Author:Anthony Pompliano, Founder and CEO of Professional Capital Management; Compiled by: Shaw Bitcoin Vision

The Fed and its Board of Governors have historically discussed policy decisions behind closed doors, but when it comes time to vote on monetary policy at regular intervals, they are almost always unanimous.That’s why two Fed governors caused such a stir in July this year when they voted against the policy at the same time.

At the same meeting, not one, but two trustees voted against it.Not since 1993 have we seen two Fed governors vote against each other at the same meeting, this situation is really rare and eye-catching.At the time, most people believed that this anomaly was due to political factors.Federal Reserve Chairman Jerome Powell does not appear to like Donald Trump, and the two governors who voted against the move were both nominated by Trump.

The Fed is supposed to remain independent, but if you really think so, then I can only say that you are naive.The Fed is made up of people, and people are biased.This bias may not necessarily manifest itself in malicious or insidious ways, but everyone is affected by personal beliefs.This is human nature.No one, not even central banks, is immune.

But now we have information that suggests the dissenting opinions of the two Fed governors in July may be a sign of things to come.Bloomberg’s Catarina Saraiva published an article over the weekend titled “Fed Watchers Focus on Vote Count as December Rate Suspense Intensifies.”In the article, she wrote:

“Divisions within the Fed have grown in recent weeks, with officials divided ahead of a December policy meeting and Chairman Jerome Powell staying silent.

On Friday, a dramatic scene unfolded.New York Fed President John Williams, sometimes seen as the voice of the Fed chair, expressed support for a rate cut after several policymakers had previously been leaning against it.

Since the Fed’s last interest rate decision on October 29, Powell himself has not made a public statement.But a tally of recent remarks shows that other voting members of the FOMC are now almost evenly divided on the rate decision, making it almost certain that no matter the outcome, there will be someone who votes against the decision on December 10.”

These objections are significant becauseThey expose the fragility of the central bank system.You can take continued dissent from Fed governors as a very negative sign.There was no consensus and no calm.These objections also highlight the difficulty and complexity of the current economic environment.

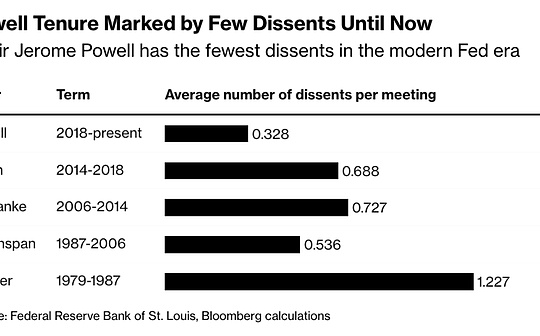

The divisions have become more pronounced recently, and Chairman Powell has done a good job of promoting consensus during his tenure, but that is all changing now.

This situation reminds me of the book “Lords of Easy Money,” which provides the best analysis of the Fed’s actions during the global financial crisis.

This book is important because it illustrates what many are afraid to say publicly:The Fed may have done more harm than good to the U.S. economy over the past 20 years.

The introduction to the book reads:

“If you asked most people what force caused today’s unprecedented income inequality and financial crisis, no one would say the Federal Reserve. For most of its history, the Fed has been flattered and touted by the media. When the economy was booming, the credit went to the Fed; when the economy collapsed in 2008, the Fed was credited with saving us.

But here, for the first time, the inside story of how the Fed sent the U.S. economy spiraling downwards… The King of Easy Money deftly tells the story of how quantitative easing is endangering the U.S. economy through the story of the man who tried to warn us.”

This man was Thomas Hoenig, and in hindsight he seemed very wise.So what exactly did Honig do?His achievements can be summarized in the following points:

“After the 2007 recession, Honig became the focus of national attention by frequently expressing his opinions on the financial crisis and its causes, as well as regulatory reform and monetary policy in response to the crisis. At eight Federal Open Market Committee (FOMC) meetings in 2010, he cast the only dissenting vote against the FOMC’s loose monetary policy and was concerned about the FOMC’s commitment to keep the federal funds rate at historically low levels for “an extended period of time.”

He has also frequently spoken publicly about large and systemically important financial institutions, so-called “too big to fail” businesses.He said negligence and mismanagement by these companies were the main reasons for the crisis.”

In hindsight, it’s hard to say that Honig was wrong.I suspect others who were there also disagreed with the decision, but they chose loyalty to the institution of the Federal Reserve over loyalty to the American people.It now appears that few Fed officials are willing to make this mistake again.

If the Fed held a monetary policy vote today instead of December 10, Jim Bianco believes that the current vote would be 7 to 5, with a higher proportion in favor of another rate cut.The market’s estimate of the probability of a rate cut in December is about 63%, which also confirms this view.

Even Polymarket currently believes that the probability of a 25 basis point rate cut in December is as high as 95%.

But the decision to cut interest rates will not come out for another four weeks.The vote will not take place today, we have to wait until December 10th.In financial markets, this is a long time.Data will change, market sentiment will change, and opinions will change.So, you can’t expect today’s information to guarantee the final outcome.

One thing that is changing, however, is the financial climate for average Americans.They are in dire straits and long for relief as soon as possible.maybeLower interest rates could help in some cases, but could cause more pain in others.

NBC News’ Kristen Welker asked Treasury Secretary Scott Bessant yesterday: “How much longer do Americans have to wait?”How long will they have to wait for the cost of living to drop?”

Bessant expressed his opinion.He said:

“I talked about the three big things that are hurting Americans: immigration, interest rates and inflation.The president has closed the border, and the massive migrant surge has subsided.Previously, large numbers of immigrants had pushed up housing prices and depressed wages.Interest rates fell…so prices began to fall across the board.Thanksgiving is right around the corner and this year the cost of Thanksgiving dinner will be the lowest it has been in four years.Turkey prices fell 16%.”

This boils down to the challenge of managing an economy.The Federal Reserve is gradually lowering interest rates while the Treasury secretary and Trump administration economic policy advisers try to address affordability issues across the country.

youThink of the Fed as trying to pull short-term levers, while the rest of the government tries to pull long-term levers.It’s not a perfect metaphor, but it’s closer to reality than people think.

There will never be perfect solutions to these problems.The global economy is a complex machine.No one can agree on what the data reveals, let alone how various decisions will affect the economy.Nowadays,Politics, monetary policy and economic decision-making are all intertwined.All eyes are on the Federal Reserve’s decision to cut interest rates in December.

I estimate the Fed will cut interest rates another 25 basis points.But I don’t entirely agree with this decision.I have been leaning towards a 50 basis point rate cut this year so that we can get the cost of funds below 3% as quickly as possible.This should reduce the burden on ordinary households, stimulate investment in research and development, and drive more significant GDP growth.

I think the chances of a 50 basis point rate cut are slim to none, especially since the Fed lacks BLS data from recent months and they’re like a blind man trying to figure out the elephant.So they will back off and continue to slowly lower the federal funds rate.But if for some reason they don’t cut rates, Wall Street will be in disarray and the market will fall.The consensus is that we need cheaper money, so the Fed should act.

And market dislocation is a risk Jerome Powell and the Fed are unwilling to take.