Source: Grayscale; Compilation: Wuzhu, bitchain vision

summary

-

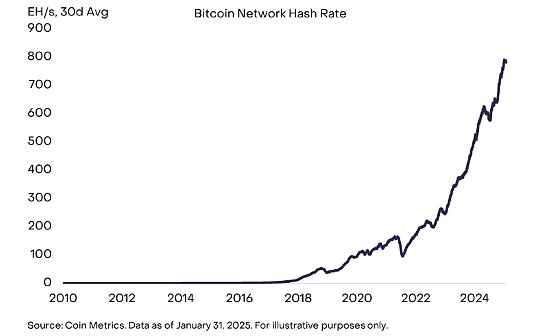

The reason why Bitcoin can act as a global digital currency system is because Bitcoin mining: a competitive process used to update blockchains and coordinate the economic incentives of individual networks.Today, the scale of Bitcoin mining network is very large, with the speed of generating “hash” per second exceeding 700 trillion.[1]

-

Bitcoin miners earn revenue by issuing new bitcoins and online transaction fees.They also have to bear the costs of capital equipment, electricity and other operating costs.Many miners also hold Bitcoin on their balance sheets, and more miners are diversifying into the fields of artificial intelligence (AI) and high-performance computing (HPC) services.

-

Grayscale Research estimates that Bitcoin mining accounts for only 0.2% of global electricity use; clean energy may also account for a higher share of electricity consumed by Bitcoin mining than other industries.Bitcoin mining may help accelerate the achievement of environmental goals, especially in areas such as methane emissions.

Bitcoin is a decentralized, open computer network worth $2 trillion.[2] This modern miracle is possible because of Bitcoin mining: network participants compete for the right to add the next block to the blockchain and receive rewards.Today, Bitcoin miners operate incredible scale, turning real resources into digital security.The computing power used to protect the Bitcoin blockchain is its digital “vac door”: an autonomous computer network can be used as a mechanism for global digital currency systems.The technical expertise, capital expenditures and ongoing operating expenses required to operate a Bitcoin mining facility, as well as the highly competitive business, helps to keep the Bitcoin network decentralized and attack costs.

Bitcoin miners investing in publicly traded can earn revenue from block production, as well as potential revenue growth from rising network transaction fees over time.In fact, most listed Bitcoin miners follow different business models, with many keeping the mined Bitcoin on the balance sheet and even buying Bitcoin on the open market.Bitcoin miners are also beginning to diversify and operate data centers for artificial intelligence and high-performance computing (HPC).

Modern Miracle

Although technically complex, the process of Bitcoin mining is conceptually simple.Specialized computers compete to guess a random number, and the machine that first guesses the correct number will gain the right to update the blockchain (“Mining Block”).The winning miner will receive newly issued bitcoin and transaction fees (“block reward”).[3]

There are no shortcuts to this race—for example, no algorithm can help find the right number faster—bitcoin miners compete on brute force.This process can be seen as a game of opportunity.The miners kept guessing until the right solution was found—like rolling a faceted dice until the required number appeared.Therefore, the probability of winning is a function of the number of guesses (“rolling dice”) that the miner can make per second.The operator with the most machines and/or the most efficient machines will make the most guesses and will most likely receive block rewards.

From a technical point of view, the winning result is not just a random number, but a “hash” that combines the number with other data.In computer science, a hash function is a mathematical operation that converts arbitrary data into a string of letters and/or numbers, called hash values.For example, using the same hash function in the Bitcoin network, the hash value of the word “bitcoin” is:

b4056df6691f8dc72e56302ddad345d65fead3ead9299609a826e2344eb63aa4

So the goal of Bitcoin miners is to quickly generate a hash: guess a random number, calculate its hash (combining the random number with other data), and then check if it is correct.

Today, an estimated 5 million to 6 million Bitcoin mining machines [4] generate hash values at an astonishing scale (Figure 1).In the past 90 days, Bitcoin miners have generated hash values at an average of 765 Ahash per second (EH/s).[5] Ahash equals one trillion (10^18) hash values.So, simply put, Bitcoin miners guess a random number per second on average and calculate their hash value over 700 million times.To put this number in context, it is estimated that there are about 7.5 trillion grains of sand and 10 trillion living insects on Earth.[6]

Figure 1: Bitcoin miner mass production hash value

It’s expensive to generate all of these hashes – that’s the point.To compete for rewards, mining operators need to purchase dedicated machines and other hardware and pay for ongoing power and maintenance costs.So, by generating the correct hash, miners provide a “proof of work”: proof of their economic resources and can trust them to update the blockchain.

