Author: Anthony Pompliano, Founder and CEO of Professional Capital Management; Compilation: Bitchain Vision

As expected, the Fed announced yesterday that it would cut its benchmark interest rate by 25 basis points.Federal Reserve Chairman Jerome Powell then held a press conference, but the information he disclosed was actually related to rumors on the Internet several months ago.

“In the short term, inflation faces upward risks, and employment faces downward risks,” Powell said at the press conference.

During the entire press conference, Powell’s posture showed a sense of “frustration”.He neither showed any enthusiasm for attending the press conference nor showed any enthusiasm for the challenges he was facing.

A key reason why the Fed is in its current dilemma is the change in its policy logic: in the past few years, the Fed adheres to the principle of “data dependence” (i.e., to formulate monetary policies based on economic data), but recently it has tended to play the role of “economic forecaster”.Originally, it only needed to formulate monetary policies based on existing economic data and real-time indicators, but the Federal Reserve chose to enter the “prediction field” and even took action based on the prediction that “tariffs will push up inflation.”

And the truth is as I predicted from the beginning: tariffs are not the driving force behind inflation.The “high inflation” that the Federal Reserve had previously worried about never appeared.This means that the Fed’s prediction itself is wrong, and its monetary policy stance of “maintaining high interest rates for longer” is naturally untenable.

However, the Fed’s situation is more complicated than it seems — its board members have huge differences on the core issue of “how current interest rates should be adjusted.”Heather Long, chief economist at Navy Federal, explained:

“The situation is simply outrageous. Looking at the predictions of 19 Fed executives on the remainder of 2025, a chart can tell the tension within the Fed:

One advocates a rate hike; six believe that the current interest rate should be kept unchanged; two support a rate cut again; nine tend to cut again; and one (probably Trump’s latest official Stephen Miran) argues that the equivalent of five rate cuts will be completed by the end of the year.

At present, the Fed will most likely cut interest rates by 2 more times, in October and December respectively.But obviously, the game around interest rate policy will continue in the future…”

Just imagine how extreme this disagreement is: some people advocated interest rate hikes yesterday, while others hope to cut interest rates five times before the end of the year.Not only are members unable to reach a consensus on the number of “rate cuts”, but there are even contradictions in the basic direction of “whether interest rate hike or interest rate cuts should be raised or lowered at present.”

This phenomenon just highlights the inherent problem of “artificially dominant monetary policy”: it is essentially impossible to succeed by allowing individuals to control the “cost of capital” (i.e. interest rates)., because humans often have limitations when making complex decisions.What’s more, the Fed’s decisions are made jointly by a committee, which makes the decision-making process more difficult – “collective decisions” are often the “must-have” that lead to bad decisions.

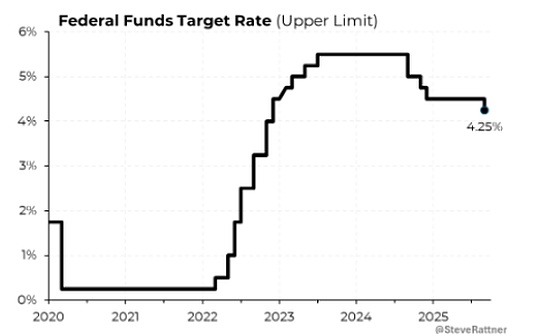

What’s worse is that if you look back at the interest rate trend since 2020, you will find that its fluctuations are “unregular.”Faced with such great uncertainty, how should ordinary people plan their lives?

In just five or six years, the cost of capital can fall from 2% to 0%, then soar to more than 5%, and then fall back to around 4% – such a volatility is really irresponsible.In fact, this unnecessary violent fluctuation could have been avoided.

In contrast, Bitcoin: its monetary policy has never deviated from the track of “programmed monetary policy” in 15 years since its establishment in 2009.In my opinion, the Fed can completely draw experience from the Bitcoin mechanism.

Finally, it should be noted that the Federal Reserve cut interest rates by 25 basis points in 1998, and this move subsequently boosted the crazy rise of technology stocks during the Dot Com Boom period.

As Puru pointed out, the current situation has a surprising similarity to 1998: The Fed is implementing interest rate cuts during the “AI-related innovation boom.”If the Fed said yesterday,With interest rate cuts many times this year, the stock market is likely to usher in a sharp rise.

Objectively speaking, the Fed’s policies have always “lagged behind the market curve.”Yesterday they chose to “retreat” and only cut interest rates by 25 basis points, which is an example.But for investors, this conservative move may not matter in the end—The current market is on an upward trend, so just hold the assets and enjoy this wave of market conditions.