author:Anthony Pompliano, Founder and CEO of Professional Capital Management

President Trump’s son talked about Bitcoin on CNBC this morning.But Eric Trump is not just talking, he is also spreading the gospel of digital currency.Listen to what he said:

Bitcoin has become contemporary gold, and people all over the world are flocking to it.Fortune 500 companies, sovereign wealth funds, and wealthy families are all hoarding Bitcoin.Bitcoin is an incredible asset with extremely high liquidity and may be the biggest hedge for real estate.It is global and protected by a huge energy mining ecosystem.Bitcoin has become the greatest asset of our time.

You don’t hear people who can call the president directly every day saying “Bitcoin has become the true greatest asset of our time”.

This sounds great, but the details determine success or failure.First, analyst Daniel Pico pointed out,So far in 2025, gold has outperformed Bitcoin.Gold rose 40%, while Bitcoin rose only 22%.Some people may be worried about this, but I will not draw conclusions.

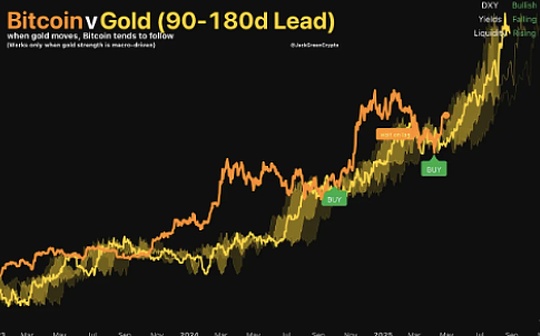

Gold has become the leading indicator of Bitcoin table

Gold performed well earlier this year, and Bitcoin eventually caught up and surpassed gold, and in recent weeks, gold has regained its lead.Why does this happen?becauseGold seems to have become the leading indicator of Bitcoin’s performance.

I shared this chart by Jack Green in May.It shows,Bitcoin tends to break through and catch up with gold’s performance, with a lag of about 100 days.So, when gold goes up, Bitcoin will wait for about 3 months and then quickly follow up.

Given this dynamic, you can think of Bitcoin as a coiled spring.BTC is waiting for further gains.

Because of this, Timothy Peterson said: “Bitcoin is experiencing its worst bull market ever.”

Many Bitcoin users are disappointed with this performance.What a classic!Any other investor in the world will be ecstatic about the annual rate of return of 23%, but Bitcoin users are already used to much higher returns.They don’t want dozens of percent, they want hundreds of percent, and they want it to be like this every year.

However, I would not expect too much from that level of performance.

Fed cuts interest rates

I do believe Bitcoin will continue to rise before the end of the year.The Fed should cut interest rates in the early morning of September 18, which will bring cheap funds to assets such as Bitcoin.

MACD indicator green for the first time in weeks

Analyst Frank Fetter stressed that Bitcoin’s MACD indicator has been green for the first time in weeks.

Bitcoin Moving Average Convergence Divergence (MACD)is a momentum indicator that historically has been a good indicator of when market sentiment has turned bullish.As market sentiment becomes more active, capital flows and Bitcoin prices will also rise.

You don’t have to think too much.Sometimes things are really simple.

3Y Bitcoin Risk Index Low Level BTC Doubled at the Last Low Level

Finally, Axel Adler points out that3-year Bitcoin Risk IndexCurrently 23%.

The last time the index was at such a low for a long time, we saw the price of Bitcoin rise from below $30,000 per coin to nearly $60,000.This happened between September 2023 and December 2023.

I’m not saying that the price of Bitcoin will double in the next 120 days, but I do think that the massive amount of data we’re seeing indicates that the price of Bitcoin will rise in the coming weeks.The Bitcoin bull market is not over yet.People still have a lot of fun to enjoy.

Just don’t expect this bull market to be like the bull market in the past.