Compiled by: Bitchain Vision

TOKEN 2049 Singapore Station officially started today.On OKX Main Stage,Tom Lee, Chairman of BitMine and Fundstrat CIO, delivered a speech on the theme of “The biggest macro shift in Wall Street since the gold standard”.Tom Lee noted,2025 is a key macro-transformation node on Wall Street since the US dollar decoupled from gold in 1971.He believesIf the value of the Bitcoin network is aligned to gold (the current value of the Bitcoin network is only about 10% of gold), its unit price potential is significant.IfThe price ratio of Ethereum and Bitcoin recovers to 2021 high of 0.087. Based on the year-end Bitcoin price of $250,000, the unit price of Ethereum may reach $22,000.;In the long run, its unit price is expected to rise to US$62,000.In addition, Tom Lee also mentioned,Stablecoins as “tokenized US dollar” can strengthen the dominance of the US dollar, the stablecoin market currently holds US$280 billion in Treasury bonds, and may become the world’s largest Treasury bond holder in the future, with a market size of US$4 trillion.

The following is the full text of the speech.

Tom Lee:

Wow, it’s great to be in Singapore at TOKEN 2049.I have 20 or 19 minutes to show a lot of slides, and I hope to leave a few minutes for the QA session, and my speech theme is a bigger shift in Wall Street since its gold standard goal.

First, let me explain the basic situation.We have been engaged in cryptocurrency-related research for about nine years, when the price of Bitcoin was $963.As you can see, Bitcoin has been an OG asset class with a return of more than 100 times, and since then it has returned twice as much as Nvidia, and Bitcoin has also performed significantly better than gold.In the same nine years, gold prices have only increased about three times.By the way, Ethereum even outperformed Bitcoin, reaching a 500-fold P/E ratio during that time.So let me explain why I think 2025 will be a drastic change in the macro economy.

Speaking of the gold standard, we need to go back to 1971.In 1971, the US dollar broke away from the gold standard, and in the same year President Nixon announced the termination of the US dollar’s peg with gold.We can think about this a little bit.In 1971, the US dollar no longer had any substantive value support except for representing itself or as a commitment to payment.When we think of this, most people will mention the situation of gold trading in 1971.Indeed, gold trading was active back then, but this was not a real major opportunity.In 1971, the financial system had to suddenly find ways to ensure that the dollar remained dominant, because once the dollar was decoupled from gold and lost its convertibility supported by gold, another currency might dominate.

So what Wall Street did was that they created a huge market for US dollar money market funds, futures, debit cards, mortgage-backed securities, currency swaps, interest rate swaps, index futures, zero-interest bonds, secured debt certificates, etc.This is the innovation that came after 1971, and in fact, 7 of the 30 largest companies in the world today are financial institutions.OK, now another thing is happening,That is, Wall Street and artificial intelligence are being built on blockchain.

In the United States,The GENIUS Act laid the foundation and created the conditions for the prosperity of stablecoins.Subsequently, the Securities and Exchange Commission (SEC) launched the “Project Crypto” to introduce Wall Street into the blockchain field.Of course, there are two other legislations in Washington that are being advanced, one is the CLARITY Act and the other is the Bitcoin Strategic Reserves Act.This means that in 2025 we are ushering in a new moment where more and more things are becoming synthetic.

Therefore, in our opinion,Bitcoin undoubtedly still occupies an important position in pioneering nature, This is because it has now become a means of storage of value with digital attributes.However, it is necessary to consider the relevant situation from another perspective.What will Wall Street do?In our opinion,Wall Street will play a very important role in building a digital asset market.Ethereum is expected to be the biggest beneficiary.

So we might as well explore in-depth what this means for Bitcoin’s external impact.

