Author: Long Yue, Wall Street News

From political pressure to the latest warning from Wall Street banks, the script of “Nixon’s Era” seems to be repeating itself.

Recently, US Treasury Secretary Bescent rarely publicly “beats” the Federal Reserve, calling on it to return to its statutory mission such as “moderate long-term interest rates”, and criticized its unconventional policies for exacerbating inequality and threatening its independence.

Following closely behind, Michael Hartnett, chief investment strategist at Bank of America, released a report pointing out that the current situation is highly similar to the “Nixon era” in the 1970s, and political pressure will force the Fed to turn and eventually adopt the extreme tool of yield curve control (YCC).

Before the Fed formally promised YCC, Hartnett was optimistic about gold and digital currencies, bearish on the dollar, and believed investors should be prepared for a rebound in bond prices and the spread of stock markets.

Is the “Nixon Era” repeated under political pressure?

In his signed article, Becenter ranked “moderate long-term interest rates” with maximum employment and stable prices for the first time, as the three statutory responsibilities that the Federal Reserve must pay attention to when rebuilding credibility.

The United States is facing short- and medium-term economic challenges, as well as long-term consequences: a central bank that puts its independence at risk.The independence of the Federal Reserve comes from public trust.The central bank must re-commit to safeguard the confidence of the American people.To ensure its future and stability of the U.S. economy, the Federal Reserve must reestablish its credibility as an independent institution focusing on its statutory mission: maximum employment, stable prices and moderate long-term interest rates.

In traditional perception, long-term interest rates are more determined by market forces, and this “name” by the Finance Minister is regarded by the market as an extremely unusual signal.It implies that lowering long-term financing costs has become a priority in the Trump administration’s policy agenda.This statement is seen by the market as a call for the Federal Reserve to take the initiative to manage long-term interest rates, and is also the prelude to the possible major shift in US monetary policy.

Coincidentally, Hartnett reached a similar conclusion in his latest report, but he believes that the main force driving the Fed’s turn will be political pressure.

Hartnett wrote in the report that this scene was exactly the same as the Nixon period in the early 1970s.At that time, in order to create economic prosperity before the election, the Nixon administration put pressure on then-Federal Chairman Arthur Burns to promote large-scale monetary easing.

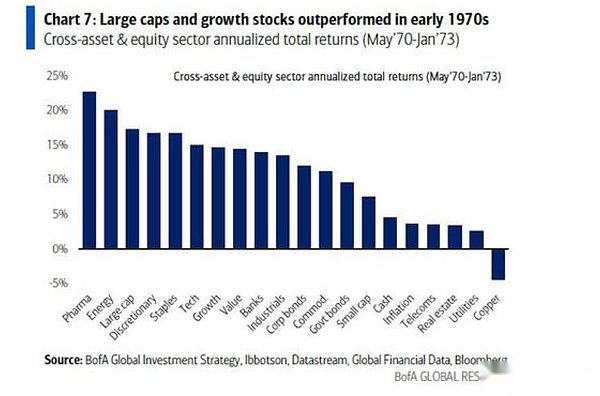

As a result, the Fed fund interest rate dropped from 9% to 3%, the US dollar depreciated, and gave birth to a bull market for growth stocks represented by the “Nifty 50”.Hartnett believes that history is repeating itself and that pre-election political motivations will once again dominate monetary policy.

Yield Curve Control: An Inevitable Policy Tool?

Hartnett believes that policy makers cannot tolerate disorderly rises in government financing costs amid soaring global long-term bond yields.

At present, the global sovereign bond market is under tremendous pressure, with long-term treasury bond yields in the UK, France and Japan hitting decades of highs, and the 30-year US Treasury bond yield also tested the psychological threshold of 5%.However, Hartnett believes that risky assets responded to this in a dull manner precisely because the market is already “betting” that the central bank will eventually intervene.

Therefore, he predicts that in order to prevent government financing costs from getting out of control, decision makers will resort to “price-keeping operations”, such as Operation Twist, Quantitative Easing (QE), and even the ultimate rate-of-yield control (YCC).

Bank of America’s global fund manager survey in August showed that 54% of respondents expected the Fed to adopt YCC.

Long for US bonds, gold, digital coins, and short for US dollars!

Under the judgment of “the Nixon era repeats itself” and “YCC will eventually come”, Hartnett portrays a clear trading strategy: long bonds, gold, digital currencies, and short the US dollar until the United States promises to implement YCC.

-

Step 1: Long Bonds

The direct consequence of YCC is artificially suppressing bond yields.Hartnett believes that as U.S. economic data shows weakness, such as construction spending fell by 2.8% year-on-year in July, the Federal Reserve has sufficient reason to cut interest rates, and political pressure will accelerate this process.He judged that the trend of U.S. bond yields is to 4%, rather than continuing to 6%.This means that there is significant upside potential for bond prices.

-

Step 2: Long Gold & Crypto

This is the essence of the entire strategy.YCC is essentially a debt monetization, that is, “printing money” to raise funds for the government.This process will seriously erode the purchasing power of fiat currency.Hartnett clearly states that gold and digital currencies, as storage means of value independent of sovereign credit, are the best tools to hedge against the depreciation of such currencies.His advice is straightforward: “Let’s go long gold and cryptocurrencies until the U.S. promises to implement YCC.”

-

Step 3: Short US Dollar

This is the inevitable result of the first two steps.When a central bank announces that it will print money unlimitedly to lower its domestic interest rates, the international reputation and value of its currency will inevitably be damaged.The history of the 10% depreciation of the US dollar in the Nixon era is a lesson learned from the past.Therefore, shorting the US dollar is the logical smoothest link in the grand narrative.

The core logic of this strategy is: YCC means that the central bank prints money and buys bonds to lower interest rates, resulting in a depreciation of the currency.Gold and digital currencies will benefit from this.At the same time, interest rates have been forced down, which is beneficial to bond prices and will also open up room for interest rate-sensitive sectors such as small-cap stocks, real estate investment trusts (REITs) and biotech stocks.

After the prosperity: inflation and collapse?

Hartnett also reminds investors that there will always be a second half of historical scripts.

Just like the Nixon era, after the easing and prosperity of 1970-72, it was out of control of inflation and market collapse in 1973-74.He recalled that boom eventually ended with inflation soaring from 3% to 12% and U.S. stocks plunging 45%.

This means that although the current trading window is attractive, it also lies huge forward risks.But before that, the market may follow the policy’s “visible fist” to perform an asset feast dominated by policies.