Author: Bradley Peak, Source: Cointelegraph, Compiler: Shaw Bitcoin Vision

1. The job market is “soft, not collapsing,” and the crypto market is showing signs of weakness

After hitting new highs in 2025, Bitcoin struggled to sustain gains for several weeks in late November.At the same time, U.S. labor market data began to issue another warning, not a sharp decline in jobs, but a significant cooling.

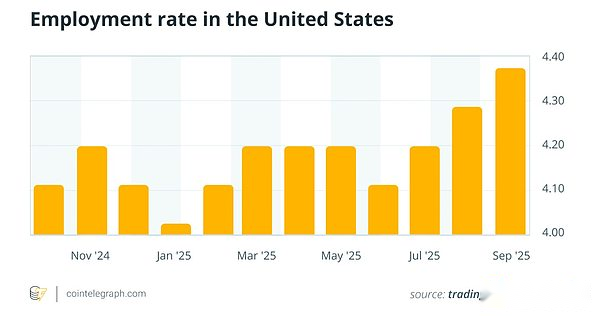

The U.S. unemployment rate has climbed from 3% in 2022-2023 to about 4%, reaching the highest level in recent years.The U.S. Bureau of Labor Statistics (BLS) and Federal Reserve Economic Data (FRED) series show that monthly growth in non-farm employment has slowed from post-pandemic levels to a more modest six-digit increase.Job openings and separations have also declined from their peaks in 2021-2022.

U.S. employment rate

This is a common occurrence in the stock, bond and foreign exchange markets.Weak labor market data tends to quickly revise expectations for economic growth and influence central bank policy.

Today, cryptocurrencies are caught in the same macroeconomic web.Rather than simply explaining it in terms of cause and effect, it’s better to understand the relationship this way: changes in the labor market affect risk appetite and liquidity conditions, and these changes tend to be reflected in Bitcoin and broader cryptocurrency price movements.

2. Why is workforce data critical to risk assets?

Every month, traders around the world stop what they are doing to wait for the non-farm payrolls report from the U.S. Bureau of Labor Statistics (BLS).The report’s main data are concise and clear: number of new jobs, unemployment rate, wage growth and labor force participation rate.

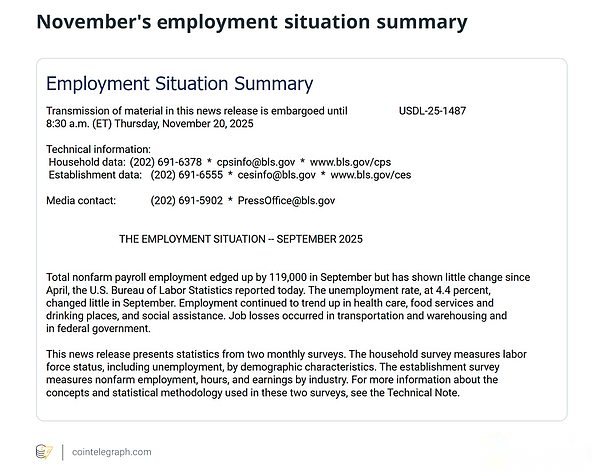

Summary of employment situation in November

Behind the data are deeper issues: the health of American consumers and the likelihood of a recession.Strong job growth and low unemployment indicate that households have sufficient income to spend, supporting corporate earnings and credit quality.Weak data suggests the opposite.

For macro markets, employment data also directly affects expectations for the Federal Reserve.If labor market data remains stable and inflation remains high, investors will infer that interest rates are likely to remain high for longer.If the unemployment rate rises and nonfarm employment growth slows, the case for a rate cut will strengthen.

Today, cryptocurrencies are also traded in the same ecosystem.Bitcoin and mainstream altcoins are widely held by macro funds, exchange-traded funds (ETFs), and retail investors who focus on both stocks and bonds.Thus, a weakening labor market can have two diametrically opposed effects simultaneously:

-

This raises concerns about an economic slowdown or hard landing, which typically prompts investors to sell high-beta assets.

-

This also increases the possibility that policies will become looser in the future, ultimately supporting risk assets by lowering yields and easing financial conditions.

The point is that labor data affects expectations and probabilities, but it does not “mechanically” determine Bitcoin’s next trading direction.

3. Two main channels through which job market weakness affects cryptocurrencies

When strategists talk about labor market pressures on Bitcoin and cryptocurrencies, they often describe two overlapping channels.

The first is growth channels.Rising unemployment, slowing hiring and weak wage growth have made markets more cautious about future earnings and default risks.In this environment, investors typically reduce the riskiest parts of their portfolios, such as small-cap stocks, high-yield bonds, and more volatile assets like Bitcoin and altcoins.Cryptocurrencies, especially those outside of Bitcoin and Ethereum, are still considered the high-beta end of the risk spectrum.

