Author: Jack Inabinet, Bankless; Compilation: Baishui, Bitchain Vision

EigenLayer is undoubtedly the most anticipated airdrop opportunity in cryptocurrency history, but is airdrop after the token decline inevitable for EIGEN and the broader Ethereum ecosystem?

EigenLayer is at the forefront of restaking, creating a shared security market that allows developers seeking to create decentralized networks to circumvent difficulties associated with booting and operating their own trust networks, lowering barriers to entry to create these networks, and giving encryption securityThe long tail of the application.

EIGEN airdrop alone is expected to be among the largest airdrops ever in cryptocurrencies, and depositors can easily get added allocations from liquidity resolution (LRT) protocols and proactively validated services (AVS)!

As these upcoming airdrops are expected, nearly 5 million ETH (worth approximately US$15.5 billion) have been redistributed to EigenLayer, but more and more people are concerned that the benefits generated by the AVS of the protocol will not meet the deposits of the post-EIGEN airdrop worldpeople.

Market participants deposit EigenLayer not out of their own inner generosity, but because they believe that doing so will produce financial returns that exceed their opportunity costs, or through alternative strategies (e.g., for decentralized exchanges).

While EigenLayer currently supports delegates to AVS, they have not generated benefits yet, meaning depositors are just speculating that future airdrops will compensate them.

Imaginations may go crazy when predicting valuations without real income, but their inevitable arrival may pour cold water on the collective illusion of “EigenLayer is easily worth tens of billions of dollars”; if AVS yieldsDisappointingly, the agreement will find it increasingly difficult to justify high valuations.

Many AVSs do not have direct comparables, however, Celestia (a blockchain that provides data availability services similar to EigenDA) generates only a few thousand dollars in revenue each year, which is only a fraction of the $12 billion network.Rely on high levels of token inflation to attract investors to protect their networks.

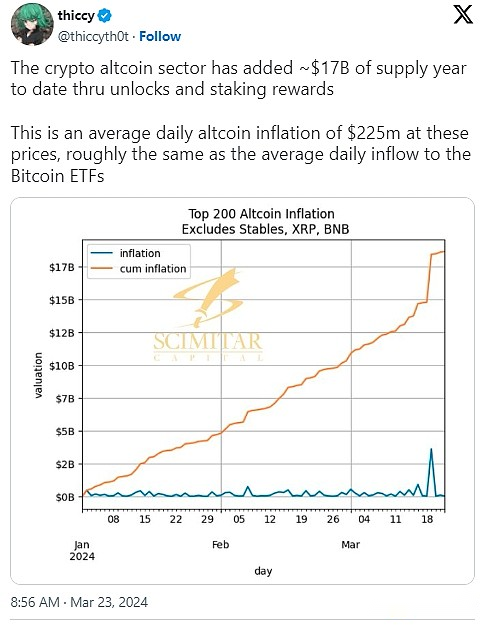

AVS must adopt its own inflation token economics to provide security, which will only further worsen the market’s oversupply of substitutes that are difficult to digest in recent weeks.

To avoid mass outflows of TVL in the event of insufficient AVS yield, EigenLayer may only distribute a small portion of the total tokens it intends to airdrop in the first round, thus achieving the commitment of future EIGEN rewards as an incentive for depositorscarrot.

Unfortunately, if the market starts to look at this sustainability, it may think that EigenLayer is overvalued, which negatively affects the perceived value of future airdrops and causes TVL to churn out of the protocol until it reaches equilibrium, remaining depositorsI feel that their capital opportunity cost is fully compensated.

Speculators seeking to maximize their EigenLayer opportunities often operate with high leverage, which stimulates the need for a wide range of crypto applications, from the regular currency market to the earnings segmentation protocol.

While high-yield EigenLayer opportunities benefit the entire Ethereum DeFi ecosystem, depositors’ dissatisfaction with implicit returns may close positions, weakening yields and causing negative consequences for projects that rely on successful resolution.

Additionally, EigenLayer has been the main absorber of ETH since December, with deposits growing by 6,100% in less than 5 months.If EigenLayer users seeking airdrops turn marginal funds into sales while abandoning the DeFi protocol that promotes speculative activity, the prices of Ethereum and other related crypto assets will be adversely affected.

By targeting greatness and catalyzing the revolution in crypto-economic security, EigenLayer makes its airdrop preemptive transactions an obvious strategy, but the returns of cryptocurrencies will not be risk-free, and it is questionable whether EigenLayer’s current deposit levels are sustainable.

While the protocol can freely mint and inflate its tokens, market participants must purchase an ever-increasing supply, otherwise the token price will fall.

While the concept EigenLayer pursues is certainly commendable, it remains to be seen whether restaking is truly the next great crypto innovation or just another one that relies on crypto daydreams.Token inflation is unsustainable and produces almost no real income.

If the latter situation proves true, EigenLayer will be placed in the “bad idea” box, causing a major blow to the Ethereum ecosystem and losing a critical shared narrative.