Authors: Dong Jing, Bao Yilong, Wall Street News

Ethereum fell below the $3,900 mark, hitting a new low in the past seven weeks, continuing the momentum of a sharp correction in cryptocurrency since this week, the wholeCryptocurrency market has evaporated by more than $140 billion in market value.

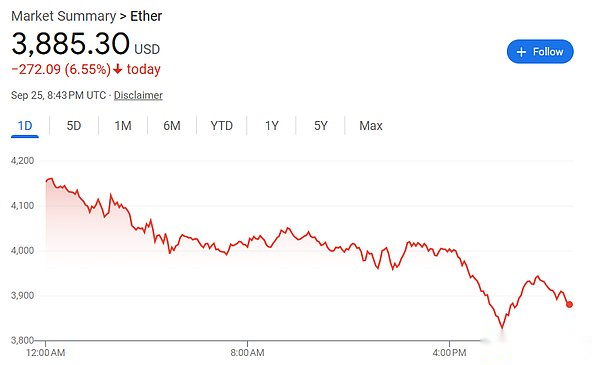

In the early morning of September 26, Ethereum, the world’s second largest cryptocurrency, fell by more than 7%, hitting a low of US$3,823, and then rebounded slightly, with the intraday decline still reaching 6.55%.

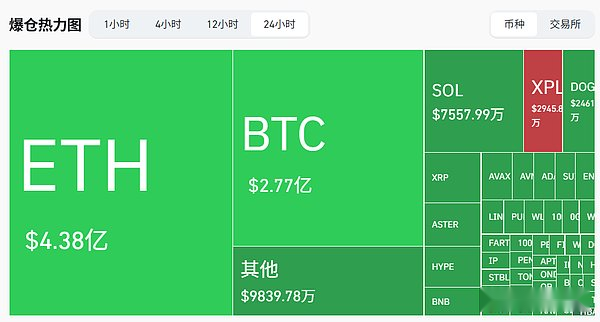

Coinglass shows that nearly 250,000 people worldwide were exposed in the past 24 hours.The total amount of liquidation exceeds US$1.1 billion.

The thermal map of the liquidation of Bitcoin and Solana rank second and third in terms of liquidation, second only to Ethereum.As of the late trading session of New York on Thursday, Bitcoin fell 3.62%, falling below the key support price of $110,000, while Solana fell 7.2%, falling for six consecutive days.

Cooling of institutional capital inflows has exacerbated selling pressure.Since Monday,Investors have withdrawn nearly $300 million from U.S.-listed Ethereum ETFs.On Monday, the market fell suddenly, resulting in a forced closing of long bets worth US$1.7 billion, and almost all mainstream cryptocurrencies were hit.

According to Rachael Lucas, cryptocurrency analyst at BTC Markets,Ethereum’s pullback stems from “cooling institutional capital inflows” and “technical indicators show short-term pressure”.Lucas warns that if Ethereum falls below $3,800, it is expected to trigger more liquidation.

Although Ethereum supply on exchanges has dropped to nine-year lows, suggesting long-term holders are stocking up,Long-term holders sell off positive effects of new capital inflows, causing Ethereum to fall into a tug-of-war between long and short forces.

Long-term holders sell off offset positive signals

Although Ethereum exchange supply continues to fall to nine-year lows, indicating that investors are withdrawing tokens from centralized platforms for long-term holdings, the market is still facing selling pressure from long-term holders.

The past month,Investors have bought more than 2.7 million Ethereum worth more than 11.3 billion US dollars, showing strong confidence in Ethereum’s long-term potential.

However, Ethereum’s activity indicator has been on an upward trend, which measures long-term holders’ behavior, and rising usually means that these investors are selling rather than hoarding.

Analysis points out that the selling behavior of long-term holders offsets the bullish pressure of new capital inflows, putting Ethereum in a stalemate between two opposing market forces.

If long-term holders continue to sell in large quantities, Ethereum prices may fall further, which will completely break the current bullish expectations.