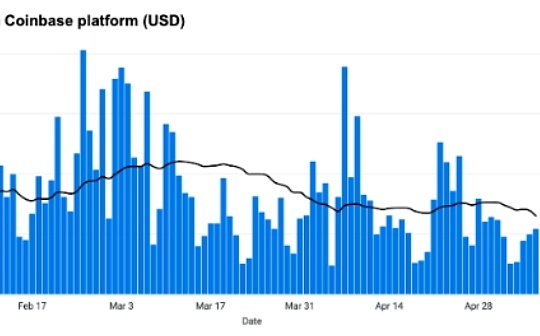

Source: Coinbase; Compiled by Deng Tong, Bitchain Vision

summary

-

Negotiations between China and the United States will be launched in Switzerland this weekend, which may become the main driver of the market.

-

New Hampshire has taken the lead in introducing a strategic Bitcoin reserve law, and other states are considering similar measures.The U.S. Senate rejected the GENIUS Act.

The market appears to be happy with the outcome of the U.S.-U.K. trade deal, and negotiations between the U.S. and China (or rather “downgrade” negotiations) will be launched in Switzerland this weekend.President Trump said tariffs on Chinese goods could be lowered if negotiations go well.Recall that the 90-day tariff extension (announced on April 9) means we have about two months left to launch any new trade agreements, and the loss of momentum in this area may affect the risk sentiment of all kinds of assets, including cryptocurrencies.However, initial progress seems encouraging, especially as Japan seeks to reach an agreement in June.These agreements have the potential to ease barriers to semiconductor trade, which is crucial to alleviating investors’ concerns about economic activity.

Trade negotiations remain the most important market driver at the moment, and the dull market response at the Federal Reserve FOMC meeting on May 7 is proof of it.While stocks initially responded to Fed Chairman Jerome Powell’s cautious statement on rate cuts, the Trump administration reversed the trend after announcing plans to lift President Biden’s ban on exporting artificial intelligence chips.We believe that this continues to show thatThe convexity around headlines remains high, resulting in a lack of attractiveness in the risks/rewards of short positions.

at present,Cryptocurrencies responded well to the recent development of the macroeconomic situation, and Bitcoin strongly recovered the $100,000 mark this week.Spot Bitcoin ETF attracted a net inflow of $2.96 billion last month following net outflows in February and March.Considering that leveraged funds increased net short positions on Chicago Commodity Exchange (CME) bitcoin futures in April by just $619 million, suggesting that most of these funds are directional flows rather than basis-related, according to the latest data from the U.S. Commodity Futures Trading Commission (CFTC).In the first eight days of May, another $1.58 billion in funds flowed into these ETFs.It should be noted that the 13F filing deadline for the first quarter of 2025 is May 15, so next week we will have a more detailed look at which ETFs purchased these ETFs in the first quarter of 2025.

In terms of regulation, New Hampshire became the first state in the United States to pass the Strategic Bitcoin Reserves Act this week, indicating that its policy support for Bitcoin applications will be further strengthened.At present, 28 states are considering legislative proposals to establish strategic Bitcoin reserves or include Bitcoin in managed funds.As of now, eight of these states—Florida, Montana, North Dakota, Oklahoma, Pennsylvania, South Dakota, Utah and Wyoming—have rejected the proposals, with another 19 states still under consideration.

The governor of Arizona rejected the SB1025 bill that allows state pension funds to invest in cryptocurrencies, but approved the HB2794 bill that allows the state to keep unclaimed digital assets.Arizona’s SB1373 Act (the establishment of a strategic reserve fund for digital assets) is still on the governor’s desk.In addition, the U.S. Senate did not approve the stablecoin bill, the GENIUS Act, in a general vote yesterday, with only 48 senators voting in favor, which is below the 60-vote threshold required to avoid lengthy debate rules.However, the veto did not weaken the risk premium for most crypto assets.

Coinbase acquires Deribit

Coinbase has made waves in the derivatives sector with its landmark acquisition of Deribit.Deribit is the world’s leading cryptocurrency options exchange with open contract volume of approximately $30 billion.This strategic move by Coinbase makes it one of the world’s leading cryptocurrency derivatives platforms, serving institutional traders and veteran traders by providing the most comprehensive products on the market.By combining Deribit’s powerful options capabilities with Coinbase’s mature spot, futures and perpetual futures products, traders will be able to trade a variety of products on one platform with efficient capital.

The acquisition sets the stage for rapid global expansion and unlocks opportunities in the booming derivatives market, especially as cryptocurrency options are about to usher in exponential growth similar to the stock options boom of the 1990s.Meanwhile, starting today (May 9), the Coinbase Derivatives Exchange will launch 24/7 24/7 futures trading for BTC and ETH contracts, providing uninterrupted risk control for U.S. traders.In addition, Coinbase is developing perpetual contracts to bridge the gap between the United States and the global cryptocurrency derivatives market through innovative, regulated, and convenient solutions tailored for cryptocurrency native traders.

On-chain: Bitcoin’s OP_RETURN battle

The Bitcoin community is in heated debate over a proposed upgrade plan planned by core developers in an upcoming release (undefined date).This change solves data storage problems through the OP_RETURN field in the transaction, a method that used to be limited to mitigating spam but is now increasingly used for non-monetary purposes.While some developers believe that removing the 80-byte size limit is a pragmatic solution to the inevitable data usage problem, hardliner critics argue that this will normalize the behavior of the network inflated and undermining the core concept of Bitcoin currency.However, we believe that providing less intrusive approaches (such as extending the OP_RETURN field) can actually help guide data storage on the network to avoid destructive practices without imposing restrictive tradeoffs that may undermine the spirit of Bitcoin’s core.

Cryptocurrency and traditional assets

Coinbase Exchange and CES Insights

This week, the cryptocurrency market rose sharply, with Bitcoin (BTC) breaking through $100,000 and Ethereum (ETH) breaking through $2,000.This bullish momentum is mainly due to optimism following the announcement of the U.S.-U.K. trade agreement and continued strong flows into U.S. spot Bitcoin ETFs.Looking ahead to next week, market focus will turn to key U.S. inflation data (Consumer Price Index (CPI) and Producer Price Index (PPI)) and retail sales data.Maintaining Bitcoin above the psychological threshold of $100,000 is crucial for the market to maintain positive sentiment.

Financing rate