theory, after three years of increases, prices will fall within the next year.

Despite the uncertain future,We believe the four-year cycle theory will be proven wrong and Bitcoin prices could reach new highs next year.First, unlike previous cycles, this bull market has not seen a parabolic price increase, which may indicate excessive price increases (see Chart 3).Secondly, the market structure of Bitcoin has changed, with new funds flowing in mainly through exchange-traded products (ETPs) and digital asset treasuries (DATs) rather than retail exchanges.Third, as we will discuss further below, the macro market environment remains favorable for the crypto asset class.

Chart 3: No parabolic price increases this cycle

There are already signs that Bitcoin and other cryptoassets may have hit a bottom.For example, Bitcoin put options have very high skew, especially for 3- and 6-month maturities, suggesting that investors have hedged against downside risk (Chart 4).Additionally, the largest digital asset treasury companies (DATs) are all trading below the value of the cryptocurrencies on their balance sheets (i.e., their “net market cap” is below 1.0), which may also indicate light speculative positioning (often a harbinger of recovery).

Exhibit 4: Higher put skew suggests hedging against downside risk

At the same time, multiple fund flow indicators suggest that demand remains weak: November futures open interest fell further, ETP flows remained negative until later in the month, and there may be more Bitcoin OG selling.Regarding the latter, on-chain data shows that “coin days to destruction” (CDD) spiked again in late November (Chart 5).”Days to Token Burn” is calculated by multiplying the number of tokens traded by the number of days since the last trade – so when a large amount of OG is traded at the same time, CDD will increase.Similar to the surge in CDD in July, an increase in CDD in late November may indicate that an investor with a long-term holding of large amounts of Bitcoin is selling.In terms of short-term prospects,Once these fund flow indicators – futures open interest, ETP net inflows, and OG selling – turn around, investors can feel more confident that Bitcoin has hit a bottom.

Chart 5: More old Bitcoins being moved on-chain

Privacy first

According to our Crypto Sector Index Series, Bitcoin’s price decline in November was in the middle of the pack for investable crypto assets.The best-performing market sector was the currency sector (Chart 6).Excluding Bitcoin, the sector gained even more for the month.The gains were mainly related to several privacy-focused cryptocurrencies: Zcash (+8%), Monero (+30%) and Decred (+40%).The Ethereum ecosystem is also heavily focused on privacy: Vitalik Buterin released a privacy framework at Devcon, while privacy-focused Ethereum Layer 2 project Aztec also launched its Ignition Chain.as we areLast monthly reportAs stated in , Grayscale Research believes that without the element of privacy, blockchain technology cannot reach its full potential.

Chart 6: Currency sector assets excluding Bitcoin outperformed in November

The worst-performing market sector was artificial intelligence, down 25%.Despite price weakness this month, there have been some notable positive developments in fundamentals.

It is particularly worth mentioning that Near, which ranks second in the AI sector by market value, is seeing rapid growth in the usage of its Near Intents product (see Figure 7).Near Intents abstract cross-chain complexity by connecting user-desired results to a network of solvers.These solvers compete to execute the optimal execution path across chains.This feature has increased the utility of Zcash, allowing users to spend ZEC privately, while recipients can receive assets such as Ethereum or USDC on other chains.While it’s still early days, we believe this integration will play an important role in expanding privacy-preserving payments in the cryptocurrency space.

Exhibit 7: Near finds product/market fit

In addition, developers are turning their attention to x402, a new open payment protocol developed by Coinbase that supports AI agent-driven stablecoins for payments directly over the Internet.The payment standard eliminates the need for account creation, manual approval steps, and payment processor fees, enabling frictionless, autonomous micro-transactions executed by AI agents, with blockchain as the settlement layer.Recently, the popularity of x402 has accelerated, with daily transaction volume increasing from less than 50,000 in mid-October to more than 2 million at the end of November.

Finally, the cryptocurrency ETP market continues to expand thanks to the new Common Listing Standards approved by the U.S. Securities and Exchange Commission (SEC) in September.The issuer launched XRP and Dogecoin ETPs last month, and more single-token cryptocurrency ETPs are expected to be listed before the end of the year.Bloomberg data shows that there are currently 124 cryptocurrency ETPs listed in the United States, with total assets under management reaching US$145 billion.

Fed cuts rates, bipartisan legislation

In many ways, 2025 will be an exceptional year for the digital asset industry.On top of that, clarity on the regulatory environment has fueled a wave of institutional investment that is likely to be the basis for continued growth in the coming years.However, valuations do not reflect improving long-term fundamentals: our market-cap-weighted cryptocurrency sector index is down 8% since the start of the year.Although the performance of the cryptocurrency market will be mixed in 2025, fundamentals and valuations will eventually converge, and we are optimistic about the prospects of the cryptocurrency market at the end of the year and into 2026.

In the short term, the key swing factor may be whether the Fed cuts interest rates at its Dec. 10 meeting and what guidance it will give on policy rates next year.Recent media reports indicate that National Economic Council Director Kevin Hassett is the favorite to succeed Federal Reserve Chairman Jerome Powell.Hassett is likely to support lowering policy rates: He told CNBC in September that the Fed’s 25 basis point rate cut was a “good first step” toward a “significant rate cut.”With other conditions remaining unchanged,Lower real interest rates should be viewed as a negative for the value of the U.S. dollar but a positive for assets that compete with the U.S. dollar, including physical gold and certain cryptocurrencies.(See Exhibit 8).

Chart 8: All else equal, a Fed rate cut could be supportive for Bitcoin.

Another potential catalyst could be the ongoing bipartisan effort to legislate cryptocurrency market structure.The Senate Agriculture Committee, which oversees the Commodity Futures Trading Commission, released bipartisan draft text in November.If cryptocurrencies can maintain bipartisan consensus and don’t become a partisan focus in the midterm elections, a market structure bill could make further progress next year, potentially driving more institutional investment into the industry and ultimately higher valuations.While we are optimistic about the short-term market outlook, the most meaningful gains may come from holding for the long term (HODL).