Author: Alex Thorn, Galaxy Research Director; Compilation: 0xjs@Bitchain Vision

Creditors have been trapped in the bankruptcy of Mt.Gox for more than 10 years – the final trustee said that the physical distribution of BTC and BCH will begin in July.

We believe that the number of tokens allocated will be less than people think, and that it will result in less pressure on Bitcoin selling than market expectations.The reasons are as follows:

The data in this article are based on review of bankruptcy filings, conversations with creditors, and various assumptions.Note that these are estimates and are intended to provide directionality rather than certainty.This is not investment advice, please study it yourself.

Mt.Gox Pays BTC Distribution Details How many BTCs will be sold

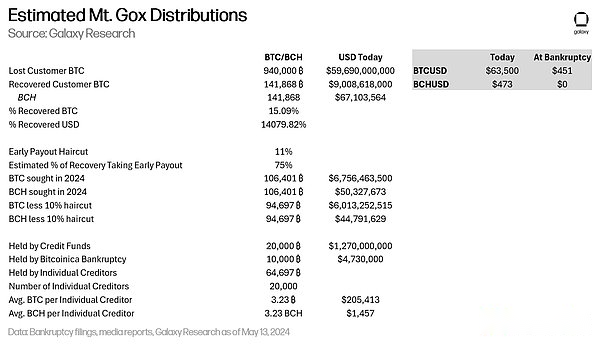

On May 13, I sent a notice to Galaxy customers and counterparties, which detailed the numbers, see the summary picture below.

Mt.Gox lost about 940,000 BTC (at the time of $424 million), and15% recovered (141,868 BTC, or about $63.9 million at the time), now worth $9 billion.althoughIt was only 15%, but for creditors in USD, it was 140 times the gain.

To get the early payout now, the creditor accepted a write-down of about 10%.We believe that approximately 75% of BTC creditors have chosen this option,About 95,000 bitcoins are used for advance payment.

in,About 20,000 Bitcoins are to the claim fund, about 10,000 Bitcoins are to Bitcoinica BK, and the remaining approximately 65,000 Bitcoins are to personal creditors.65,000 BTC/BCH is far lower than the 141,868 bitcoins released regularly by the media.

But there are reasons to believeIndividual creditors will be more inclined to hold Bitcoin than markets have expected:

1. Creditors are obviously long-term Bitcoin holders.They are early adopters of tech savvy.

2. For years, individual creditors have resisted compelling and radical offers from claim funds, indicating that they want to return their Bitcoins, rather than payouts in USD.

3. The impact of sales on capital gains will be huge.As prices rise, even though only 15% of physical recycling, creditor holders have recovered Bitcoin (in USD) has risen 140 times since bankruptcy.

That is to say,Even if only 10% of the 65,000 Bitcoins were sold, 6,500 BTCs were sold on the market, and is likely to be sold on the market.Creditors will receive Bitcoin in their Kraken, Bitstamp or Bitgo accounts, which most individuals will deposit directly into their Kraken or Bitstamp trading accounts.

Some thoughts about claims funds.Through conversations with some of these people, my understanding is thatThe vast majority of LPs in these funds are high net worth Bitcoin holders seeking discounts BTC, not a credit fund that conducts arbitrage transactions.While some LPs will certainly be sold, I don’t think these funds are composed primarily of traders seeking arbitrage.

BCH selling pressure will be much greater than BTC

Judging from the Mt.Gox allocation, BCH may perform much worse than BTC.

1. No creditor initially purchased BCH.The restored BCH originated from the fork of Mt.Gox using its BTC key Claim, which happened a few years after Mt.gox went bankrupt.

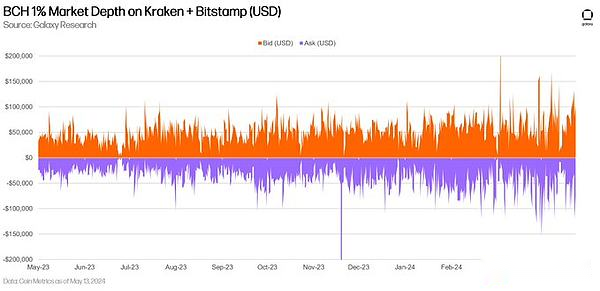

2. BCH liquidity is very low.The $400,000 liquidity on the order book is within 1% of the market price.

3. If we only look at Kraken and bitstamp, liquidity will become thinner (obviously), where individual creditors will receive tokens.BTC has 60 times liquidity on these exchanges than BCH.

Therefore, I believe that the amount of currency allocated is lower than market expectations (see all types of titles).

Therefore, I believe that the amount of currency allocated is lower than market expectations (see all types of titles).

And I think that once these crypto tokens are allocated, BCH will perform worse than BTC – a large portion will be sold by creditors to a less liquid market.