Author: Daniel Barabander, Variant Fund Investment Partner; Translated by: AIMan@Bitchain Vision

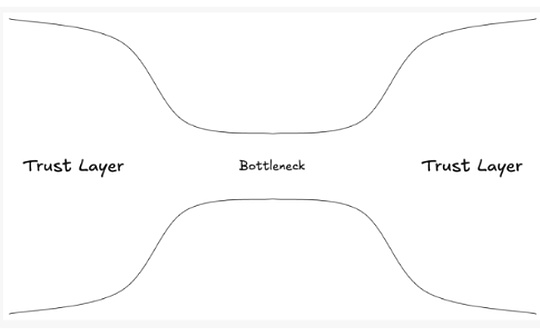

One of the biggest opportunities for cryptocurrencies is to disrupt what I call the “hourglass market” – value must be transferred from one layer of trust to another, but can only be achieved through the narrow bottleneck of intermediaries.

While such markets can be formed anywhere, they are particularly common in cross-border transactions, as political sovereignty prevents countries from consolidating their domestic trust layers into a single global trust layer.

The best place to observe these dynamics is in the payment field.

Imagine if you plan to buy groceries but you have to give the cashier a personal IOU of $50 and pay it back in 30 days, you will definitely be ridiculed by the clerk.The fundamental problem is the settlement risk: you take the groceries now, but promise to pay later.Since the grocery store doesn’t know if you will fulfill your obligations, it won’t accept your IOU as a payment method.

However, if you and the supermarket both open an account at Bank A, then it will be easier to transfer value now.This is because you all trust Bank A, so when Bank A updates the ledger, deducts $50 from your account, and deducts $50 from the supermarket account, each participant confirms that the transaction has been settled.We solved the settlement problem by stacking and uploading the trust layer to the shared trust layer, Bank A.

The problem reappears when participants have different banks.Bank A does not trust Bank B’s account book for the same reason as supermarkets do not trust your account book.But again we solve this problem by stacking and pooling trusts into another shared trust layer—the central bank.We open accounts for Bank A and Bank B in a government-run central bank; in order to complete the cross-bank transfer, the central bank will deduct money from Bank A’s account and credit Bank B’s account.

From this we can see thatThe default way to scale payments is to stack trusts from the decentralized trust layer and pool them into the same centralized trust layer.But when things go cross-border, we face a fundamental coordination problem that makes stacking and pooling unfeasible.No “central” bank to settle cross-border payments, because no country trusts another country to operate a global central bank; each country maintains its own political and economic sovereignty (especially because every sovereign issuing country is the true source of its own currency).Our settlement issues were raised again.

Because banks in different jurisdictions do not share a unified settlement layer, they rely on bilateral agreements to bridge the gap between the disconnected layers of trust.In fact, Bank C in Argentina must open an account with Bank B in the United States.But since Bank C does not trust Bank B, it must establish this trust through legal contracts so that the transfer on Bank B’s books is considered final settlement.These bilateral agreements are expensive and require disclosure of information, compliance with anti-money laundering/anti-terrorist financing regulations, providing collateral and conducting audits.Institutions that provide such services are called agent banks because they have agent accounts at each other’s banks.

Because banks in different jurisdictions do not share a unified settlement layer, they rely on bilateral agreements to bridge the gap between the disconnected layers of trust.In fact, Bank C in Argentina must open an account with Bank B in the United States.But since Bank C does not trust Bank B, it must establish this trust through legal contracts so that the transfer on Bank B’s books is considered final settlement.These bilateral agreements are expensive and require disclosure of information, compliance with anti-money laundering/anti-terrorist financing regulations, providing collateral and conducting audits.Institutions that provide such services are called agent banks because they have agent accounts at each other’s banks.

Only a few banks are large enough to win enough trust and operate at the scale required for these protocols at high costs.In fact, as of 2019, just eight banks have processed more than 95% of euro-denominated cross-border transaction volume.These few banks monopolize this interoperability function, forming an anti-competitive bottleneck that limits the flow of funds between trust layers.Take remittances as an example, this is a nearly $1 trillion market: the average cost of remittances is about 6%, and the average arrival time usually takes a full day or more, mainly due to the inefficiency caused by this bottleneck.This is an hourglass market.