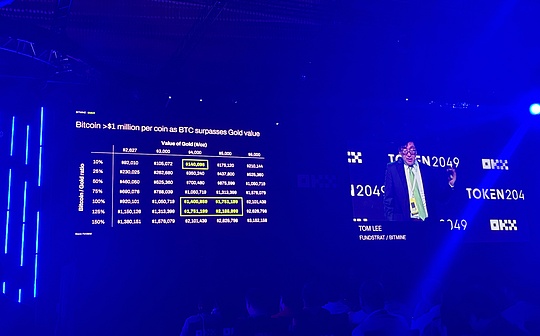

Suppose the current price of gold is $4,000 per ounce and it is likely to rise to $5,000 per ounce.Then we need to think about the relative relationship between Bitcoin and gold.The so-called gold ratio means that it is necessary to clarify what percentage of the value of the Bitcoin network should account for?If it is only 10%, then the value of each Bitcoin is $140,000.I think this number is too low.I thinkIt will basically be on par with the value of gold, or even surpass it.That’s why Bitcoin can reach $1.4 million to $2.2 million.

So, we are still optimistic about Bitcoin at the moment, with its price around $110,000.But let’s think about another storyline that is about to develop, that is Wall Street.Wall Street will innovate in blockchain over the next 10 to 15 years.And we have seen part of the storyline, that is the stablecoin we are talking about, that is, the tokenized dollar.This phenomenon is somewhat similar to the historical events of 1971.

But we are talking about tokenized stocks, tokenized credit, real estate credit and even, ultimately, intellectual property rights, which are all factors measured in today’s economy.I thinkThere will be invisible measurements on the blockchain tokenized, such as data collection, royalty payments, loyalty programs, smart contract agents, and even human identity proofsSuch an important thing.So a lot will happen in the cryptocurrency space.And we already know that Ethereum has experienced a moment of change similar to ChatGPT due to stablecoins.There are many different companies and institutional entities that are building stablecoin projects.

You may wonder, why does the US government care about stablecoins?In fact, this is exactly the same as the reason why the United States attaches importance to the synthetic dollar.The US dollar now accounts for 27% of GDP, but accounts for as much as 57% of the foreign exchange reserves of central banks.That 57% suggests that Wall Street’s efforts to make the dollar the standard for trading since 1971 are effective.It accounts for as much as 88% of financial market transactions, do you understand?

But fundamentally, it is almost 100% a stable unit of pricing.Therefore, if we turn to synthetic US dollar tokens based on blockchain technology, the dominance of the US dollar is expected to be further consolidated.From the overall scale,Stablecoins have now become the twelfth largest U.S. Treasury bond holder.By the way,Currently, stablecoins hold Treasury bonds at US$280 billion, Finance Minister Becent believes that the market size is expected to grow to $4 trillion.Once stablecoins hold Treasury bonds in excess of $1 trillion, they will become the world’s largest single holder of US Treasury bonds..

This goal is not out of reach.It is also worth noting that when an enterprise builds its business based on blockchain, what actually happens is that we essentially redesign its business architecture, which allows the enterprise to effectively improve operational efficiency.I think there are many reasons for this.By the way, many people are probably curious about what position and role does artificial intelligence play in the concept of blockchain-based business construction?a16z has published a good white paper to discuss this.

In terms of blockchain construction around artificial intelligence, there are about 11 application scenarios.I only emphasize a few of them, such as the third, a forward-compatible personality proof.This is like a project like World Coin; the sixth, keeping AI synchronized through coding applications.I think an example of this is the device I wear, called U Critter.It can measure the CO2 content in your location, the ideal value is 420, and currently it is 980.

We are often asked what are the benefits of Wall Street building on blockchain?They would say the bank works well.But I don’t understand how JPMorgan can become more profitable?In fact,Companies natively built on blockchain are essentially more profitable.For example, Tehther is raising funds at a valuation of $500 billion.

Check out the list of the 12 largest banks in the world.Tether comes in second place.Think about it, Tether is 50% larger than Bank of America, and Bank of America is a behemoth.It is twice as big as Citigroup, twice as big as Morgan Stanley, and even bigger than Goldman Sachs.But interestingly, if you look at the number of employees in Tether, JP Morgan has a market capitalization of $869 billion and has 317,000 employees, which equates to a market capitalization of $2.8 million per employee.

