Source: M31 Ventures; Compilation: Bitchain Vision

M31 Ventures recently published a 95-page research report on Chainlink.The report believes that LINK tokens represent one of the best risk/return investment opportunities they have ever seen.

The following are the main contents of the research report:

LINK tokens represent one of the best risk/reward investment opportunities we have ever seen:

1. The main beneficiary of the long-term trend of US$30 trillion; 2. Has a complete monopoly position in the on-chain financial middleware field; 3. Assets that are undervalued and their narratives are seriously misunderstood; 4. There are catalysts to change market narratives in the near future; 5. The actual reasonable 20-30-fold increase room; (objectively not as good as it) The premium for similar tokens trading reaches 15 times.

1. The main beneficiaries of the long-term trend of $30 trillion

The global financial system is undergoing a structural shift to tokenization: digitizing real-world assets, payments and market infrastructure onto the blockchain track.Industry forecasts show that by the end of 2030, hundreds of trillions of dollars of assets will be tokenized, covering treasury bonds, real estate, funds, commodities and currencies.This transformation requires a secure, standardized and compliant infrastructure layer to connect traditional finance (TradFi) with emerging on-chain economies.

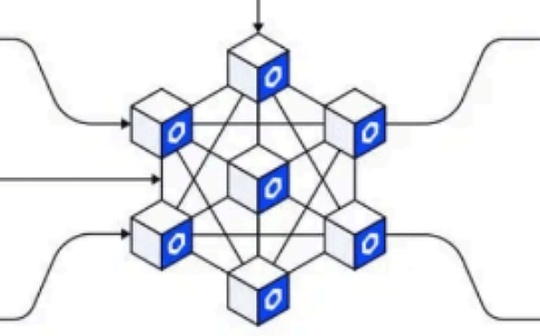

Chainlink has established its position as this infrastructure layer.As the de facto standard for on-chain data delivery and cross-chain interoperability,Chainlink guarantees hundreds of billions of dollars in decentralized finance (DeFi) value every day, providing mission-critical systems for the Global Banking Finance and Telecommunications Association (SWIFT), the U.S. Depositary Trust and Settlement Corporation (DTCC), JPMorgan, Euroclear, Mastercard, and sovereign state projects, and is recognized at the highest policy level, including the White House Digital Assets Report (excerpted below).Its enterprise-grade products, such as Price Feeds, Proof of Reserve (PoR) and Cross-Chain Interoperability Protocol (CCIP), have been deeply embedded in regulated pilot projects connecting traditional systems and tokenized assets.

These integrations are not only a proof of technology concept, but also a strategic foothold in regulated tokenization workflows.As the first infrastructure provider to address compliance-level interoperability and asset verification issues, Chainlink has positioned itself as the default choice for institutions that cannot afford operational or reputational risks.

These integrations are not only a proof of technology concept, but also a strategic foothold in regulated tokenization workflows.As the first infrastructure provider to address compliance-level interoperability and asset verification issues, Chainlink has positioned itself as the default choice for institutions that cannot afford operational or reputational risks.

2. Have a complete monopoly position in the on-chain financial middleware field

No competitor is comparable to Chainlink in terms of technical reliability, integration breadth, compliance readiness and institutional trust.Once integrated, it becomes a mission-critical infrastructure with high conversion costs and self-reinforcement network effects.

Chainlink’s recognition in Washington, D.C., leadership in the “American Tokenization” initiative, and consulting role in the state-level reserve proof program all mark unprecedented policy-level trust.Its involvement in the SEC working group and the central bank pilot program has made Chainlink a policy-aligned infrastructure partner; a key differentiator when institutions adopt regulatory clarity.

3. Assets that are undervalued and whose narrative is seriously misunderstood

LINK’s story has been seriously misunderstood for over 5 years; despite its unparalleled integration, dominant market share and trillions of dollars in potential markets, Chainlink’s market value is still far behind compared to its strategic value and objectively inferior to its tokens of its kind.This pricing error stems directly from three common narratives of error: 1) it is just a data oracle; 2) it has no profitability; 3) Chainlink Labs (the core contributor and product company behind the Chainlink protocol) keeps selling tokens to retail investors.These three points are completely wrong or misleading:

1) As mentioned above, Chainlink provides a comprehensive platform for decentralized finance and large financial institutions.Although it pioneered the blockchain oracle category when it launched in 2017, the protocol has since expanded into the premier one-stop middleware provider, connecting the real world (data, computing, value, laws, regulations, etc.) with on-chain systems.As shown in the figure below, oracle price feed is only one of many products on the platform, and its proportion of total revenue will continue to decline in the future.

