Jessy, bitchain vision

On September 9, Yunfeng Securities Co., Ltd. was recently approved by the Hong Kong Securities and Futures Commission (SFC) to upgrade its existing securities trading license (license No. 1) to provide virtual asset trading services.This financial platform, which is closely related to the “Jack Ma Group”, not only entered a compliant digital asset channel in its business, but its parent company Yunfeng Finance (00376.HK) has previously publicly disclosed that it has purchased about 10,000 Ethereum, with a total investment of US$44 million.

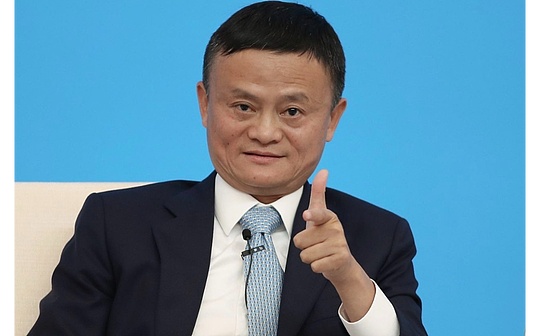

Jack Ma’s accelerated layout of the crypto industry is not only a topic of talk that the industry talks about, but also a weather vane.At present, large capitals have entered the market one after another, and the crypto industry has become an important part of mainstream finance.

Jack Ma’s all-round Web3 bets

Yunfeng Securities is affiliated to Yunfeng Financial Group, which is listed in Hong Kong.Yunfeng Finance’s largest shareholder is Jade Passion Limited, which holds 47.25% of the shares. The company is an investment entity under Yunfeng Fund.Yunfeng Fund was co-founded by Alibaba founder Jack Ma and Juzhong Media founder Yu Feng. Jack Ma indirectly holds Yunfeng Financial’s interests through holding 40% of the shares of Shanghai Yunfeng Investment Management Co., Ltd.Jack Ma himself indirectly holds a stake in Yunfeng Finance through Yunfeng Fund, and the market generally believes that he is one of the key figures behind the group.

As a licensed brokerage firm, Yunfeng Securities’ core businesses include securities brokerage, wealth management, asset management and related financial technology services.In recent years, the group has not yet entered the first echelon of Chinese securities companies in terms of Hong Kong market size and trading volume. Compared with giants such as Guotai Junan International, CITIC Lyon, and Futu, its market share is relatively small and medium.

However, it may be thanks to the frequent trends in the Web3 industry that have exploded since September that its stock price has also risen.Since September, its stock price has doubled.

In early September this year, Yunfeng Finance disclosed that it had purchased about 10,000 Ethereum in the open market, with a total amount of about 44 million US dollars, and listed it as a “strategic reserve asset.”

On September 1, Yunfeng Finance announced a strategic cooperation with Ant Digital Technology. The two parties will jointly explore cutting-edge fields such as RWA and Web3 through the new generation of Layer1 public chain Pharos platform.

In the announcement of Yunfeng Finance, it was clearly stated that the purchase of ETH aims to cooperate with the group’s strategic layout in cutting-edge fields such as Web3, RWA tokenization, digital currency, ESG zero-carbon assets and artificial intelligence, provide infrastructure support for RWA tokenization, and explore innovative applications of ETH in insurance business.

All of the above shows that Yunfeng Finance is indeed planning the Web3 track in all aspects.

The big capitals have entered the market one after another, and the future of Web3 has come

After this approval, Yunfeng Securities can provide retail and professional investors with compliant trading services for virtual assets such as Bitcoin and Ethereum.

SFC’s regulatory arrangements do not allow every broker to do an independent virtual asset exchange (VATP); for brokers like Yunfeng Securities, they open “comprehensive accounts” for customers on SFC-licensed VATP or regulated platforms. The brokerage is responsible for traditional brokerage functions such as customer contact, compliance due diligence, KYC/AML, and trading instructions docking, while the actual digital asset trading/settlement is performed by a regulated trading platform or custody mechanism.

The Hong Kong Securities Regulatory Commission has established a VATP license system since 2023 and continues to promote securities companies to “upgrade licenses” from 2024 to 2025.Since the beginning of this year, many brokerages listed or operating in Hong Kong have applied and approved to upgrade their “No. 1 license plate” to provide virtual asset trading services.For example, Guotai Junan International (1788.HK) was approved for upgrade in June, and other approved or being upgraded include Tianfeng International, Harfu Securities, Futu Securities (Hong Kong), Interactive Brokerage, and some Chinese brokerage International subsidiaries.Overall, dozens of traditional brokerages have already provided compliance services in the field of virtual currency asset trading by upgrading licenses, cooperating with VATP or opening comprehensive accounts.

As an important financial platform for the “Jack Ma Group” in Hong Kong, Yunfeng Securities has officially entered the field of virtual assets under the compliance framework, which not only demonstrates the trend of deep integration of traditional securities companies and digital assets, but also highlights that large capital forces are incorporating Bitcoin, Ethereum, etc. into the asset allocation map.This not only means that Hong Kong is accelerating the construction of a global leading virtual asset compliance market, but also indicates that digital assets will no longer be limited to speculative tools in the future, but will gradually become a link in the mainstream financial system.

With more securities firms approved, Hong Kong may become one of the few financial centers in the world that allows retail and institutions to directly trade virtual assets under the compliance system.