Author:Anthony Pompliano, Founder and CEO of Professional Capital Management

Bears have been dominating financial markets over the past few days.The S&P 500 is down 2.5% over the past five days, the Nasdaq is down 4% over the same period, and Bitcoin is down 5% over the past week.

All week long, red numbers flashed across the screen.

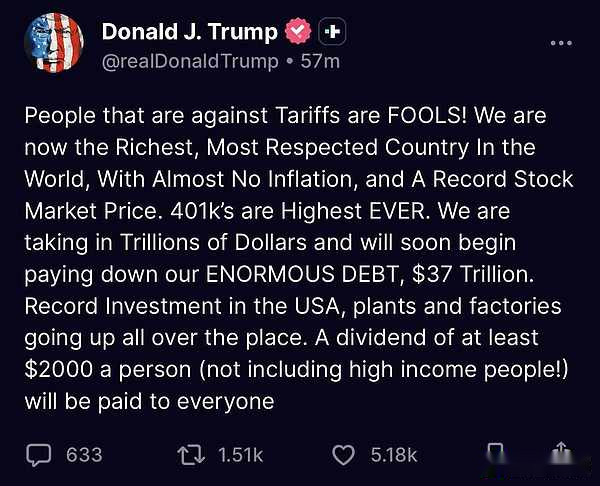

But don’t worry;Trump-style bailout is coming.President Trump posted via Truth Social on Sunday morning,Promises a $2,000 “tariff bonus” to all non-high-income U.S. citizens.

Do you think that a president who measures the health of the U.S. economy by the performance of the stock market will sit back and let the short sellers triumphantly celebrate their victory?

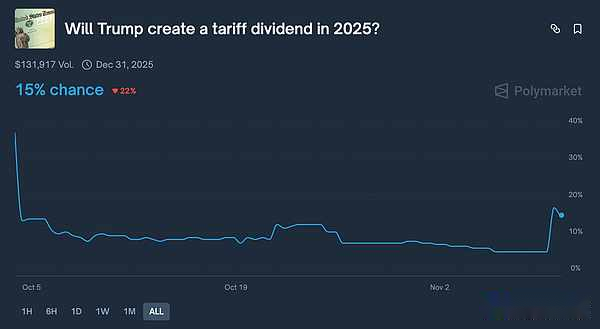

Will the tariff dividend finally materialize?I have no idea.The current odds on Polymarket are only 15%.

Another question is, will the tariff dividend actually materialize?I don’t think it matters.The ‘Trump put’ has had its intended effect.

Just one social media post can completely change the course of an asset price.Stocks and Bitcoin prices surge as market enthusiasm returns.

This is the “Trump put.”He always makes comments that impact the stock market at the right time.You may remember that before the stock market bottomed in April this year, he posted on social media that “now is a great time to buy!”A few weeks ago on Sunday night, about an hour before the futures market opened, Trump dropped his threat to impose 100% tariffs on China.And yesterday, amid all the panic and fear, the most exciting news was Trump’s promise to send out billions of dollars in stimulus checks.

Are stimulus checks good for the health of the U.S. economy in the long term?Of course not.But does anyone care now?Not really.People are too focused on short-term concerns, like a stock market bubble or a coming Bitcoin bear market.

Most people believe that if President Trump wants to send $2,000 to millions of citizens, especially after New York City elects a new mayor with an agenda over housing affordability, then let him do it.This approach completely ignores the long-term soundness of the economy and the depreciation of the dollar.

Remember,Inflation can only be created by Washington, and handing out thousands of dollars to hundreds of millions of people is a quick way to increase the chances of high inflation.

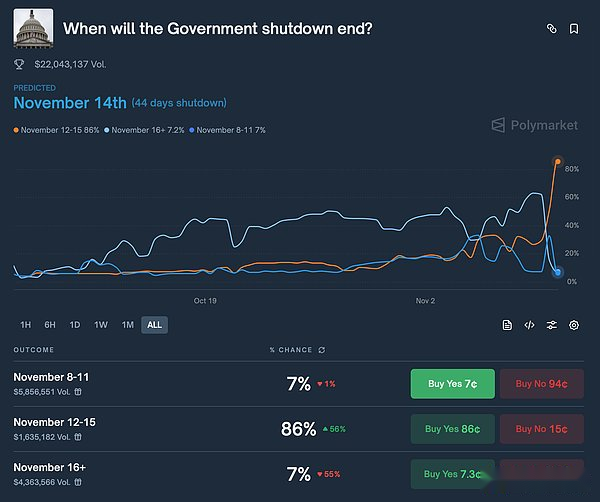

But “Trump puts” aren’t the only thing that could push asset prices higher before the end of the year.We already know the prospects for a U.S.-China trade deal will become clear.We also saw the Fed cut interest rates for the second time in two meetings.Now, Polymarket data shows that the likelihood of the government shutdown being resolved before November 15 is increasing.

On Sunday morning, the consensus view was that the probability of the government shutdown being resolved after November 16 was 62%, but in the past 24 hours, that probability has plummeted to just 7%.A big reason for this change was reports last night that the Senate had reached a deal that would have enough Democrats defecting to vote for the government to reopen.

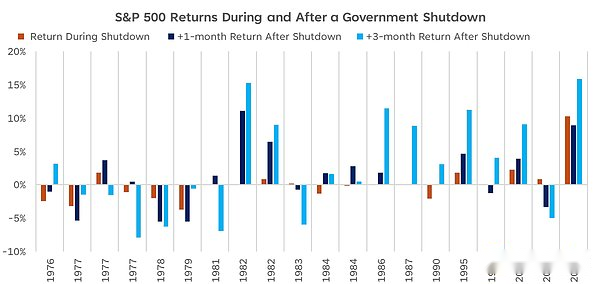

Stocks and Bitcoin expected to rise quickly if government shutdown ends.Opening Bell Daily’s Phil Rosen writes: “Over the past 50 years, the United States has experienced 21 government shutdowns, and the S&P 500 has gained an average of 1.2% one month after the shutdown and 2.9% after three months. Stocks almost always rise after a government shutdown.”

Altcoin Gordon data shows,Bitcoin is also up 50% in the 3 months since the last government shutdown.

So what happens next?No one knows.We are all trying to predict an unknown future.But what I’ve learned over the past five or six years is to trust your gut, trust your feelings, trust your animal instincts.

No matter what you call it, people’s perception of the market often determines how it performs.Last week was a perfect example.Panic and negativity flooded the market.People are predicting that Bitcoin is about to usher in the next bear market, or that the stock market rally is about to end.

But things are different this week.All we need is the promise of some stimulus checks to get everyone excited again.If everyone gets excited, money will flood into the market, pushing up asset prices.

I’m not the smartest guy in the world, but I know the implications of the “Trump put” shouldn’t be ignored.

yesterday morning‘Trump puts’ are here, asset prices are reacting, and the bull market is back.