1) As mentioned above, Chainlink provides a comprehensive platform for decentralized finance and large financial institutions.Although it pioneered the blockchain oracle category when it launched in 2017, the protocol has since expanded into the premier one-stop middleware provider, connecting the real world (data, computing, value, laws, regulations, etc.) with on-chain systems.As shown in the figure below, oracle price feed is only one of many products on the platform, and its proportion of total revenue will continue to decline in the future.

2) To some extent, following Amazon’s market seizing strategy, Chainlink was able to win dominant market share from the beginning through subsidized services.However, unlike Amazon, this is also necessary to foster young Web3 industry, as the vast majority of Chainlink’s customers are still looking for product market fit (PMF) and cannot continue to pay for Chainlink’s mission-critical service fees.Although Chainlink is able to win well-known clients and expand its business in decentralized and traditional finance, this never translates into substantial on-chain revenue.However, the recent launch of Chainlink token reserves has completely changed that.

3) Chainlink Labs has not received venture capital since 2017, but instead funded the operations of its 400-500 employees through treasury token sales.This leads to the saying that Labs keeps “selling tokens” (although it can be said that the venture capital of every other project is the same… In the end, someone uses cash for tokens to fund operations), which discourages potential investors.Similar to the above view, Chainlink reserves completely subvert this narrative.

4. There are catalysts that have changed the market narrative recently

8Earlier in the month, Chainlink launched a strategic token reserve, marking a major shift in the economics of the network token and triggering a 50% price surge in a week.The reserve uses payment abstract technology to automatically convert on-chain (still heavily subsidized) and previously opaque off-chain enterprise revenues to LINK, creating strong and sustained buying pressure.This immediately transformed LINK’s “token sell-off” narrative into a net buy narrative as it had generated “hundreds of millions of dollars” of revenue from corporate clients.

This also reveals the scale of monetization of Chainlink in the real world.While we are still in the early stages of a decade-long tokenization megatrend and Chainlink is just beginning to integrate its institutions into production, the platform has generated hundreds of millions of dollars in revenue from enterprise data feeds, proof of reserve contracts, CCIP usage and private institutional agreements.

These verifiable institutional revenues that were previously unavailable through on-chain analysis completely reversed their “lack of profit potential” narrative and provedChainlink will become one of the highest-paid agreements.As more institutional pilot projects enter production in the next 12 to 18 months, and the inevitable on-chain service “fee switch”, verifiable revenue will surely soar.

5. The actual reasonable 20-30 times increase space; (objectively inferior to it) the premium of similar tokens transactions reaches 15 times

Chainlink monetization opportunities cover CCIP transaction fees, data feed subscriptions, proof of reserve certification, automation services and new enterprise-specific products.Each new consolidation increases usage and drives recurring, diversified revenue growth, making Chainlink a multi-business infrastructure enterprise that grows along with the global blockchain economy and grows exponentially in the coming years.With a large amount of revenue now available for verification on-chain, we believe valuations are about to be closer to fundamentals; the bullish reason forecasts presented in this report,LINK has 38 times the increase by 2030.

Furthermore, LINK’s most similar liquidity token is XRP; not because Ripple is actually comparable to Chainlink, but because LINK has all the qualities that XRP holders think of as XRP.In fact, XRP has no practicality, no formal connection with Ripple, and no institutional traction, but the transaction price is 15 times premium to LINK, giving investors the most asymmetric risk/reward opportunity possible in the market today.In the long run,We think traditional financial companies like Visa and Mastercard will be a more suitable comparison of similar products, which means LINK has 20-30 times the increase.

This revaluation may be sudden, violent and persistent, as institutional capital will recognize the scale of this opportunity.Now is the time to invest.

This revaluation may be sudden, violent and persistent, as institutional capital will recognize the scale of this opportunity.Now is the time to invest.

Full text address of the research report: https://docsend.com/view/d9zgwzxxfbdjg7ck