Tether has only 150 employees.This number is even less than JP Morgan’s junior analyst team, roughly similar to the number of new analyst teams (assuming it is June).It can be seen that the average market value of each employee of Tether is as high as US$3.3 billion.We must recognize this fact: Tether, a native blockchain company operating on public chains, has a market value of almost the same as JPMorgan Chase, but its employee size is only 150 people.

So, in my opinion, obviouslyCreating a company on blockchain and rebuilding Wall Street is very profitable.OK, then now I want to elaborate further.Why is this good for Ethereum and even how to consider the reserves of digital assets.As mentioned earlier, a key node with signs like 1971 is coming and is of great significance.Why is this happening?The reason isMany companies on Wall Street have the need to build business in the blockchain field and tend to choose neutral public chains as their underlying architecture..

As you can see, there are a lot of companies that choose to do this on Ethereum.In fact,If you look at data such as value locked on public chains, Ethereum is the preferred chain.It accounts for 68% of all total locked value.Of course, TDL has been the bottom support of Ethereum over the past few cycles.Even companies like the Global Banking Association of Financial Telecommunications (SWIFT) announced just a few days ago that they will use Ethereum’s layer 2 network for experiments on on-chain migration.So, companies like SWIFT also show that they want to use public chains, not corporate chains.

In the field of artificial intelligence, many discussions have been conducted around Ethereum, which is regarded as an ideal platform for building products with chaotic characteristics.Here is the price history of Ethereum.It has reached its high in 2021 since 2018, and then, over the past four years, we can clearly observe that it has gone through an extremely significant and extensive consolidation phase.At present, Ethereum’s price is beginning to break through this consolidation range.Here, it is necessary for us to pay special attention to the previous consolidation period.

Ethereum was in a consolidation state between 2018 and 2020, and then its token price rose from $90 to $4,000, an increase of more than 50 times.The low for this rise is $1385.So what will happen to Ethereum next?I have some ideas to share.But when looking at this price trend chart again, it did not show a bearish signal.Another chart worth thinking about is the ratio of Ethereum price to Bitcoin price.The ratio is currently 0.036, with an average of 0.047, and a high of 0.087 in 2021.

I think these numbers are important because in my opinion, Ethereum is at a critical moment in 2025, just like in 1971.I think its price ratio should be restored to its previous high of 0.087 at least.So what does this mean?Well, if you look at the price of Bitcoin, we think it will reach at least $250,000 by the end of this year.So its price ratio will reach its average of 0.0479.

If it reaches its 2021 high, then each Ethereum will be worth $12,000, which I think is reasonable given the changes in Ethereum fundamentals.In this case, each Ethereum is worth $22,000.However, in terms of Ethereum’s development potential, I don’t think this is its price cap.Another important node isEthereum becomes the payment track for the future, when its network value will be on par with Bitcoin.Then each Ethereum will be worth $62,000.

As you can see, taking Ethereum’s current value of 4100 as an example, all of the above three value expectations indicate extremely considerable value-added potential.So, let me talk about the last point, if you are interested in Ethereum, why would you consider holding a related interest in a digital asset reserve (DAT) company?

At present, we publish content called “Chairman’s Speech” on our website every month.However, given the limited time, I would like to briefly elaborate on the relevant points so that the explanation can be completed within a few minutes, and then leave time for the Q&A session.A digital asset reserve company aims to increase Ethereum holdings corresponding to each share.The logic behind this strategy is that in this way, companies can issue stocks at a premium.Do you understand this principle?

When studying this field, there is a very valuable case – Microstrategy.The company’s stock price has climbed from $13 per share to $335 in a specific development stage, a change that fully demonstrates the impact and potential of relevant strategies in the market.

Microstrategy achieves this by issuing shares to buy more bitcoins.In the five years since Microstrategy launched the strategy, the price of Bitcoin has risen from $11,000 to $108,000, a 10-fold increase.This situation shows that Microstrategy surpasses Bitcoin in terms of return on investment through its asset reserve strategy.Today, BitMine is following this strategy model.Among the many DAT stocks that exist on the market, BitMine, as the world’s second largest crypto asset holder, is one of the most liquid stocks.

