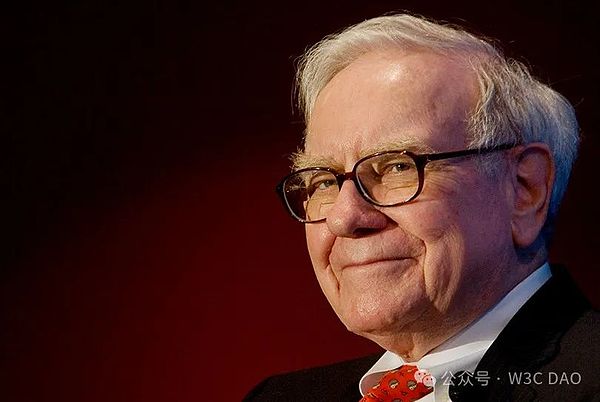

Warren Buffett has been making it clear that he dislikes cryptocurrencies.However, Berkshire Hathaway has invested millions of dollars in Nu Holdings Ltd., a Brazilian bank linked to cryptocurrency, whose stock has risen by 34% annually.

Attitude changes

Warren Buffett, CEO and chairman of Berkshire Hathaway, has repeatedly expressed his stance on cryptocurrencies: He doesn’t like it.

At the 2018 Berkshire Hathaway Annual Meeting, Buffett called Bitcoin “a possible square of rat poison.”

“We don’t hold any cryptocurrencies, we don’t short any cryptocurrencies, we will never hold them.”

“In terms of cryptocurrencies, I can almost say that they will end with a bad ending,” Buffett said in a 2018 interview with CNBC.

But recent reports show that Berkshire Hathaway and some of its investment managers may become more relaxed in their views on cryptocurrencies.

Berkshire Hathaway invests in Nu Holdings, a Brazilian digital banking company that has its own cryptocurrency platform and supports the cryptocurrency market.

According to Nu, Berkshire Hathaway initially participated in a $500 million Series G round in 2021, and then invested another $250 million.

Nu launches encryption platform

In 2022, Nu launched its cryptocurrency platform, Nubank Cripto, which initially supported Bitcoin, Ethereum and Polygon.The platform now includes Uniswap and Chainlink and allows users to send, receive and exchange cryptocurrencies.

Nu Holdings did not immediately respond to Fortune’s request for comment.

Berkshire Hathaway increased its stake in Nu from 0.1% at the end of the fourth quarter of 2022 to 0.4% in the third quarter of fiscal 2024, according to the Securities and Exchange Commission filing.

Representatives of Berkshire Hathaway and Buffett did not immediately respond to Fortune’s request for comment.

This means that by the end of the third quarter of fiscal year 2024, Berkshire Hathaway held more than 86 million shares of Nu, worth nearly $1.2 billion.So, Buffett and Berkshire Hathaway are benefiting from a business he once claimed to not understand.

“I’ve already caused a lot of trouble because of what I think I understand,” Buffett said in a 2018 interview with CNBC.”Then why should I go long or short on things I don’t understand at all?”

As of noon Wednesday, Nu Holdings’ shares rose nearly 34% year-on-year.

Revisited

And now that Berkshire Hathaway seems to be making crypto-related investments, Buffett may need to rephrase his previous remarks about cryptocurrencies not having an impact.

“If you told me that you own all the bitcoins in the world and sell them to me for $25, I wouldn’t pick them up because what would I do with it?” Buffett’s Berkshire Ha in 2022Thave said at the general meeting of shareholders.”I have to sell it back to you, no matter what. It won’t do anything.”

Despite this, it should be noted that Berkshire Hathaway is generally more conservative in investment strategies.

According to the company’s fourth quarter 2024 financial statements, Berkshire Hathaway holds more than $325 billion in cash and equivalents, most of which are U.S. Treasury bonds.This means that Berkshire Hathaway avoids investing in hot stocks when it even achieved good results in the market.

“Berkshire has been successful over the years because it has kept the boring way at this point,” said Mayer Shelds, managing director of boutique investment bank Keefe, Bruyette & Woods.In an interview with Fortune’s Alena Botros in November 2024.