Second is the liquidity and interest rate channels.Equally weak economic data could stoke investor panic and prompt central banks to adopt loose monetary policy.If markets begin to anticipate multiple rate cuts, real yields could fall, the dollar could weaken, and global liquidity could expand.Some macroeconomic research and digital asset research institutions have noted that periods of rising global liquidity and falling real yields tend to coincide with periods of strong Bitcoin performance, although this correlation is far from perfect.

Macro strategists are increasingly describing Bitcoin as an asset whose role changes depending on market conditions.Sometimes it behaves like a high-growth tech stock; sometimes it acts as a macro hedge.Before and after the release of labor market data, a common situation is: in the case of poor data, the market will experience short-term risk aversion fluctuations; then, as interest rate cut expectations and ETF capital inflows resume, the market will partially rebound.

4. What do current U.S. labor market trends actually mean?

To understand the pressure cryptocurrencies are under today, one needs to look beyond an unemployment rate number.

A recent report from the U.S. Bureau of Labor Statistics (BLS) shows that the economy is still adding jobs, but the growth rate is slower than during the post-pandemic boom.Employment growth has slowed and the unemployment rate continues to rise. Survey data shows that fewer Americans think there are ample job opportunities, while more Americans think jobs are hard to find.

Industry segmentation is also important.Recent job creation has come primarily from relatively stable industries such as health care and government, as well as service industries such as leisure and hospitality.Sectors that are more cyclical or engaged in commodity production, such as manufacturing, parts of construction and the interest-rate-sensitive corporate sector, performed weaker on all indicators.

Forward-looking indicators also confirm this cooling trend.Job openings and separations tracked in the Job Openings and Labor Turnover Survey (JOLTS) are well below peak levels.Employees are changing jobs less frequently, suggesting that the strength of the labor market has faded from its hot 2021-2022 season.

A series of mixed signals on labor employment have left the market debating whether the U.S. economy will have a smooth soft landing or will encounter more twists and turns.This uncertainty alone may prompt investors to adopt a more conservative strategy in risk asset allocation, including a reluctance to chase Bitcoin after a strong rally.

5. How cryptocurrencies are affected by recent changes in the employment landscape

Recent trading surrounding the release of monthly employment data, while imperfect, provides a useful window into these developments.

Over the past few years, non-farm payrolls numbers have been lower than expected or the unemployment rate has unexpectedly risen, and they have followed a familiar pattern.One study found that when non-farm payrolls beat expectations, Bitcoin rose by an average of about 0.7%, while when non-farm payrolls missed expectations, Bitcoin fell by an average of about 0.7%.This suggests that traders do reduce exposure to high-beta assets when employment data disappoints.

Algorithmic trading and day traders, driven by headlines about an economic slowdown, tend to sell stocks and cryptocurrencies in the minutes and hours after the data is released.For example, around the time the report was delayed in September 2025, Bitcoin prices soared to around $90,000 before falling back to mid-$80,000, and more than $2 billion in cryptocurrency positions were liquidated, including nearly $1 billion in long Bitcoin positions.

After the dust settled, market focus turned to the interest rate market.If weak economic data triggers futures and swaps expectations for deeper rate cuts from the Fed, long-term yields will fall.In some cases, Bitcoin stabilizes or partially rebounds in the coming sessions as investors move back into longer duration, higher beta assets.In other cases, especially when labor market weakness accompanies banking stress or geopolitical shocks, risk aversion takes over and violent swings in cryptocurrencies persist for longer.

Analysts at both traditional macro research firms and crypto-native companies emphasize that special news such as ETF flows, stablecoin liquidity, on-chain activity, and protocol upgrades or exchange issues can easily overshadow any single data release.In other words, employment numbers are important, but they are just one of many cryptocurrency-specific drivers.

6. Labor Data Cycle Key Points Cryptocurrency Investors Should Watch

For investors who want to understand these correlations but don’t want to treat them as trading rules, a simple macro dashboard can go a long way.

The main contents include:

-

New jobs and unemployment rate: These two items form the core of the monthly employment situation report.A continued rise in the unemployment rate while job creation slows usually signals a cooling trend in the economy.

-

Wage increases and working hours: These reflect household income and purchasing power, which in turn affect economic growth expectations and the Fed’s forecast for the outlook for inflation.

-

JOLTS data such as job vacancies, departures and hiring: High job vacancies and turnover rates indicate a tight labor market; declines indicate slowing labor demand and low confidence.

-

Weekly initial jobless claims: Many macro and quant funds use this high-frequency series as an early warning signal of changes in the labor market.

Different combinations send different signals.The employment situation is solid and benign and inflation is moderating, which provides room for the Federal Reserve to gradually ease monetary policy, a situation that is generally more conducive to risk-on assets.Rapidly rising unemployment and fewer job openings have increased the risk of a sharp economic downturn, in which case investors may be more inclined to hold cash, Treasury bonds and defensive assets.

The key for Bitcoin and cryptocurrencies is that a weak labor market means lower prices, and labor data helps predict macroeconomic conditions.These data influence growth expectations, interest rate trends and liquidity, which in turn influence the amount of risk investors are willing to take.