author:Anthony Pompliano, Founder and CEO of Professional Capital Management; Compiled by: Shaw Bitcoin Vision

Asset prices like market catalystsreact.Sometimes catalysts are foreshadowed, sometimes they are unexpected.Take the Federal Reserve’s scheduled meeting on Tuesday and Wednesday of this week, for example.

Every investor knows this day is coming.It’s on the calendar year-round.Most investors expect the Federal Reserve to cut interest rates.In fact, Polymarket currently shows a 98% chance of a 25 basis point rate cut.

Asset prices favor lower costs of capital as investors move further along the risk curve.Lower interest rates portend continued gains for stocks and Bitcoin.And it’s not just the Fed’s monetary policy decisions that are key here.

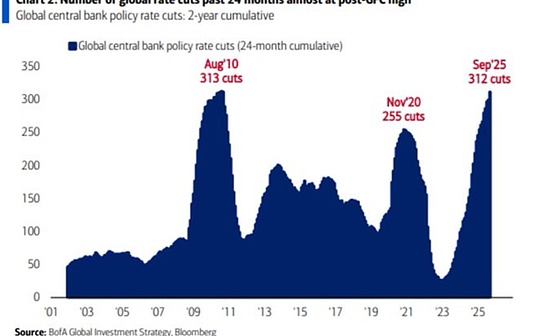

Bitwise’s André Dragosch wrote: “The number of global interest rate cuts in the past 24 months has been higher than since the COVID-19 pandemic, but bears still believe that Bitcoin has peaked.”

In the past 24 months, global interest rates have been cut 312 times, which is simply incredible, after all, the Federal Reserve still maintains interest rates at 4% or higher.The Fed still has plenty of room to lower interest rates to 1% to 2%.

But this week’s rate cut is only part of the story.Everyone knew a rate cut was coming, but we didn’t know until this weekend how likely the U.S. and China were to reach a trade deal.

Finance Minister Scott Bessant held a media briefing on Sunday morning in a bid to let the world know a trade deal was imminent.Bloomberg reports:

Top trade negotiators from China and the United States say they have reached agreement on a series of contentious issues, laying the groundwork for President Xi Jinping and President Trump to reach a deal and ease trade tensions.

After two days of talks in Malaysia on Sunday, a Chinese official said the two sides had reached preliminary consensus on export controls, fentanyl and shipping taxes.

U.S. Treasury Secretary Scott Bessent later said in an interview with CBS News that Trump’s threat to impose 100% tariffs on Chinese goods is “effectively off the table” and that he expects China to purchase large amounts of soybeans and delay the implementation of comprehensive rare earth control measures.

So what should we expect if the US-China trade deal is officially announced?

Investors like certainty.They want predictability.If there is clear progress in U.S.-China trade talks, markets will rise sharply.Don’t believe it?Scott Bessant’s comments over the weekend have sent stocks and Bitcoin slightly higher as investors look forward to confirmation of the important trade deal.

The key is that what people don’t want to admit is that the world is caught between two extremes.China and the United States do compete with each other economically, but the two countries are interdependent.Therefore, this trade deal will be reached.

The market knows this too.The market also knows that interest rates will fall and the government will never stop printing money.These 3 things are good for stocks and Bitcoin.

But I do have some unexpected news for you.The sharp rise in gold prices over the past few months may indicate that further appreciation is unlikely before the end of the year.In fact, we have seen gold prices decline over the past two weeks, and I think this is likely to continue throughout the remainder of 2025.

In this case, Bizyugo noted that the Bitcoin mania began in 2020 when gold prices peaked.

While there is no guarantee that the conditions of 2020 will be repeated,The macro environment has prepared us almost perfectly.I would be surprised if Bitcoin fails to rise by the end of the year.Moreover, the stock market will also keep pace with Bitcoin.

The S&P 500, Dow Jones and Nasdaq all hit record highs.Once something starts moving it stays in motion.I guess the feast has just begun.