Author: Martin Young, CoinTelegraph; Compiled by: Tao Zhu, Bitchain Vision

Utah has passed a strategic Bitcoin reserve bill in the House, which has now been submitted to the Senate for consideration, and Utah is one step closer to becoming the first state in the United States to have Bitcoin reserves.

“The ‘Strategic Bitcoin Reserve’ bill has been officially passed in the Utah House of Representatives,” said Dennis Porter, founder and CEO of Satoshi Action Fund, on Feb. 6.“The bill is now submitted to the Senate,” he added.

The Utah House Economic Development Committee voted 8-1 on Jan. 28 to pass HB230, the Blockchain and Digital Innovation Amendment Act.

Utah Rep. Jordan Tscher introduced the bill on Jan. 21.It will give the state’s Treasury Secretary the authority to allocate 5% of certain public funds to the purchase of “qualified digital assets” such as BTC, high-cap crypto assets and stablecoins.

“We strongly believe that Utah will be the first state to propose this legislation,” Porter said in a recent interview.

The bill will now be submitted to the Senate for consideration and will require a majority of votes to be approved before it can be signed or rejected by the governor.

Another U.S. state that has received similar bill approval is Arizona, a Strategic Bitcoin Reserves Act (SB1025) jointly initiated by Senator Wendy Rogers and Rep. Jeff Wenninger, who was passed on January 27.The Senate Finance Committee is currently awaiting a House vote.

Meanwhile, New Mexico became the latest U.S. state to propose a strategic Bitcoin reserve, with the state’s legislature (SB57) proposed by Sen. Ant Thornton on February 4.

The Strategic Bitcoin Reserves Act proposes to allocate 5% of public funds to Bitcoin.

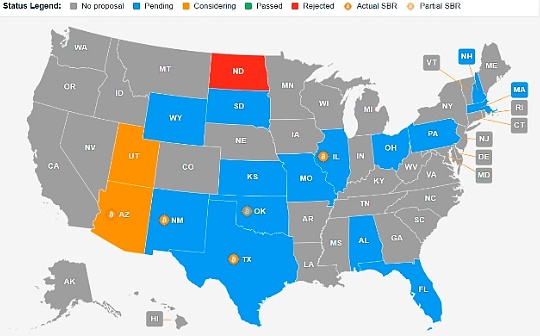

Recently, North Dakota lawmakers rejected House Bill 1184, which would allow state governments to invest in crypto assets and precious metals.

The bill failed to pass on January 31 in the House of Representatives by 32 votes in favor and 57 votes.

According to the Bitcoin Reserve Monitor, 14 U.S. states have introduced bills to allow their local Treasury Department to buy crypto assets.

SBR status in U.S. states.Source: Bitcoin Reserve Monitor