Source: On-Chain Mind, compiled by: Shaw Bitcoin Vision

There is a quiet force at work currently reshaping the market’s supply dynamics: Bitcoin exchange-traded funds (ETFs).These products have absorbed 7% of the total Bitcoin circulation, and if you are not paying attention to them, you are missing the most important piece of the puzzle.

In this article, we’ll explore ETF flows in detail, dissect newly developed metrics at the forefront of fund flow analysis to help measure the impact of ETFs, and consider what these flows reveal about market dynamics and human behavior.

Let’s get started.

Key points overview

-

absorb large supply: Global Bitcoin ETFs currently hold over 1.4 million BTC, representing over 7% of the total supply, with implications for scarcity and price stability.

-

Fund flow patterns and psychology: Daily and cumulative fund flows reflect investor behavior, highlighting opportunities to buy when money is flowing out and sell when money is flowing in.

-

Custom indicators for in-depth analysis: New tools such as cumulative flow differential, flow volatility, and flow-weighted average price provide signals for market highs, lows, and investor cost bases.

-

Long-term bullish outlook: ETFs are buying more Bitcoin than are newly mined, a structural shift that could support future price increases.

A new era of Bitcoin adoption

Since its launch in January 2024, the US-based exchange-traded fund (ETF) has become a transformative force in the Bitcoin ecosystem.These financial products allow both retail investors and institutional giants to gain exposure to Bitcoin without directly holding it.Given that Bitcoin’s supply is fixed at 21 million coins, this mechanism has a significant impact on Bitcoin’s supply and demand dynamics.

However, it is estimated that between 3 million and 6 million Bitcoins are permanently lost due to loss of private keys, death of the owner, or other irretrievable circumstances.This reduces the actual number of Bitcoins in circulation to about 15 million to 18 million, which is the upper limit of the total number of Bitcoins.

Against this backdrop, the fact that the ETF currently holds over 1.4 million BTC, equivalent to over 7% of the maximum supply, or potentially over 10% of the circulating supply, shows just how important its growing dominance is.

Quarterly and monthly updates

Let’s start by looking at the health of ETFs in general.

The total amount of BTC held by all Bitcoin ETFs in the world has exceeded 1.4 million.Even though the quarter has not yet ended, these ETFs have absorbed more than 91,000 BTC.It was a strong quarter, lagging behind only inflows late last year when the first ETFs were launched and the post-election rally.

Broken down by month, the capital inflow situation is even more eye-catching:

-

May-August 2025: Continued inflows and steady withdrawal of more Bitcoin from the market.

-

41,000 BTC were absorbed in August alone.

-

Bitcoins mined per day: ~450, or ~14,000 per month.

Simply put, ETF inflows this month have exceeded three times the new supply entering the system through miners.This absorption puts continued upward pressure on the price by tightening available liquidity, and may explain why we have been experiencing a passive gradual climb to highs so far.

Fund flow analysis

Cumulative fund flow

Looking at cumulative ETF flows, net inflows since January 2024 have reached a staggering $54 billion.The overall trend is “continuously rising”, with only a brief pause, showing the continued influx of passive funds.

Cumulative flow difference

One of the most insightful custom metrics to emerge from this data is Cumulative Flow Divergence, an oscillator that measures the deviation of ETF flows from their long-term trend.The indicator takes these factors into account by moving values forward on non-trading days, such as weekends, and applies a 75-day moving average to smooth the data while avoiding excessive noise.The differential is the difference between daily funds flows and this average, highlighting any acceleration or deceleration in net funds flows.

Data from March 2024 shows that when the cumulative flow differential is above +8, it indicates that local prices are high, capital inflows are above normal levels, and local market sentiment is high.When the cumulative flow difference is close to zero or negative, it marks a low point and there may be undervalued investment opportunities.This indicator essentially quantifies the behavior of retail investors and encourages contrarian operations.

daily fund flow

A closer look at the daily ETF flow reveals that it echoes Bitcoin’s price action.During rallies, inflows dominate, while during pullbacks, outflows surge.The connection is obvious: retail investors, who make up the bulk of ETF participants, exhibit chasing behavior.They flock in because of FOMO at the highs and leave out of fear, uncertainty, and doubt at the lows.

The largest outflows occurred in February 2025, when Bitcoin fell 17% from $100,000 to $83,000, triggering panic selling.Instead, November 2024 saw the largest inflows during Bitcoin’s rally from $70,000 to $90,000.These patterns are real-time manifestations of behavioral finance principles, such as herd psychology and loss aversion.

From an educational perspective, these data provide a counter-strategy:

-

Buy heavily on red trading days when there are heavy outflows.

-

Reduce buying on green trading days when inflows surge.

It might be that simple.

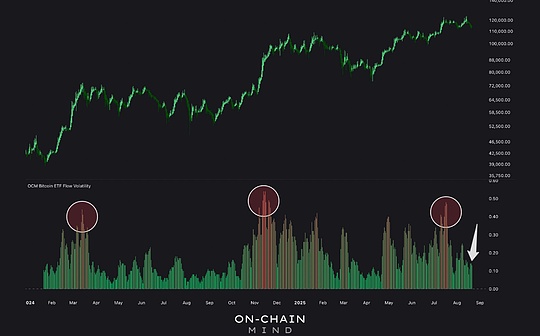

Traffic volatility

Another layer of analysis I perform is traffic volatility, which tracks how much daily traffic fluctuates relative to historical averages.The red areas in the chart below indicate high volatility, which typically coincides with large price moves.

Interestingly, volatility has remained low during the recent decline of $10,000 from all-time highs.This reflects Bitcoin’s maturity: what were once “plunges” are now just regular swings.Three to five years ago, a similar move would have halved the price; today, with a market capitalization of over $2 trillion, such a move would be just a blip.

Traffic Weighted Average Price (FWAP)

Perhaps the most innovative metric is the flow-weighted average price (FWAP), an experimental metric that weights Bitcoin’s price based on daily ETF flows.This indicator calculates the price-flow product and the decreasing cumulative sum of flows, emphasizing recent activity to reflect current holder market sentiment.

I’ve come to think of this as an ETF’s version of a “realized price” – a cornerstone of on-chain analytics that represents the average price of all tokens when they last changed hands.And FWAP also attempts to estimate an average cost basis, but for ETF investors.

Currently, the average cost price is $105,000, which is also not far off from short-term holder realized prices.This suggests that ETF holders may still be in the black even during this pullback.Recent history shows that when prices fall below this level, panic selling occurs, marking a local bottom in extreme pessimism.

The potential of this indicator also extends to the derivatives world, such as FWAP-based oscillators and risk indicators, so I will further refine these indicators in the coming weeks.But even now it provides a unique look at the institutional/retail cost base that I haven’t found anywhere else.

Bullish sign of tighter supply

From a broader perspective, what is clear is this: ETFs are structurally absorbing Bitcoin supply at a rate far exceeding mining output, fundamentally reshaping the supply landscape.This “supply absorption” is bullish in the long term because it reduces the amount of Bitcoin available for spot trading.

But that doesn’t mean it will only “go up forever.”We can clearly see from the flow of funds that investors are also happy to sell their coins (or stocks) when prices fall.So that’s something I’ll be keeping a close eye on.

The data also revealed some surprising insights.While exchange-traded funds (ETFs) are quietly hoovering up Bitcoin, money flow data provides a compelling window into human psychology.The emerging indicators discussed here represent the cutting edge of money flow-based Bitcoin analysis, and they will undoubtedly become key tools in my future accumulation strategies.

At the current rate, these ETFs and the metrics that track them will only become more important as the market develops.