What about cryptocurrencies?Cryptocurrency solves settlement issues by creating an ledger that is not controlled by anyone, building a shared trust layer that all participants recognize its effectiveness.Tokens on blockchain are like a digital bearer asset: whoever controls the key is recognized as the owner.This makes the pathway to hold and transfer value more democratic, because we can complete transaction settlement without trusting the sender of the asset.Therefore, participants can transfer assets point-to-point.

This is the real reason why stablecoins have such a high product market fit in the cross-border payment field.By enabling peer-to-peer transfers of the US dollar, cryptocurrencies allow participants to bypass the bottleneck of this hourglass-type market, thus greatly improving the efficiency of cross-border payments.

While this is like a “beginner of cryptocurrency” in a sense, this framework allows us to amplify our perspective and see the natural formation of hourglass markets in cross-border transactions, even inevitable.This is because there are always coordination issues in the principle of political sovereignty, which hinders the integration of different countries’ separate layers of trust.No matter where we see this pattern, cryptocurrencies can bypass the inevitable bottlenecks and break this pattern.

Stocks are another example of the cross-border hourglass market.The ownership of the stock of a publicly listed company is very similar to our banking system.In the United States, we accumulate and pass trust through brokers and custodians before passing it to a central securities depository (CSD) called DTCC.Europe follows a similar pattern, with trust eventually passing to its own clearing agencies, such as Euroclear in Belgium and Clearstream in Luxembourg.But just as there is no global central bank, global CSD is not feasible.Instead, these markets are connected through a few large intermediaries using costly bilateral agreements across the trust layer to form an hourglass market.As a result, it is predictable that cross-border stock trading remains slow, expensive and opaque.Similarly, we can use cryptocurrencies to democratize ownership, bypass bottlenecks, and allow participants to directly own these securities no matter where they are.

Beyond cross-border

Once you know how to find it, the hourglass market is everywhere.In fact, even in the field of cross-border payments, there can be said that there are two hourglass markets: the one I focus on in this article – cross-border capital flows – and currency exchange.For similar reasons, the foreign exchange market also appears to be an hourglass-like shape, with a small number of global transaction banks—connected through a dense network of bilateral trade agreements and privileges of settlement systems such as CLS—being in the bottleneck of disconnection between currencies in various countries.Projects like OpenFX are now using cryptocurrencies to bypass this bottleneck.

While cross-border transactions are the easiest way to identify hourglass-type markets, these markets are not specific to geographic location.As long as the right conditions are met, they can appear anywhere.The following two markets are particularly prominent:

-

Assets with cross-layer utility.The hourglass market requires assets with cross-layer utility; otherwise, there is no reason for participants to transfer them, and there will be no bottleneck.For example, Kindle Bookstore and Apple Bookstore can be seen as disconnected trust networks—both of which issue IOUs for digital book licenses, but neither has the motivation to make their IOUs compatible with each other’s network.Since Kindle books are useless for Apple, there is no reason to transfer across layers.Without this effect, there will be no intermediary agencies to promote flow and no hourglass market will be formed.In contrast, assets with broad or universal utility, such as currency or speculative instruments, are more likely to form.

-

Regulatory fragmentation.We can describe cross-border bottlenecks as fragmentation of trust layers caused by different regulatory regimes, and the same effect may also occur within a single jurisdiction.For example, in the domestic securities market, cash is usually settled through a real-time full settlement system (RTGS), while securities are settled through a central custody agency (CSD).This leads to the high cost of coordination through brokers, custodians and other intermediaries – a domestic mechanism that causes US$17 billion to US$24 billion in transaction processing annually, according to the Bank for International Settlements.

In the process of writing this article, I heard a range of other potential hourglass markets, including syndicated loans, commodity futures, carbon trading, and more.Even in the cryptocurrency space, there are many similar markets, such as fiat to cryptocurrency channels, certain bridges between blockchains (e.g., packaged BTC), and interoperability between stablecoins supported by different fiat currencies.The builders of these hourglass markets will be the most capable of leveraging the principles of cryptocurrencies beyond systems rooted in bilateral protocols.