Author: On-Chain Mind, Compiled by: Shaw Bitcoin Vision

Bitcoin’s moves haven’t followed most people’s expectations.If you’re still counting on the classic four-year cycle to peak in 2025, you’re probably stuck with the same old strategy.

The fact is: this cycle appears to last longer than historical patterns suggest, and the most explosive phase may yet to come.

In this article, I’ll explore why the traditional four-year cycle may be outdated, predict possible dates and price targets for this bull market’s peak, and explain how market psychology interacts with these extended cycles.

Key points overview:

-

The classic cycle is turning: Bitcoin’s past four-year historical cycle pattern no longer lines up with current price action, suggesting longer cycles are likely in the future.

-

Linear and Quadratic Models: Different methods of predicting the next peak produce different dates and price ranges, presenting two different outlooks: conservative versus aggressive.

-

price prediction: The linear model predicts a peak between $174,000 and $243,000; the quadratic model predicts as high as $272,000 in a long-term bullish scenario.

-

psychological change: Longer cycles build investor confidence, and as patience wears thin, the likelihood of a sharp market top crash increases.

Rethinking the four-year cycle

For years, the Bitcoin community has clung to the clear concept of a four-year cycle, often associated with halving events that slash mining rewards and theoretically trigger scarcity-driven price increases.

This is certainly a reassuring statement.Every four years, like clockwork, we prepare for a bull market, reach its peak, and then inevitably face a correction.But as someone who has been poring over charts and on-chain data for years, I can tell you:The market doesn’t care about our seemingly perfect theories.It has been evolving and is heavily influenced by institutions and global liquidity, factors that did not exist in Bitcoin’s early days.

To understand why I think classic cycles are fading, we need to take a step back and look at the definition of a cycle.In fact, there has never been a general consensus on how to measure a “cycle”:

-

Some routes from one peak to another.

-

Some people prefer to work from the bottom up.

-

The halving event is also a commonly used reference point.

-

Some studies focus on macroeconomic or liquidity cycles.

There is no one-size-fits-all approach.Some analysts believe in the halving date, others rely on macro indicators such as M2 money supply, and many use bull-bear cycle turning points as a yardstick.

I chose a more comprehensive framework that combines the best elements of these approaches:Measures the cycle from bear market lows to bull market peaks.

In my opinion, this approach provides the clearest picture of the full emotional progression of Bitcoin’s cycles.

continued cyclical expansion

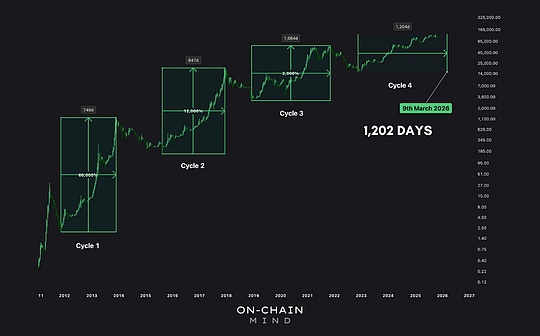

Looking at Bitcoin’s historical cycle from this perspective, you will find a remarkable pattern:Each cycle is gradually lengthening.

-

Cycle 1: Duration 749 days; price increase 60,000%

-

Cycle 2: Duration 847 days; price increase 12,000%

-

Cycle 3: Duration 1064 days; price increase 2000%

Each cycle stretched about six months: the first lasted more than two years, the second two and a half years, and the third nearly three years.It’s currently 1,071 days (approximately three years) later, and if this pattern continues, we can expect it to be approximately six months before the potential peak arrives.

Bitcoin’s first cycle lasted about two years, when it was still a niche experiment traded by early adopters on rudimentary exchanges.The gains, while impressive, come from a small base.As adoption increased, so did the cycle duration: the second cycle lasted two and a half years, and the third nearly three years.

Notice the pattern?It’s no accident that each cycle lasts about six months longer.It reflects diminishing returns and increasing market efficiency.

Predicting the next bull market peak

Fast forward to today and our fourth cycle has passed1071 days.This is well within a three-year cycle and is strikingly consistent with historical trends.If the six-month extension forecast holds true, the peak is still yet to come.

There are two main ways to predict where Bitcoin’s next peak may occur:

1. Linear regression model

This approach assumes that the cycle will continue to lengthen at a stable and predictable rate, like the previous three cycles.Following this approach, the fourth cycle would last approximately1202 days (about 3.5 years).Counting from the bottom of the last bear market, the potential peak of the bull market may appear inAround March 2026.

Linear regression is the most conservative model.It assumes that Bitcoin will continue along its historical path without significant acceleration.

2. Quadratic model

A more sophisticated approach takes into account the phenomenon of period lengthening acceleration.By fitting the first three cycles to the data, the model predicts that the duration of the fourth cycle will be approximately1400 days (3.5 to 4 years), indicating that its peak value may appear atAround September 2026.

This approach embodies the compounding effect of longer periods: Not only does the market stretch out over time, it absorbs higher prices and investor confidence in the process.

Predicting fair value prices and peak prices

To quantify potential valuation, I use the Log Growth Band indicator.The tool charts Bitcoin’s long-term trend and takes into account diminishing returns as the asset matures.

1. Linear regression model

According to the linear regression model, the fair value of Bitcoin is about $106,000 by the March 2026 price target, with an upper limit of nearly $243,000 and a lower limit of about $52,000.During a typical bull market mania, the price of Bitcoin can fluctuate between $174,000 and $243,000, reflecting the phenomenon of prices often exceeding fair value later in the cycle.

2. Quadratic model

Under a quadratic model scenario that accounts for an extended acceleration cycle, fair value rises to approximately $126,000, with a potential peak between $199,000 and $272,000.

The psychology of long term cycles

Long-term cycles are not just about dates and prices, they are a psychological game.The longer Bitcoin consolidates, the more high prices will become the norm.

What was the price of Bitcoin one year ago today?$67,000.But I don’t think you can guess it.It feels like a long time ago that Bitcoin dropped to this price, but in reality, not that long has passed.As prices rise, so do our expectations and our patience begins to wear thin.

In my experience, the combination of these factors amplifies the potential for a price surge.As markets have time to consolidate expectations, digest price levels, and gradually build optimism, the potential for a parabolic move increases.

my opinion

My personal opinion is:The old cyclical model is no longer valid.The data shows that the fourth cycle will be longer, and based on historical patterns and on-chain indicators, the next real peak is more likely to occur in early to mid-2026 than 2025.

To me, this is a reminder that Bitcoin trading timing is not about following a rigid pattern.Don’t get hung up on 2025.Relying on the traditional four-year cycle could cause you to miss out on opportunities.Remember:Models are only references, not absolute truth.Linear models and quadratic models can provide a certain prediction framework, but the market is inherently unpredictable, so you should use them to assist thinking rather than letting them influence your judgment.

The market may surprise you.But not in the usual way, but in a more subtle, long-lasting way.Bitcoin moves at its own pace—it’s best not to fight against it.