Author: that1618guy, Marketing Researcher at Delphi Digital; Translated by Yuliya

The market generally expects the Fed to cut interest rates for the first time in September.Historically, Bitcoin usually rose before the introduction of loose policies, but fell back after interest rate cuts were implemented.However, this pattern is not always true.This article will review the situation in 2019, 2020 and 2024 to predict possible trends in September 2025.

2019: Increased in expectations, fell after cashing out

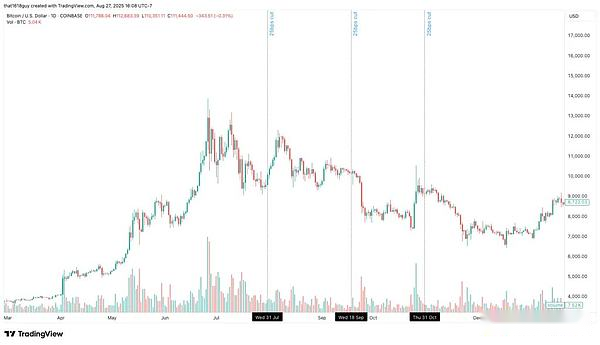

In 2019, Bitcoin rebounded from $3,000 at the end of 2018 to $13,000 in June.The Federal Reserve announced interest rate cuts on July 31, September 18 and October 30 respectively.

Each decision to cut interest rates marks the near-exhaustance of Bitcoin’s upward momentum.BTC rose sharply before the interest rate meeting, but was sold after the meeting as the reality of weak economic growth emerged again.This shows that the positive for interest rate cuts has been digested by the market in advance, and the reality of slowing economic growth has dominated the subsequent trend.

2020: Exceptions under emergency rate cuts

The situation in March 2020 is not a typical cycle.At that time, in order to deal with the panic caused by the new crown epidemic, the Federal Reserve cut interest rates to zero.

During this liquidity crisis, BTC plummeted along with stocks, but then rebounded strongly with massive fiscal and monetary policies.Therefore, this is a crisis-driven special case and cannot be used as a template for predicting trends in 2025.

2024: Narrative overwhelms liquidity

Trends have changed in 2024.BTC did not fall back after the rate cut, but instead continued its upward momentum.

The reason is:

-

Trump’s campaign turns cryptocurrency into an election issue.

-

Spot ETFs are attracting record inflows.

-

MicroStrategy’s purchasing demand at the balance sheet level remains strong.

Against this background, the importance of liquidity has declined.Structural buying and political positive factors overwhelm the traditional economic cycle impact.

September 2025: Conditional market launch

The current market background is not the same as the out-of-control rise in the past few cycles.Bitcoin has been in a consolidation state since late August, with ETF capital inflows slowing down significantly, and corporate balance sheet buying, once a constant positive factor, has also begun to weaken.

This makes the rate cut in September a conditional market trigger rather than a direct catalyst.

If Bitcoin rises sharply before the interest rate meeting, the risk of history repeating itself will increase – that is, traders “sell the facts” after the loose policy is implemented, resulting in a situation where “the rise is falling”.

But if prices remain stable or slightly lower before this resolution, most of the excess positions may have been cleared, allowing interest rate cuts to play a more role in stabilizing the market rather than becoming the end point of the upward momentum.

Core point

The current Bitcoin trend may be affected by the Fed’s September interest rate meeting and related liquidity changes. Overall, Bitcoin may experience a wave of rise before the FOMC meeting, but the increase may be difficult to break through new highs.

-

If the price rises sharply before the meeting, there is a very likely “sell news”-style pullback;

-

But if prices consolidate or fall between early September and the meeting, there is a possibility of unexpected rises due to interest rate adjustments.

However, even if there is a rebound, the market still needs to be cautious.The next round of gains could form a lower high (approximately in the $118,000 to $120,000 range).

Assuming this lower high, this could create conditions for the second half of Q4, when liquidity conditions are expected to stabilize and demand may rebound again, pushing Bitcoin to new highs.