Jessy, bitchain vision

According to common sense, a token is removed from the exchange, which is a major negative news.

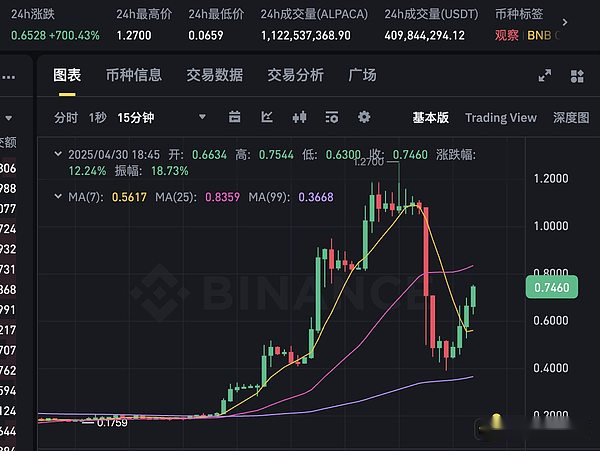

However, this rule has not been perfectly reproduced on May 2nd on the ALPACA token that will be removed from Binance.At first, when the news of ALPACA’s removal came on April 24, it also performed a brief decline, but its price rose more than ten times in the next three days.

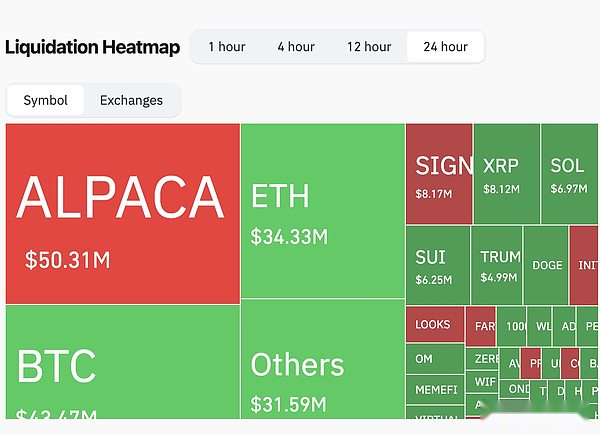

By April 30, the price rose by nearly 50 times when it was announced to be removed.According to Coinglass data, in the past 24 hours, the amount of ALPACA tokens has reached US$50 million, exceeding Bitcoin.

Behind such a ridiculous phenomenon is just a perfect harvest from the ALPACA dealer.

Trading maker who violates common sense, the sad song of retail investors

On April 24, about five days before the news that Binance announced the removal of ALPACA, the trading volume of ALPACA tokens suddenly increased, and the price doubled at the highest.At this time, it can be inferred that it was the dealer who made low-level funds absorbing before the news of the removal was released.

As the news of the removal on April 24 was officially released, retail investors expected the price to plummet, and the comparison between long and short at that time reached 1:4. The price of tokens did not fall as expected by retail investors. Instead, it started to rise after a brief decline of 30%.

The exchange also played an important role in this, and Binance shortened the settlement cycle of contract fund rates from 8 hours to 1 hour.When the fee rate fell to -2%, it also means that airdrops need to pay high rates to short, and the high rates also cause short sellers to close their positions one after another, and the price of tokens also rises with the trend.

However, the change in fees does not work every moment, over the rise and fall of the token price on ALPACA.

ALPACA is always unfamiliar. It is precisely because of this unfamiliarity that many traders make mistakes when trading according to the “rule”. For example, on April 29, Binance increased the upper limit of the ALPACA contract rate to ±4%.The original increase in the rate upper limit and the increase in the short-selling rate will persuade the short sellers to be withdrawn. The price of the token should have risen, but its price did not rise as much as it was on April 24. Instead, it ushered in a decline, falling directly to 3/4.

On April 30, the game of the dealer who was strangled back and forth reached its peak, with the highest price within 24 hours being 20 times higher than the lowest price.At 5 pm on April 30, Binance removed the ALPACA contract. After ALPACA took the trend and fell by more than 60% from its high point, it started to rise again.

In the past 24 hours, the largest ALPACA forced draw on the entire network occurred at Bybit, at $3.98 million.ALPACA’s contract liquidation volume also topped the list.

Summarize:

The most interesting thing about this incident is that the cooperation between the dealer and the news side is too perfect, making retail investors unable to touch their minds.And the exchange itself has become more or less accomplices in this.

For example, Binance’s adjustment to the contract fee rate this time seemed to be for the purpose of maintaining market stability and other purposes, but this time it was exploited by traders.For example, on April 29, Binance raised the ALPACA fee rate to ±4%. It was originally intended to discourage short sellers, but the price fell instead and the position volume rose inversely.

The dealer undoubtedly took advantage of this news and caught retail investors off guard.This also shows that the exchange’s rules formulation and adjustment need to be more cautious, and all possible situations should be fully considered to avoid giving market operators an opportunity to take advantage of.

This incident also revealed that retail investors are just toys in the hands of the dealer that can be harvested at any time. If you want to dance with the dealer, you are bloodthirsty at the edge of the knife.