Attacking Bitcoin means destroying the existing Bitcoin mining industry.In theory, if a malicious actor controls 51% of the network hash rate, thus mining most blocks, they can break the network (e.g., double payment of bitcoin or censor certain transactions).In a paper, researchers estimate that the cost of an hourly 51% attack on the Bitcoin network will reach $5 billion to $20 billion as of February 2024 (depending on how the attacker gets the mining machine).[7] In fact, no actor has the economic incentive to spend these resources, and in any case, the network has other defense mechanisms besides mining.[8]

Bitcoin mining business

Bitcoin miners earn equals the reward for mining new blocks, and they also need to pay for the electricity costs of running the machine and generating hash values (and possible other operating costs such as maintenance, mining pool costs, etc.).Therefore, the goal of Bitcoin miners is to generate the most hash values per second at the lowest possible cost.

In 2024, miners made a total of about 230,000 bitcoins, worth nearly $15 billion (based on price for the same period).[9] This is about 19 times higher than in 2014, with a CAGR of 34% (Figure 2).The speed of newly issued Bitcoins drops every four years, an event known as Bitcoin halving.Although there has been a decline in issuances in Bitcoin, mining revenue has increased over time due to the appreciation of Bitcoin price in USD.In the future, the growth in mining revenue may come from rising Bitcoin prices and/or the increase in online transaction fees.

Figure 2: Bitcoin mining revenue grows over time

Miners will incur operating expenses, mainly in the form of electricity required to run machines.[10] Each operator negotiates its own power purchase agreement, which vary greatly around the world.For heuristic analysis, we can create a simplified picture of the overall economic situation of Bitcoin miners by using hypothetical electricity costs and ignoring other costs.For example, Chart 3 compares the income of Bitcoin miners with estimates of total electricity costs of $0.05 per kilowatt-hour (kWh).The difference between income and electricity costs can be considered as a simplified measure of miner’s operating margin.When the dollar value of the block reward increases, the miners benefit, and when the dollar price of the production hash increases, the miners suffer.

Figure 3: Miner operating margin reflects the difference between block rewards and electricity costs

Given the difference in electricity costs faced by miners around the world, a more intuitive measure might be the dollar value earned for a given electricity consumption—such as miners’ income per megawatt-hour (MWh).Mining industry participants often mention the closely related concept “hash price”, which is calculated as the ratio of daily miner income to network hash rate.Although the concept is very similar, hash prices will tend to decline as miners improve efficiency.therefore,The proportion of miner income relative to electricity consumption may more accurately reflect the changes in miner economy over time.Figure 4 shows the daily income per megawatt-hour of Bitcoin miners.This estimate has remained largely stable over the past two years, despite significant fluctuations around the 2024 halving.

Figure 4: Miners’ income per megawatt-hour has remained stable over the past two years

Invest in Bitcoin Miners

Investing in publicly traded miners’ stocks can be exposed to the Bitcoin economy through stock market tools.The business model of Bitcoin miners may become increasingly diversified, but all miners are involved in the core business of producing hash values, mining blocks, and earning block rewards.Due to differences in power costs, non-power operating expenses and other factors [11], each miner receives a block reward at a different effective price.In the third quarter of 2024, the average cost of producing Bitcoin by the largest publicly traded miners was $34,000 to $59,000 (Figure 5).By comparison, the average price of Bitcoin this quarter was $61,000.

Figure 5: Different miners have different production costs

Bitcoin miners hold Bitcoin on their balance sheets in different ways.Some miners clear the block rewards immediately, some miners retain the block rewards, and some miners even buy extra bitcoins on the open market.certainly,Differences in balance sheet policies can have a significant impact on the relative financial performance of listed miners when Bitcoin prices change(Figure 6).Having said that,Many factors affect individual miners’ risk profile, and miners with relatively high Bitcoin balance sheet holdings are not necessarily more risky than miners who clear block rewards.

Figure 6: Some miners hold Bitcoin on balance sheet

Recently, Bitcoin miners have begun to enter other areas of artificial intelligence and high-performance computing (HPC) services, which have rapidly grown demand for data center infrastructure.For example, Goldman Sachs’ research [12] estimates that electricity demand in data centers (excluding cryptocurrencies) may grow by 160% between 2023 and 2030.Bitcoin miners may have a competitive advantage in supplying the AI/HP computing market as they have gained access to low-cost electricity and related infrastructure.In early 2024, Core Scientific, the third largest listed miner by market value, announced a long-term contract with dedicated AI infrastructure service provider CoreWeave.[13]Several other listed miners have taken steps to advance into the AI/High Performance Computing field since the announcement of the Core Scientific/CoreWeave deal in June 2024.

Bitcoin Mining and Sustainability

Bitcoin mining consumes real economic resources—power—to create decentralized digital security.The success of Bitcoin as a digital currency system means that mining now consumes a lot of electricity.Bitcoin is a unique energy consumer that has used a considerable portion of clean energy resources, and Grayscale Research believes it can make a positive contribution to the green energy transition over time.

