Author: Yohan Yun, Source: Cointelegraph, Compiled by: Shaw Bitchain Vision

Token generation events (TGE) are increasingly criticized as a means of cashing out by cryptocurrency founders, resulting in the leaving of blockchains with almost no actual activity.

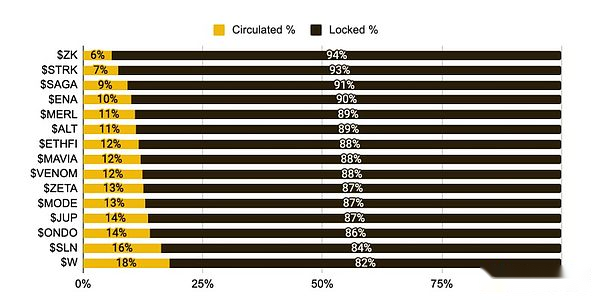

Many projects are usually sparse in circulation and overvalued at the beginning of the issuance, which makes it almost impossible for real supporters to get sustainable returns.Industry insiders believe that low circulation and automatic market makers (AMMs) can temporarily maintain prices, but once the unlocking period begins, selling pressure will often overwhelm the market.

Some tokens soared due to hype and scarcity at issue, but most of them gradually declined as supply increased.

“This is an endless cycle. A new chain becomes irrelevant, and talent leaves, and those who stay can only watch it as the chain is supported by market makers and AMMs,” said Brian Huang, co-founder of cryptocurrency management platform Glider.

TGE is the beginning of a blockchain project, but it is becoming the end of the project.

The number of orphan chains continues to rise after TGE

Over the past year, some founders have left their projects shortly after the token issuance, sparking backlash.

Story Protocol founder Jason Zhao quit his full-time job about six months after the token went online.Early reports said his resignation was related to a six-year vesting period, but Story officially denied this statement and pointed out that core contributors faced a one-year vesting period in the four-year vesting arrangement.

“In fact, the token issuance should be the beginning of the project,” said Brian Huang, who questioned the intention behind this premature departure.

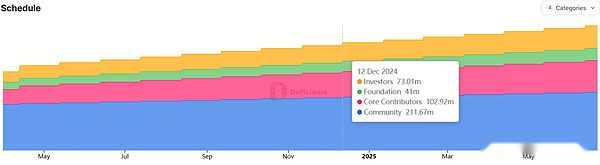

Aptos founder Mo Shaikh also resigned on December 19, more than two years have passed since the release of Aptos tokens and mainnet.Although his resignation was not as sudden as Zhao Changpeng, critics pointed out that his resignation occurred shortly after an important lifting period.

The number of APT unlocks of core contributors exceeded 100 million.Source: DefiLlama

Blockchain Capital investor Sterling Campbell admits that some founders view token issuance as a means of making money, but he believes the problem is more complicated.

“There are also founders exhausted, inconsistent incentives and, in some cases, cruelly realizing that the product does not match the market,” Campbell said.

“This dynamic is not so much a personal malice as a system that makes it easy to exit early.”

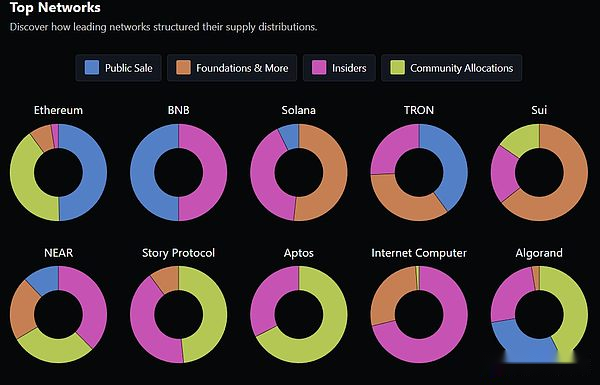

Messari researchers report that token ownership is crucial to the performance of tokens.An analysis of 150 major tokens found that tokens with higher proportions of insiders performed poorly in 2024.

Cryptocurrencies with higher public offering quotas performed better than cryptocurrencies with higher internal token quotas.Source: Messari

Does the exit wave after TGE indicate that there are too many blockchains?

The wave of token generation events (TGE) has raised a broader question: Does this industry really need more blockchains?Once the launch platform for an ambitious new network, it has been criticized for being the ultimate goal, and the blockchain it should have supported has gradually faded out of people’s sight.

Annabelle Huang, co-founder of Altius Labs, said the industry does not need more general blockchains like Ethereum or Solana.However, she added that there is still room for development to build new networks for specific use cases.

Some projects highlight this shift.For example, Hyperliquid gained attention by committing to launch a new universal chain, but by building a derivatives exchange and then vertically developing its own chain.In contrast, many new Layer 1 and Layer 2 projects do not have a breakthrough application that proves their existence when token generation events (TGE).

“We’re seeing a lot of money flowing into Hyperliquid applications and other projects that already have practical uses. By contrast, many new L1 and L2 projects are still on the wait-and-see stage,” Brian Huang said.

The rise of Hyperliquid has put HYPE in the top 15 cryptocurrencies in market capitalization.Source: CoinGecko

The reason why new blockchain projects can continue to attract venture capital is unclear.Solana once justified its launch on the grounds that its speed advantage surpassed Ethereum, but now most emerging blockchains have similar performance.Therefore, investors may tend to have a network with a mature user base.At the same time, as blockchains led by enterprises such as Stripe and Robinhood enter the market and have a huge user base, competition is also intensifying.

“They speed up the circulation of cryptocurrencies and make them acceptable to ordinary users, but they have the potential to undermine the ethos of online without permission,” Campbell said.

“Robinhood does have the potential to take advantage of the open source network we have built over the past 10 years to steal everyone’s interests.”

TGE and vesting programs put pressure on long-term supporters

The situation is particularly worrying when the founders exited a multi-million-dollar project shortly after TGE, even if the tokens are bound by a vesting program designed to phase out restrictions on sale by insiders.

Some in the community pointed out that the terms of ownership are public and investors should be aware of the risks before buying.

These attribution clauses also present difficult challenges to many true supporters of modern blockchains.A Binance Research Institute report in May 2024 estimates that $155 billion worth of tokens are expected to be unlocked by 2030.If there is not enough demand to digest these tokens, the continued release of supply may put ongoing selling pressure on the market.

The supply of tokens is low when they are issued, and most of them will be locked by May 2024.Source: CoinMarketCap via Binance Research

This tension highlights the deeper problems that exist in TGE itself.TGE was originally designed as a financing mechanism, but now it has evolved more and more into liquidity events that make insiders profitable, while the ecosystem has lost its founding guardian.

Unless the project can prove that it still has lasting use value after its launch, the pattern of overvalued valuations, premature exits and gradual decline of blockchain may continue.