Author: Matt Hougan, Chief Investment Officer of Bitwise; Compiled by: 0xjs@Bitlink Vision

Currently, there is an interesting dichotomy between institutional investors and retail investors in the cryptocurrency field.

On the one hand, the agency’s sentiment towards cryptocurrencies is the most optimistic I’ve ever seen.When investment professionals look at cryptocurrencies today, they see something like this: Institutional capital is allocating to the field with record amounts through ETFs, and Washington has gone from one of the biggest threats to cryptocurrencies to its biggest supporterone.

What we dreamed about a year ago—such as the adoption of strategic Bitcoin reserves of nation-states—now seems to be somewhere between possible and imminent.The biggest risks facing encryption, such as government bans or legal threats to software developers, are distant nightmares.

From a risk adjustment perspective, now is arguably the best time to invest in cryptocurrencies in history.

However.

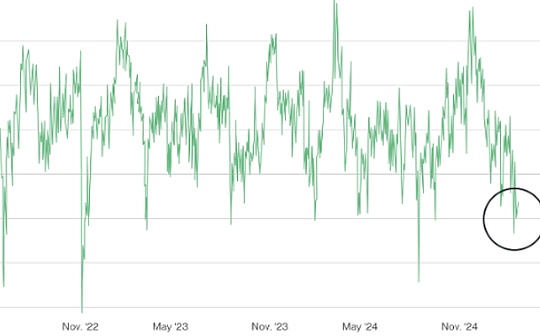

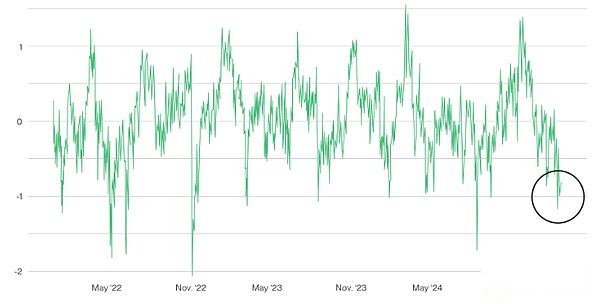

Nowadays, retail investors are in deep despair.They seem to live in another reality.Bitwise has a proprietary crypto sentiment score that determines crypto investor sentiment by looking at on-chain data, traffic and derivative analytics.The index is currently at one of the lowest levels in history.

Crypto Asset Sentiment Index

Source: Bitwise Asset Management, data from Bloomberg, CoinMarketCap, Glassnode, Nilsson Hedge, Alternative.me and Bitwise Europe.

This is consistent with the feeling I get from “encrypted Twitter” and other emotional metrics on the market.

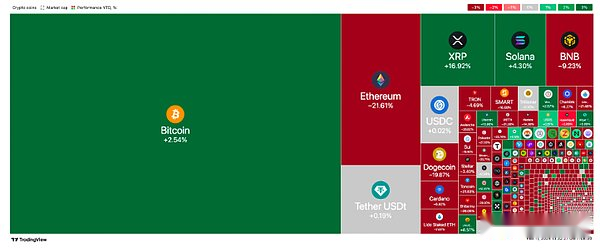

Retail investors feel sad because crypto assets other than Bitcoin (commonly called “altcoins”) perform poorly.The following heat map from TradingView shows the returns on all crypto assets so far this year.While there are some green dots—mostly Bitcoin, Solana and XRP—mostly it’s a red ocean.Ordinary crypto assets are suffering hard.

Crypto Assets Year-to-Date Return

Source: TradingView.Data as of February 11, 2025.

Source: TradingView.Data as of February 11, 2025.

You can extend this analysis to the last 12 months and the results have not improved much.Bitcoin has risen 95% over the past year; Ethereum has risen 2%.Retail investors like to speculate on altcoins, and the lack of “altcoin season” frustrates them.

So the biggest question is: Who is right?

Answer: Institution

Every bone in my body tells me that the answer is “institution”.

Indeed, it is easy to be optimistic about Bitcoin now.So far this year, ETFs have purchased about 47,000 BTC, businesses have purchased about 57,000 BTC, and the Bitcoin network has only minted about 18,000 new BTC.It would be possible without genius that this supply and demand dynamic will drive prices to record highs over time.

I admit, the altcoin story is even more complicated.At present, there are no major new applications that have attracted huge interest in the field like the 2020-2021 bull market (DeFi) or 2017-2018 bull market (ICO).Today, the closest we are in the altcoin space is the memecoin craze, but most investors think it’s just a short-term casino.It’s hard to tell yourself that you’re building a new and better world based on Fartcoin or Hawk Tuah tokens.

But in the long run, I think the altcoin scenario is stronger than ever before in history.Altcoins have been in a regulatory gray area over the past four years, with the US SEC accusing most of the altcoins being issued illegal securities.This has hindered real-world adoption and prevented large companies and the best developers from entering the field.

All of this was reversed.Today, the United States has made stablecoin development a national priority, which will support the development of Ethereum and Solana.Today, the world’s largest institutions feel secure when built on cryptocurrencies, which will make DeFi applications popular to the public.

If you look closely, you will find evidence of this shift, such as the recent all-time high stablecoin market cap, or the recent move by Ondo Finance to tokenize all U.S. stocks and ETFs.Under the leadership of the past government, the project could never be launched.

I guess in a year or two, you can see the transformation of altcoins without having to work hard; the impact will be self-evident and unstoppable.

It is hard to tell if a particular catalyst will cause altcoins to rise in the coming months, but it is even harder to imagine that the market will not expand significantly in the coming years.

Retail investors in cryptocurrencies are in bad mood right now, and for me, that means opportunity.