Author: Ciaran Lyons, CoinTelegraph; Compiled by: Wuzhu, Bitchain Vision

The number of Ethereum withdrawn from crypto derivatives exchanges has reached its highest level since August 2023 — an analyst interpreted this as a positive signal for Ethereum prices.

On February 6, Ethereum net traffic on the crypto derivatives exchange was negative 300,000 ETH, equivalent to about $817.2 million outflows, with ETH trading at $2,724 as of this article.

The net Ethereum traffic for crypto derivatives is -300,000 ETH.Source: CryptoQuant

CryptoQuant contributor Amr Taha said in a February 6 analyst report,This is a bullish signal as traders pull their Ethereum off derivatives exchanges(This involves a contract between the buyer and the seller that trades assets at a pre-agreed price on a specific date) meansReduce selling pressure, while closing leveraged positions and possibly transferring ETH to cold wallets.

Taha said the increase in the number of Ethereum withdrawn by derivative exchanges has reduced “instant supply available for sale”, which makes falling Ethereum prices even more difficult.

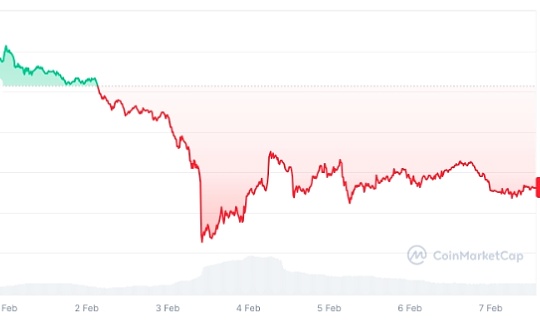

ETH has dropped 19.42% in the past 30 days, and has been below the psychologically important $3,000 price level since February 3.

As of the time of this article, Ethereum was trading at $2,720.Source: CoinMarketCap

Taha added: “If demand remains stable or increases, prices will rise due to reduced supply.”

Cryptocurrency commentator Kyle Doops said in a February 6 X post,“Big moves like this often mean less selling pressure and major positions closing – often a bullish signal.”

Just a few days ago, Eric Trump, son of U.S. President Donald Trump, posted on X that “now is a good time to increase ETH.”

Ethereum has been growing bullish catalysts, including the possible launch of staking Ethereum exchange-traded funds, and Donald Trump’s World Liberty Financial cryptocurrency project continues to increase its Ethereum holdings.

Consensys founder Joe Rubin recently said that ETF issuers hope that the funds that provide pledged will be approved by regulators soon.

“We have been talking to ETF providers and they’ve worked hard on it, so they expect to get approval soon,” Rubin said.