Using data from Coin Metrics’ MINE-MATCH algorithm, we estimate that the Bitcoin network has consumed power at about 175 terawatt hours (TWh) in the past 12 months.[14] This is comparable to the estimates of the Cambridge alternative financial center (Figure 7).According to data for 2023 (the latest available year), Bitcoin’s energy consumption accounts for 0.2% of total global electricity consumption (considering power losses during transmission).[15] According to data from the Cambridge Alternative Financial Center, the data center consumes about 200 TWh of electricity per year, and the forecast indicates that energy consumption in the data center may rise due to the use of AI models.[16]

Figure 7: Bitcoin mining consumes power to create digital security

Compared to the typical residential or commercial user, Bitcoin is a unique energy consumer.Bitcoin mining is characterized by modularity and portability, location-independent, interruptible and highly sensitive to electricity price changes.Therefore, miners can often operate in places where clean energy resources are cheap.It is estimated that about 50%-60% of the electricity used by the Bitcoin mining industry comes from sustainable energy (including nuclear energy).[17] For the United States and the world as a whole, the share of sustainable power generation is approximately 40%.[18] Using data from 2023 (the latest available year) and assuming that Bitcoin’s sustainable share of electricity consumption is 50%-60%, we estimate that Bitcoin mining accounts for 0.2% of global power-related carbon dioxide emissions-0.3%.[19]

Grayscale Research believes thatBitcoin mining helps accelerate the adoption of renewable energy production in the coming years.Due to its unique attributes, Bitcoin mining incentivizes investment in renewable energy infrastructure development, especially where it is not transmitted to major popular centers.Bitcoin mining can also help stabilize grid demand—Otherwise grid demand will fluctuate by consumption patterns and weather — as the Texas Electricity Reliability Commission (ERCOT) system does.[20] In addition, startups like the Sustainable Bitcoin Protocol have created market-based mechanisms to incentivize the use of clean energy and reward efforts to reduce methane emissions.Addressing methane emissions could be a particularly important way for Bitcoin miners to contribute to environmental goals.Methane is released from burning gas or natural gas produced by burning oil.Companies like Crusoe Energy have developed ways to capture excess gas instead of freeing it, then convert it into electricity and power bitcoin miners.

The growth in technology use will generate a huge demand for power production in the coming years – from digital assets, artificial intelligence and other industries.Grayscale believes thatBitcoin helps the global power infrastructure function healthily, and compared to many other industries, Bitcoin has unique advantages to help accelerate the transition to renewable energy.

Comments

[1] Source: Coin Metrics.Data as of January 31, 2025.

[2] Source: Coin Metrics.Data as of January 31, 2025.

[3] This number is called “nonce” (a number used only once), and is not purely random.For example, see “The Mystery of Bitcoin Nonce Model”, BitMEX Research, 2019.

[4] Source: Grayscale Research Calculates based on the reported network hash rate and estimates of miner average productivity.For the latter, we use a central estimate of 125 TH/s, based on Coin Metrics’ MINE-MATCH data and an analysis of the profitability of individual miners under different hash prices and power prices.

[5] Source: Coin Metrics.Data as of January 31, 2025.

[6] Source: “Which is greater, the number of sand on Earth or the number of stars in the sky?”, NPR, September 2012; “Insect Number (Species and Individuals)”, Smithsonian Society.

[7] Nuzzi, Waters, and Andrade, “Breaking BFT: Quantitatively Attacking Bitcoin and Ethereum.” February 15, 2024.

[8] See, for example, “Analyzing Bitcoin Consensus: Risks of Protocol Upgrades,” Ren Crypto Fish, Steve Lee, and Lyn Alden, November 2024.

[9] Source: Coin Metrics.

[10] There are many different types of mining machines running at any given time.Data provider Coin Metrics has developed technology to identify types of machines that actively contribute hash rates to the network.We use this data to estimate power consumption and the number of active machines on the network.

[11] For example, miners may incur other costs, such as pool expenses, and income may vary depending on the expense income of a particular block.

[12] Source: “Intergenerational Growth – Global Power Rises in Artificial Intelligence/Data Centers and Its Impact on Sustainability”, Goldman Sachs, April 30, 2024.

[13] Source: “Core Scientific signs a 12-year agreement with AI companies with estimated total revenue of $3.5 billion”, The Block, June 4, 2024.

[14] Within 365 days ended January 31, 2025, this method implies an annualized power consumption of 177.8 TWh; this should be considered an estimate with great uncertainty.

[15] Source: Grayscale calculations based on data from the Energy Institute World Energy Statistics Review and Cambridge Alternative Financial Center.

[16] Source: Cambridge Alternative Financial Center; “Carbon emissions surge in artificial intelligence and cryptocurrencies, tax policies can help”, Shafik Hebous and Nate Vernon-Lin, IMF Blog, August 15, 2024.

[17] Source: For example, see Daniel Batten’s Bitcoin Energy and Emissions Sustainability Tracking and “Bitcoin Mining Commission Investigation Confirms Sustainable Power and Technical Efficiency Improvement Year by Year,” Bitcoin Mining Commission, 2023August 2019.

[18] Source: Grayscale calculation based on data from the Energy Institute World Energy Statistical Review.

[19] Source: Grayscale calculation based on data from the Energy Institute World Energy Statistical Review.

[20] Source: U.S. Energy Information Administration.