Author: NingNing

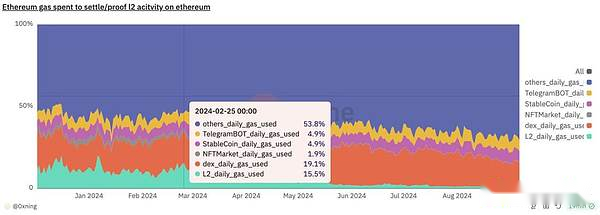

Before the Cancun upgrade, the gas consumption of L2 during peak period accounted for 15.5% of the total gas on the Ethereum main network, which was more than 10% most of the time. After the Cancun upgrade, the gas consumption of L2 accounted for cliff-like halving and then halving., has been fluctuating slightly since August 1%

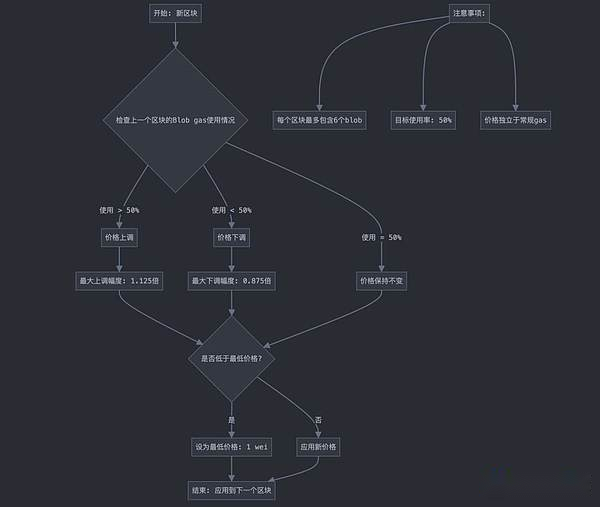

In order to cope with Celestia’s DA price war and based on optimistic expectations for explosive growth of application-based Rollup, Cancun upgraded EIP4844 while adding a special block space Blob to store L2 status data, while designing the Blob pricing mechanismWe are also committed to reducing the DA fees paid by L2.

For example, the Base Fee in the Blob Space market is priced from 1 Wei. When there is insufficient space, each block will increase its Gas fee by 12.5%, which makes it difficult to form effective pricing of Blob Space.

What everyone unexpectedly did not expect was that the expected explosive growth of the application-type Rollup actually came to an abrupt end.

These two points have led to the current situation of blood loss subsidy of L2 on the Ethereum main network.Therefore, some people in the Ethereum community began to call for modification of the Blob’s pricing mechanism, impose more DA taxes on L2, destroy more ETH, and let Ethereum supply return to its deflationary state.

How do you view these voices of the Ethereum community?Personally, I believe that compared with restoring the leading position of the stablecoin payment network and revitalizing the monopoly position of the Ethereum main network in the long-tail asset issuance and trading market, this is indeed a shortcut to enhancing Ethereum value capture capabilities.But as the community objection voice said, it is not a good thing to be a bit eager for quick success and short-term fluctuations in secondary market tokens excessively affect the development direction of the agreement.

For some reason, compared with other PoS public chain communities, the Ethereum community has a pathological mystery about deflation, and subconsciously positively correlates deflation with rising coin prices.But in fact, after the halving, Bitcoin’s actual annualized inflation rate was also 0.84%.The annualized inflation rate of the native tokens of other mainstream PoS L1 (Solana, Polkadot, Cosmos) is generally between 7% and 15%.

Between simple things and right things, we should choose the right thing; between the narrow door of long-termism and the wide door of short-term benefits, we should choose the narrow door.In short, the future of Ethereum lies in the technology iteration of chain abstraction, EOA address smart walletization, modularization, single-block confirmation, and other technical iterations have triggered a new round of application layer innovation Summer, and it does not pose more DA taxes at the moment..