Author: Doug Colkitt, Source: Author Twitter @0xdoug; Compilation: Wuzhu, Bitchain Vision

This is a good analysis and the most reasonable reason for DA to be bullish.But I don’t think it’s possible that DA is close to 50% of the L2 fee.

For structural economic reasons, sorting always produces greater value than DA…

Blockchain is basically a business that sells block space.Since block spaces are not easy to interchange between chains, they almost form a monopoly.

But not all monopolies can earn excess profits.The key lies in the consumer’s ability to distinguish prices.

Without price distinction, monopoly profits will hardly be higher than commodity profits.

Think about how airlines distinguish business travelers who are price-insensitive from consumers seeking bargains.Or how the same SUV model will be sold at very different prices under the brands of Volkswagen, Audi and Lamborghini.

Priority fees are an incredible price discrimination mechanism in blockchain.The highest priority transaction pays for fees that are actually orders of magnitude higher than the median.

Both L2s and Solana achieve high throughput and high revenue by using sequence priority as a form of price distinction.

The payment of marginal transactions is very low, resulting in a huge TPS.But transactions that are not sensitive to prices will receive commissions and pay most of the network revenue.

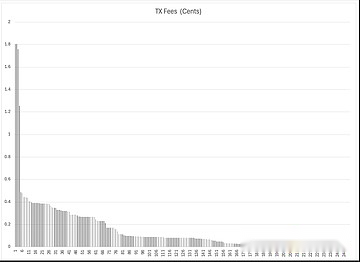

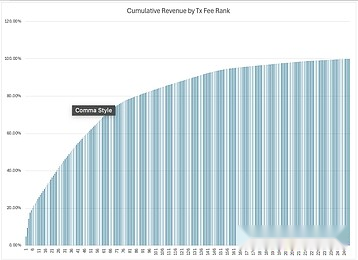

The following is the distribution of 5 blocks randomly drawn from Base L2.This is a clear Pareto distribution, which makes the price distinction very effective.

The top 10% of transactions paid 30% of revenue.The latter 10% of transactions pay less than 1%.

The problem is that while the sorter makes a lot of money from it, the DA layer is not involved because it doesn’t have any price distinction ability.

That super high value arbitrage pays the same fee for Ethereum DA as 1 wei spam transactions because they are settled in a batch.

Since marginal transactions are very low value, you can only get high TPS if intermediate transactions can be put on the chain at near zero cost.But with DA, basically every transaction pays the same.

The DA layer can have high throughput or high income.But you can’t have both.

This makes it essentially impossible for rollup to scale without the Ethereum network revenue crash.

A rollup-centric roadmap is fundamentally flawed because it abandons the valuable part of the network (sorting) and thinks it will return to the worthless part (DA).

I was initially optimistic about the Rollup-centric roadmap because I think any rational person would recognize the economics of price discrimination and that it will operate in parallel with the extension of L1.

High-value, price-insensitive users will use L1 because of its reliability, security finality and source verifiability.L2, while it focuses on marginal low-income users whose prices are excluded from L1 fees.Therefore, Ethereum will still receive a considerable sorter rent.

But Ethereum leadership repeatedly stressed that L1, as the application layer, has actually died and can never scale.Therefore, users and developers have responded very rationally, and the L1 application ecosystem is now dying, and Ethereum network revenue is dying with it.

If you think the long-term valuation claim of ETH is a monetary asset, then this may still be OK.Let more people have ETH and make it a form of currency.Subsidies to L2s, which accumulate the value of the base layer to zero, should help achieve this.

But if you think ETH’s long-term valuation claim is a network interest in a widely used protocol (*I* think this is more likely than ETH as a currency), then you need value accumulation.

Obviously, we really messed up this with the wrong economic assumptions.