In today’s U.S. stock market, BitMine ranks 26th with a daily trading volume of $2.6 billion.It is worth noting that BitMine’s daily trading volume exceeds Visa and Oppenheimer, and is almost comparable to Marvell Technologies or Inco in terms of daily trading volume.This has always been an advantage because when you look at those 200 DAT stocks, BitMine and Microstrategy make up 84% of all trading volumes.Therefore, from the perspective of companies holding stocks, the flow of institutional funds will be concentrated in these two companies.

This means BitMine needs a lot of money to quickly expand its Ethereum reserves.We can observe that in about nine weeks since the company began to engage in Ethereum-related reserve business, the corresponding Ethereum holdings per share have increased by nine times.This growth rate shows that the company’s performance in Ethereum reserve growth far exceeds Ethereum’s own regular growth trend.Therefore, from an investment perspective, if investors are optimistic about the market prospects of Ethereum and pay attention to investment opportunities related to Ethereum reserves, then BitMine’s stock will have the potential to bring more Ethereum returns to investors every day.Of course, this is only one aspect of this investment opportunity, and its potential value is not limited to this.

Ethereum reserve-related companies are confident in crypto infrastructure.From a technical perspective, Ethereum adopts a Proof of Stake (PoS) mechanism, and related companies use stakes Ethereum to provide security guarantees for the Ethereum network while obtaining corresponding benefits.From the perspective of long-term development trends, based on the core need to ensure network security, we have reason to believe that any participant involved in cryptocurrencies will ultimately be very likely to choose Ethereum as the key pledged asset due to the same security considerations.

That’s BitMine’s strategy, we will actively participate in the community to ensure that the Ethereum Foundation and Ethereum developers are successful in the decentralized finance field, and the company will also make bold investments that will span Wall Street and cryptocurrency fields.

This is roughly the case.Now we have two minutes to leave for everyone to ask questions.But before it ends, I think the future of cryptocurrencies is bright.We believe that Ethereum will become a place for many such projects.So now, I want to start the questioning session.

Question 1: Will there be only one chain in the future that can survive?

Tom Lee: I don’t think so. Today’s Wall Street has dozens of different infrastructure and platforms.Even in areas like exchanges.There are many large exchanges around the world, from the Chicago Mercantile Exchange (CME) to the Nasdaq to the New York Stock Exchange (NYSE).So I think the market is big enough.When we think about this, we are talking about the global gross domestic product (GDP) of $80 trillion.Half of all economic activity is financial transactions, which is equivalent to a potential market of $80 trillion per year.Many intellectual property fees in GDP flow on the chain, and this part is about $20 trillion.

Therefore, if this total $100 trillion economic activity is carried out on Ethereum, the value of Ethereum will theoretically reach $10 million.It can be seen that there is still a lot of room for development for the Layer1 blockchain, which focuses on specific segments.So I think chains like Solana and other chains have room for development.And I think one thing we have to remember is that we don’t want to be too narrow and divide the current realm too much.I think this is a huge improvement.

Question 2: Do you have any strategies in the face of a very bear market?Because you know, for cryptocurrencies, if the global macro market goes down, we will also go down.

Tom Lee: OK, this is a good question.The question is, basically how do DAT companies survive in a bear market?I think a DAT company needs to do two things to deal with this situation.First, and the primary principle is to maintain a clean balance sheet.BitMine has no debt because during a downturn, investors holding stocks do not want other factors on the company’s balance sheet to form a competitive relationship with their equity.After all, there is competition between debt holders and shareholders in the distribution of equity, and convertible bond holders will also compete with shareholders.This is why companies with complex capital structures may experience share price compression during recessions.

Second, companies need to hold assets in the form of Ethereum per share, assuming a bear market arrives in 12 months.OK, BitMine increases Ethereum every day, so in 12 months, the value of Ethereum per share may rise from $40 to $80.Based on the above situation, even if the crypto market falls into a downturn in the future, the company’s stock price may fall by 50%, but it will still be higher than today’s level.Therefore, in response to market downturns, if DAT companies can continuously increase their Ethereum holdings corresponding to each share, they will have stronger risk resistance.

I think it’s time for me to end.So, thank you everyone.I hope you have something to gain.