Source: Asset Allocation Study Club

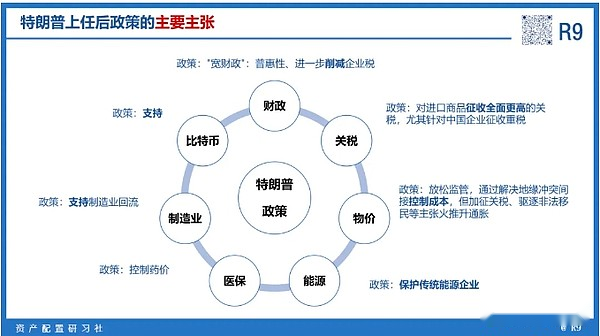

The US election, the boots landed.

Trump was elected the 47th president of the United States.

On November 8, 2016, Trump was elected the 45th President of the United States.

It has been 8 years since he was last elected president. The following reviews the trends of various major assets since Trump was elected as the president of the United States last time.

(Note: There is a certain difference between this round of macroeconomic and monetary policy and 2016)

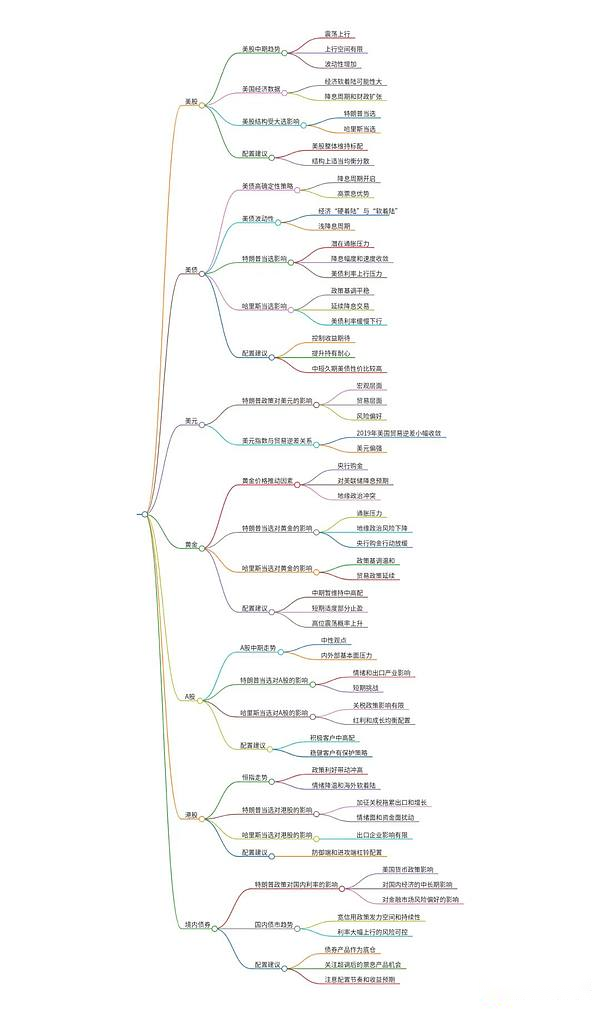

1. The trend of the US dollar after Trump was last elected

Risk aversion sentiment is rising, and the US dollar is favorable.

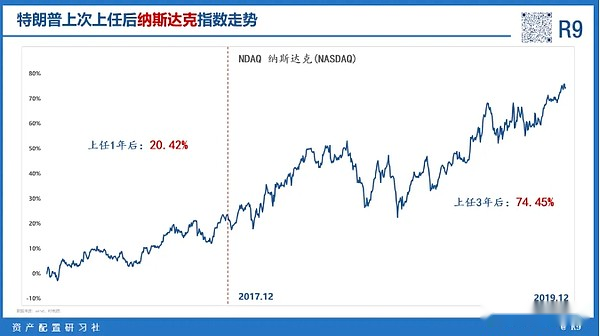

2.Nasdaq Index trend after Trump’s last election

Finance, industry, medicine and other sectors led the U.S. stock market.

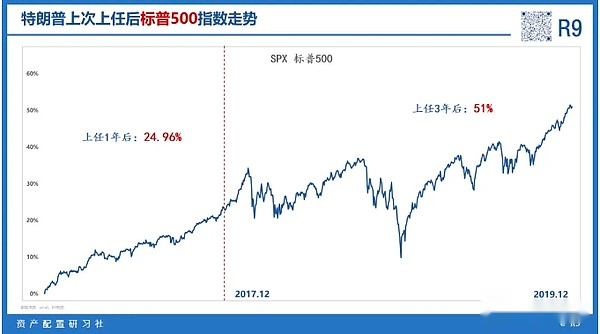

3. S&P 500 trend after Trump was elected last time

Finance, industry, medicine and other sectors led the U.S. stock market.

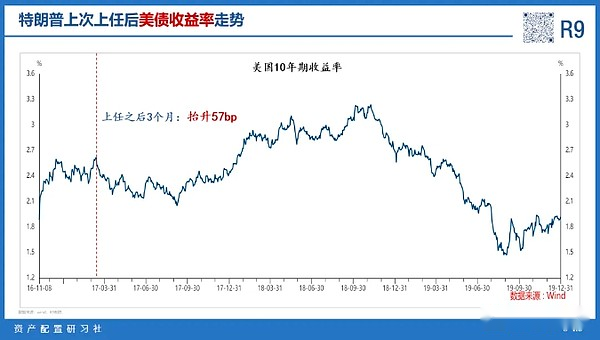

4. U.S. Treasury Interest Rate Trends After Trump’s Last Election

Under the influence of the expectation of the “loose fiscal” policy after Trump’s election, coupled with the Fed’s expectation of interest rate hikes, U.S. bond interest rates rose rapidly, and the center of November rose rapidly from 1.8% to 2.6%.

5. Gold trend after Trump was elected last time

Gold fell in the short term after Trump was last elected.

6. The trend of crude oil after Trump was elected last time

Crude oil has risen by more than 45% a year after Trump was last elected

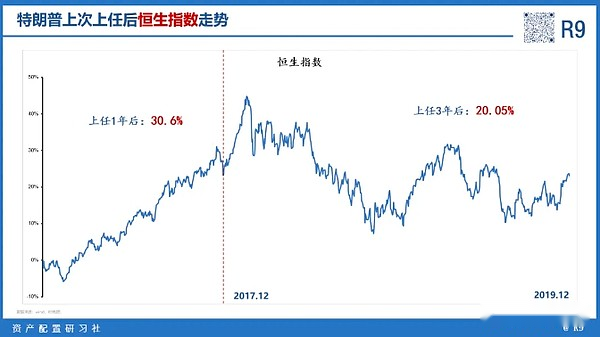

7. Hong Kong stock trends after Trump was elected last time

Hang Seng Index rose by more than 30% a year after Trump was last elected

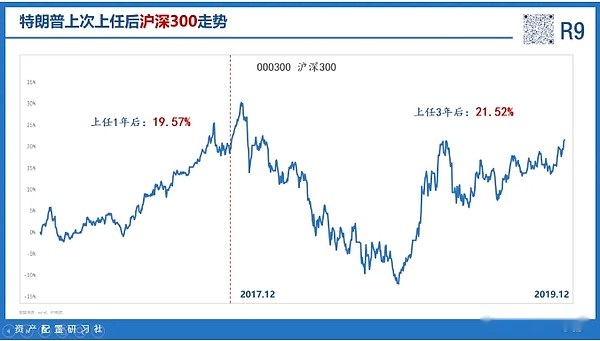

8. A-share trend after Trump was elected last time

Within one year after Trump took office, the Shanghai and Shenzhen 300 rose by 19%.

Petrochemical, construction, and real estate performed relatively well, while electronics, computers, consumer services and other sectors were relatively backward.Driven by the recovery of real estate in the fourth quarter of 2016, the A-share market performed relatively well and ushered in a slow bull market. Domestic demand and pro-cyclical sectors such as petrochemicals, construction, and real estate performed relatively well, while industries such as electronics, computers, and home appliances wereThe increase is relatively low.Overall, the market did not fully expect trade frictions at that time.

9. The trend of equity-oriented funds after Trump was elected last time

The index of equity-oriented mixed fund index rose by 9.42% within one year after Trump was last elected.

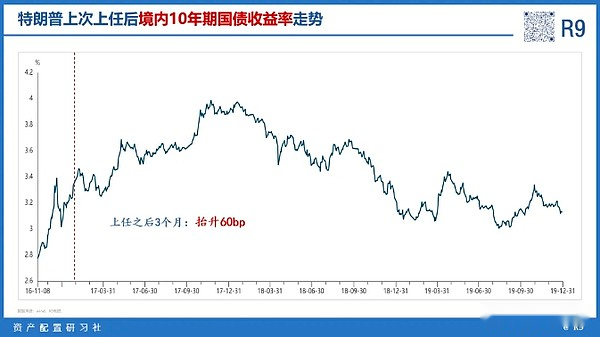

10. Domestic bond trends after Trump’s last election

Three months after taking office, the yield on 10-year Treasury bonds rose by 60 bp

US stocks: The medium-term fluctuates upward, but the upward space is limited and volatility increases.

US Treasury: a high-certainty strategy, but the volatility continues, and US Treasury in the medium and short term is relatively cost-effective.

US dollar: Continuing a strong trend, inflation attributes and risk aversion sentiment support the US dollar.

Gold: It may change from positive to neutral, with gold prices fluctuating at high levels.

A-shares: medium-term neutral, we need to pay attention to domestic policies, and structurally recommend balanced allocation of dividends and growth.

Hong Kong stocks: Lay out on both ends during the fluctuation, focusing on policy dividends and balanced new economy.

Domestic bonds: The low-level fluctuation time is longer and the fluctuations are increasing. We need to pay attention to the coupon product opportunities after overshooting.