Author: Alana Levin, investment partner of Variant Fund; Translation: @bitchainvisionxz

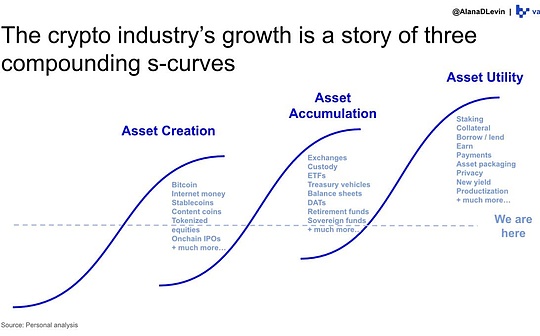

The core point of this crypto trend report is that the growth of the crypto industry can be viewed as an evolutionary trilogy composed of three compound S-curves, namely asset creation, asset accumulation and asset utilization.

Stage one is the creation stage: The tokenization process of value.This stage started with the birth of Bitcoin in 2009, and has now covered multiple categories such as Layer 1 monetary assets, project tokens, stable coins, content tokens, meme coins, NFTs, and tokenized equity.Between 2024 and 2025, the industry crossed the steepest growth range of the S-curve—the number of tradable tokens surged from about 20,000 to millions in just a few years.Although there is still a vast space for innovation (such as tokenized credit, on-chain structured products, real assets on the chain, etc.), the most disruptive breakthrough period from zero to one has been basically completed.

The second stage is the accumulation period: The richer the asset types and the higher the value, the stronger the holding demand.This provides tailwinds for several segments of the industry: custody products, exchanges and security solutions.Different custody solutions serve different user groups: applications that support stablecoins may use embedded wallets such as Turnkey, institutional investors often use qualified custodians, and active on-chain users may use super application wallets such as Phantom.The growing demand for buying, selling and holding crypto assets has also catalyzed the expansion of distribution channels.Trading volumes on many established exchanges (such as Coinbase) have soared, traditional financial technology companies (such as Robinhood) have doubled down on crypto channels, and emerging platforms (such as Axiom) have shown explosive growth.Asset managers are offering crypto asset allocations in retirement accounts, public companies are starting to include Bitcoin and stablecoins on their balance sheets, and even some sovereign wealth funds are starting to accumulate such assets.We are just beginning to climb the steepest part of this phase of the S-curve.

Stage three is the utilization period: Let assets create value.When people hold assets, they start using them.Cryptoassets are by far the most composable, accessible, and programmable financial assets.Many exciting and mature use cases are already emerging: stablecoin payments, supplying and borrowing funds in lending protocols such as Morpho, providing liquidity to on-chain exchanges, and network staking.However, we are still in the very early stages of the diverse ways in which tokenized assets can and will be used – a stage where the climb up the S-curve has only just begun.I believe that the design space to expand and enhance the utility of assets will be one of the largest and most exciting blue ocean opportunities in the coming years.

This report is divided into five major sections: macro trends, stablecoins, centralized exchanges, on-chain activities and future prospects.Each part adopts the triple composite S-curve framework system to help understand the main trends and opportunities in the current encryption industry.Here is our summary of the main current trends in crypto:

1, macro trends

Mainstream crypto assets continue to expand in size.Even as total crypto market capitalization continues to grow, market capitalization concentration among the top ten assets remains surprisingly stable.New assets struggle to crack the top five.Many top assets exhibit true Lindy Effect and copycat potential.

2, stable currency

Stablecoins have achieved explosive growth and run through three S-curves: new issuance (asset creation) is advancing at a record speed, deposit channels (asset accumulation) are becoming increasingly diverse, and stablecoin application scenarios (asset utilization) continue to expand.This category has a strong network effect – the greater the circulation, the higher the practical value.Likewise, the more entities that hold stablecoins, the greater the ability to build products and services around these assets.At present, stablecoin productization dividends have been shown in areas such as payments, income products (such as lending protocols), and exchanges.But we believe that there is still broad room for innovation in the triple S curve.

3, centralized exchange

Centralized exchanges are the most significant beneficiaries of the “accumulation” S-curve.Over the past five years, both transaction volume and revenue have grown significantly.It is worth noting that the second-order effect of trading activity is that users retain assets on the exchange – which allows the exchange to expand its service scope (such as staking, income and lending products).Although many new application scenarios for crypto-assets will be built directly on-chain, powerful distribution channels may be gained through integration with centralized exchanges.

4, on-chain activities

Want to explore novel ways to use crypto assets?Please pay attention to the ecology on the chain.This is a hotbed of innovative experimentation.Every step of the asset lifecycle – issuance, liquidity provision, trading, listing and productization – is permissionless and open on the blockchain, whereas in traditional finance there are barriers to entry at every step.This setting greatly expands the design space for asset creation and utilization.In addition, many types of on-chain protocols have gradually matured into commercial entities with sound fundamentals.Decentralized exchanges, lending platforms, token launch boards and perpetual contract exchanges all demonstrate significant product-market fit.

5, future prospects

Development based on cryptographic infrastructure turns products into platforms.This section takes the growth of the prediction market as an example to show the typical paradigm of new economic models enabled by encryption technology, and summarizes the entrepreneurial opportunities that Variant is focusing on (non-exhaustive list).

Within the framework of the triple composite S-curve (asset creation, asset accumulation and asset utility), we have witnessed many achievements, but there is still a vast world to explore: