Author: Zixi.eth Source: X, @Zixi41620514

I have held ETH/SOL for 3 years, and the market will not lie. Users voted for the answer with their feet for one and a half years.In summary, it is:

-

The overall funds and developers of Ethereum are still available>solana;

-

The users of the Ethereum main network have moved to L2, but the value of L1 capturing L2 is still weak, while the number of Solana users is much larger than Ethereum L1;

-

Ethereum-priced assets This cycle is less than Sol-priced assets;

-

Ethereum’s Ecosystem direction is tilted.

In the past, our basic criteria for judging public chains were: 1. Funding TVL; 2. Number of developers; 3. Users; 4. Ecosystem; (5. Is there a banker or not).We will continue to analyze the current Ethereum (L1+L2) and Solana ecosystems from these five perspectives.

1. From the perspective of capital

The Ethereum mainnet far outperforms Solana.The trend has not changed in the past three years. Since 21 years, Ethereum TVL has been 50%-60%.Although Ethereum TVL Dominance has declined recently, including Base/Arbitrum’s TVL, the overall Dominance is still at 60%, which is the same level as the 21-year bull market.But it is worth noting that Solana TVL has now grown to 8%, a significant increase from 1%-3% in 21 years.

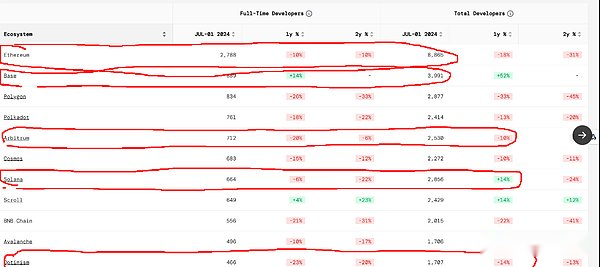

2. From the perspective of the developer

The total number of Ethereum ecosystem developers is still far ahead.Ethereum’s main network developers have declined in the past year, and some may gradually migrate to L2, such as Base.In 22-23, Ethereum’s builder took “halal” as its supreme glory, and Ethereum investors took halal as its investment core.During that time, I listened to the project party saying that various zk changed everything, and it was painful, but I had to admit that ZK was gradually landing.

But in the past year, I have personally felt the rise of Solana ecosystem developers.I feel particularly deep from breakpoint this year in 2049. I haven’t seen a big public chain that can organize the ecosystem activities so well for a long time.In addition, Solana foundation has been continuously running hackerhouses, and many teams around me have turned to solana, which can confirm the data that the number of solana devs has increased by 20% in one year.

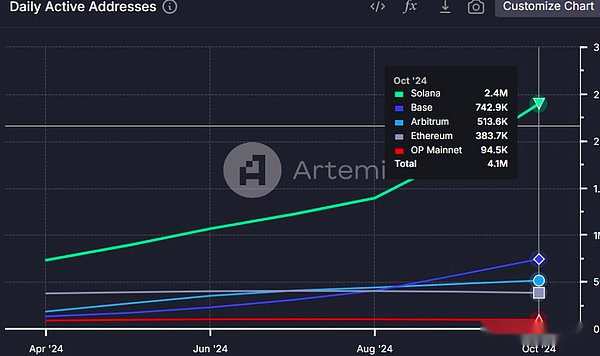

3. User

Solana is far ahead.Solana has more daily active users (58%) than Ethereum and L2 combined (42%), and Solana’s transaction volume (84%) far exceeds the Ethereum system (16%).However, the transaction volume of core assets is still accumulated on Ethereum and L2.This is in line with Solana’s current ecological positioning local dog launch platform.In addition, you can focus on Base, which has a very fast rise.

4. Ecological Dogecoin Asset Pricing

The pricing of Dogecoin assets is actually the result of the development of the public chain ecosystem.From 20 to 21, Ethereum relied on the two ecosystems of DeFi/NFT to allow all DeFi and NFT assets to be priced with E.Everyone will say that DeFi TVL is tens of thousands of E, and the price of NFT is several E.Whether it is a substantial purchase or a virtual psychological pricing, the currency standard will be used as the final pricing standard, although these coins will be sold in the end:)

Looking back at GameFi on BSC in 21 years, users also use the BNB standard to price ecological assets, which led to the surge in BNB’s gamefi period.

What Solana has done the most right recently is that @pumpdotfun constantly uses the three-plate theory of “Send a new local dog” and the myth of making wealth by a very small number of users to attract a large number of buyers to the entire market.Over time, the user’s psychology will form a model of pricing local dog assets with SOL.BTW, http://pump.fun is the third most perfect product I have seen in the past 3 years (the first and second will be discussed later).

5. Has the Ethereum ecosystem developed well in the past two or three years?

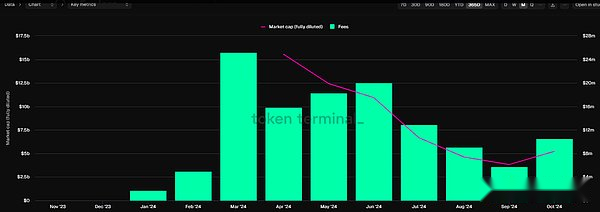

On the contrary, I think it’s developing very well.I think the most perfect top1/2 products in the past 3 years are @ethena_labs and @Polymarket.Ethena sold capital rate arbitrage that only a very small number of people could do in the past to decentralized retail investors, with a 251-day agreement revenue of US$100 million. The project party/investor/user won three wins, but there are indeed problems with the design of token utility.

Polymarket put the prediction market on the chain, using blockchain to avoid traditional prediction market payment and supervision issues, and seized the election opportunities. Now media platforms around the world refer to Polymarket’s election data to view polls.

Ethena brings real returns to users with financial management needs. Polymarket uses blockchain to solve the actual problems of the web2 prediction market and successfully breaks the circle.Ethena and Polymarket have continued to write new successes to the Ethereum ecosystem, but what has it brought to the Ethereum price?It is difficult for two successful brothers, Ethena and Polymarket, to reproduce the glory of using Ethereum to price the ecosystem during DeFi/NFT.

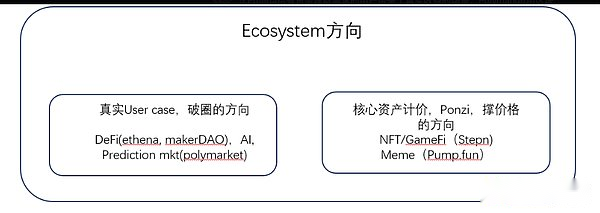

6. Ecological Future Outlook

I think the ecology will be viewed in two aspects in the future.On the one hand, there is a real use case, such as @ethena_labs and @Polymarket for Ethereum, and PayFi on Solana needs more and more, which is the real direction of blockchain development.At the same time, a split-disk project similar to @pumpdotfun is also needed to give the price of core assets.Both are indispensable.